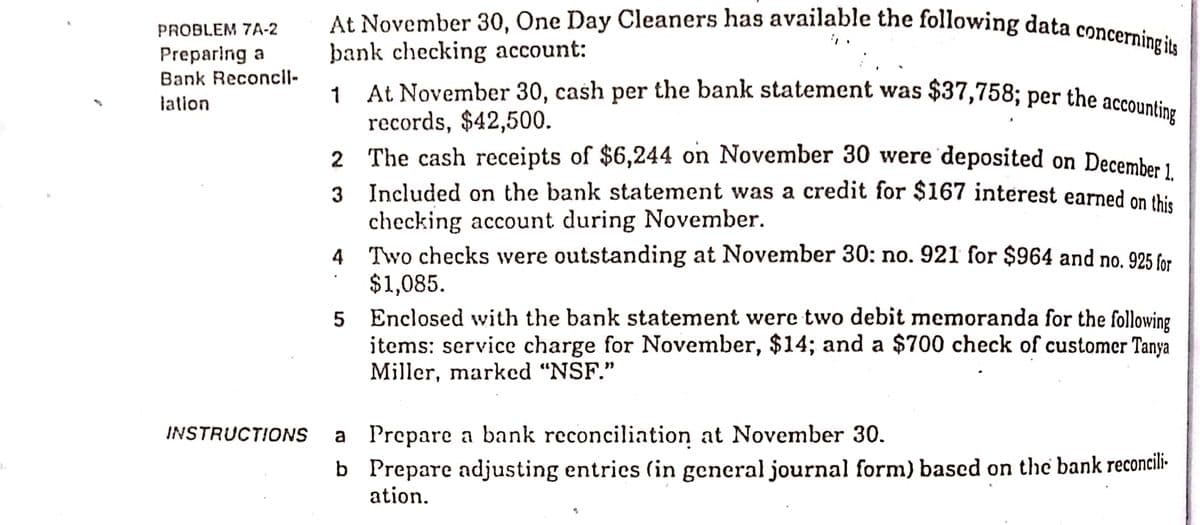

At November 30, One Day Cleaners has available the following data concerning its PROBLEM 7A-2 Preparing a Bank Reconcll- þank checking account: 1 At November 30, cash per the bank statement was $37,758; per the accounting lation records, $42,500. 2 The cash receipts of $6,244 on November 30 were deposited on December 1 Included on the bank statement was a credit for $167 interest earned on this checking account during November. 4 Two checks were outstanding at November 30: no. 921 for $964 and no. 925 for $1,085. Enclosed with the bank statement were two debit memoranda for the following items: service charge for November, $14; and a $700 check of customer Tanya Miller, marked "NSF." a Prepare a bank reconciliation at November 30. b Prepare adjusting entrics (in general journal form) based on the bank reconcili- INSTRUCTIONS ation

At November 30, One Day Cleaners has available the following data concerning its PROBLEM 7A-2 Preparing a Bank Reconcll- þank checking account: 1 At November 30, cash per the bank statement was $37,758; per the accounting lation records, $42,500. 2 The cash receipts of $6,244 on November 30 were deposited on December 1 Included on the bank statement was a credit for $167 interest earned on this checking account during November. 4 Two checks were outstanding at November 30: no. 921 for $964 and no. 925 for $1,085. Enclosed with the bank statement were two debit memoranda for the following items: service charge for November, $14; and a $700 check of customer Tanya Miller, marked "NSF." a Prepare a bank reconciliation at November 30. b Prepare adjusting entrics (in general journal form) based on the bank reconcili- INSTRUCTIONS ation

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PB

Related questions

Question

Transcribed Image Text:1 At November 30, cash per the bank statement was $37,758; per the accounting

At November 30, One Day Cleaners has available the following data concerning its

PROBLEM 7A-2

þank checking account:

At November 30, cash per the bank statement was $37,758; per the accounti.

records, $42,500.

2 The cash receipts of $6,244 on November 30 were 'deposited on December 1

Preparing a

Bank Reconcll-

lation

3 Included on the bank statement was a credit for $167 interest earned on thi.

checking account during November.

4 Two checks were outstanding at November 30: no. 921 for $964 and no. 925 for

$1,085.

5 Enclosed wvith the bank statement were two debit memoranda for the following

items: service charge for November, $14; and a $700 check of customer Tanya

Miller, marked "NSF."

INSTRUCTIONS

a Prepare a bank reconciliation at November 30.

b Prepare adjusting entries (in general journal form) based on the bank reconcili-

ation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,