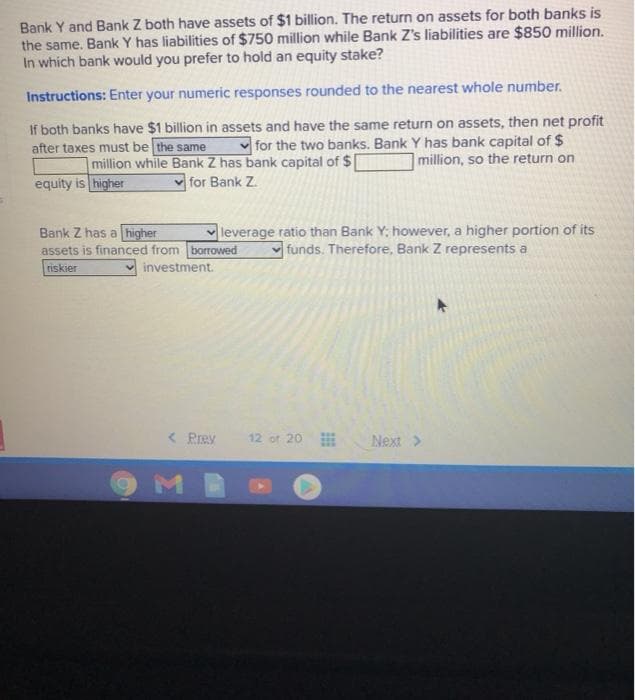

Bank Y and Bank Z both have assets of $1 billion. The return on assets for both banks is the same. Bank Y has liabilities of $750 million while Bank Z's liabilities are $850 million. In which bank would you prefer to hold an equity stake? Instructions: Enter your numeric responses rounded to the nearest whole number. If both banks have $1 billion in assets and have the same return on assets, then net profit v for the two banks. Bank Y has bank capital of $ million, so the return on after taxes must be the same million while Bank Z has bank capital of $ v for Bank Z equity is higher Bank Z has a higher assets is financed from borTowed leverage ratio than Bank Y; however, a higher portion of its funds. Therefore, Bank Z represents a niskier investment.

Bank Y and Bank Z both have assets of $1 billion. The return on assets for both banks is the same. Bank Y has liabilities of $750 million while Bank Z's liabilities are $850 million. In which bank would you prefer to hold an equity stake? Instructions: Enter your numeric responses rounded to the nearest whole number. If both banks have $1 billion in assets and have the same return on assets, then net profit v for the two banks. Bank Y has bank capital of $ million, so the return on after taxes must be the same million while Bank Z has bank capital of $ v for Bank Z equity is higher Bank Z has a higher assets is financed from borTowed leverage ratio than Bank Y; however, a higher portion of its funds. Therefore, Bank Z represents a niskier investment.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Bank Y and Bank Z both have assets of $1 billion. The return on assets for both banks is

the same. Bank Y has liabilities of $750 million while Bank Z's liabilities are $850 million.

In which bank would you prefer to hold an equity stake?

Instructions: Enter your numeric responses rounded to the nearest whole number.

If both banks have $1 billion in assets and have the same return on assets, then net profit

for the two banks. Bank Y has bank capital of $

million, so the return on

after taxes must be the same

million while Bank Z has bank capital of $

for Bank Z.

equity is higher

Bank Z has a higher

assets is financed from borTowed

leverage ratio than Bank Y; however, a higher portion of its

funds. Therefore, Bank Z represents a

riskier

investment.

< Prey

12 of 20

Next >

9M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning