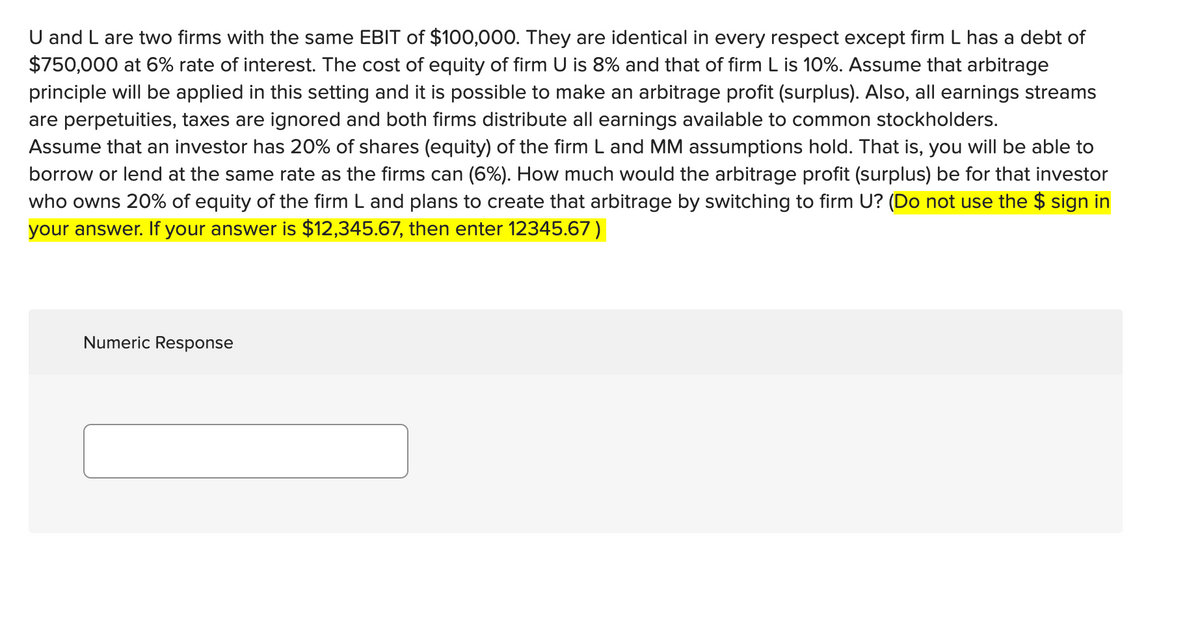

U and L are two firms with the same EBIT of $100,000. They are identical in every respect except firm L has a debt of $750,000 at 6% rate of interest. The cost of equity of firm U is 8% and that of firm L is 10%. Assume that arbitrage principle will be applied in this setting and it is possible to make an arbitrage profit (surplus). Also, all earnings streams are perpetuities, taxes are ignored and both firms distribute all earnings available to common stockholders. Assume that an investor has 20% of shares (equity) of the firm L and MM assumptions hold. That is, you will be able to borrow or lend at the same rate as the firms can (6%). How much would the arbitrage profit (surplus) be for that investor who owns 20% of equity of the firm L and plans to create that arbitrage by switching to firm U? (Do not use the $ sign in your answer. If your answer is $12,345.67, then enter 12345.67) Numeric Response

U and L are two firms with the same EBIT of $100,000. They are identical in every respect except firm L has a debt of $750,000 at 6% rate of interest. The cost of equity of firm U is 8% and that of firm L is 10%. Assume that arbitrage principle will be applied in this setting and it is possible to make an arbitrage profit (surplus). Also, all earnings streams are perpetuities, taxes are ignored and both firms distribute all earnings available to common stockholders. Assume that an investor has 20% of shares (equity) of the firm L and MM assumptions hold. That is, you will be able to borrow or lend at the same rate as the firms can (6%). How much would the arbitrage profit (surplus) be for that investor who owns 20% of equity of the firm L and plans to create that arbitrage by switching to firm U? (Do not use the $ sign in your answer. If your answer is $12,345.67, then enter 12345.67) Numeric Response

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 7P

Related questions

Question

24) Can i please get help with this practice question.

Transcribed Image Text:U and L are two firms with the same EBIT of $100,000. They are identical in every respect except firm L has a debt of

$750,000 at 6% rate of interest. The cost of equity of firm U is 8% and that of firm L is 10%. Assume that arbitrage

principle will be applied in this setting and it is possible to make an arbitrage profit (surplus). Also, all earnings streams

are perpetuities, taxes are ignored and both firms distribute all earnings available to common stockholders.

Assume that an investor has 20% of shares (equity) of the firm L and MM assumptions hold. That is, you will be able to

borrow or lend at the same rate as the firms can (6%). How much would the arbitrage profit (surplus) be for that investor

who owns 20% of equity of the firm L and plans to create that arbitrage by switching to firm U? (Do not use the $ sign in

your answer. If your answer is $12,345.67, then enter 12345.67)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College