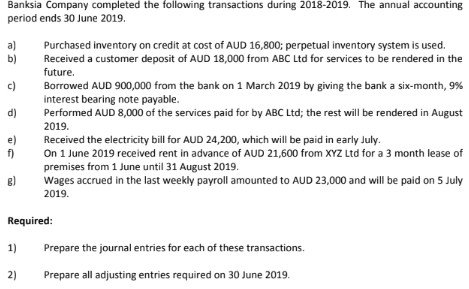

Banksia Company completed the following transactions during 2018-2019. The annual accounting period ends 30 June 2019. a) Purchased inventory on credit at cost of AUD 16,800; perpetual inventory system is used. Received a customer deposit of AUD 18,000 from ABC Ltd for services to be rendered in the b) future. c) Borrowed AUD 900,000 from the bank on 1 March 2019 by giving the bank a six-month, 9% interest bearing note payable. Performed AUD 8,000 of the services paid for by ABC Ltd; the rest will be rendered in August d) 2019. Received the electricity bill for AUD 24,200, which will be paid in early July. On 1 June 2019 received rent in advance of AUD 21,600 from XYZ Ltd for a 3 month lease of premises from 1 June until 31 August 2019. Wages accrued in the last weekly payroll amounted to AUD 23,000 and will be paid on 5 July f) 2019. Required: 1) Prepare the journal entries for each of these transactions. 2) Prepare all adjusting entries required on 30 June 2019.

Banksia Company completed the following transactions during 2018-2019. The annual accounting period ends 30 June 2019. a) Purchased inventory on credit at cost of AUD 16,800; perpetual inventory system is used. Received a customer deposit of AUD 18,000 from ABC Ltd for services to be rendered in the b) future. c) Borrowed AUD 900,000 from the bank on 1 March 2019 by giving the bank a six-month, 9% interest bearing note payable. Performed AUD 8,000 of the services paid for by ABC Ltd; the rest will be rendered in August d) 2019. Received the electricity bill for AUD 24,200, which will be paid in early July. On 1 June 2019 received rent in advance of AUD 21,600 from XYZ Ltd for a 3 month lease of premises from 1 June until 31 August 2019. Wages accrued in the last weekly payroll amounted to AUD 23,000 and will be paid on 5 July f) 2019. Required: 1) Prepare the journal entries for each of these transactions. 2) Prepare all adjusting entries required on 30 June 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 24E: Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January...

Related questions

Question

Transcribed Image Text:Banksia Company completed the following transactions during 2018-2019. The annual accounting

period ends 30 June 2019.

a)

Purchased inventory on credit at cost of AUD 16,800; perpetual inventory system is used.

Received a customer deposit of AUD 18,000 from ABC Ltd for services to be rendered in the

b)

future.

c)

Borrowed AUD 900,000 from the bank on 1 March 2019 by giving the bank a six-month, 9%

interest bearing note payable.

Performed AUD 8,000 of the services paid for by ABC Ltd; the rest will be rendered in August

d)

2019.

Received the electricity bill for AUD 24,200, which will be paid in early July.

On 1 June 2019 received rent in advance of AUD 21,600 from XYZ Ltd for a 3 month lease of

premises from 1 June until 31 August 2019.

Wages accrued in the last weekly payroll amounted to AUD 23,000 and will be paid on 5 July

f)

2019.

Required:

1)

Prepare the journal entries for each of these transactions.

2)

Prepare all adjusting entries required on 30 June 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning