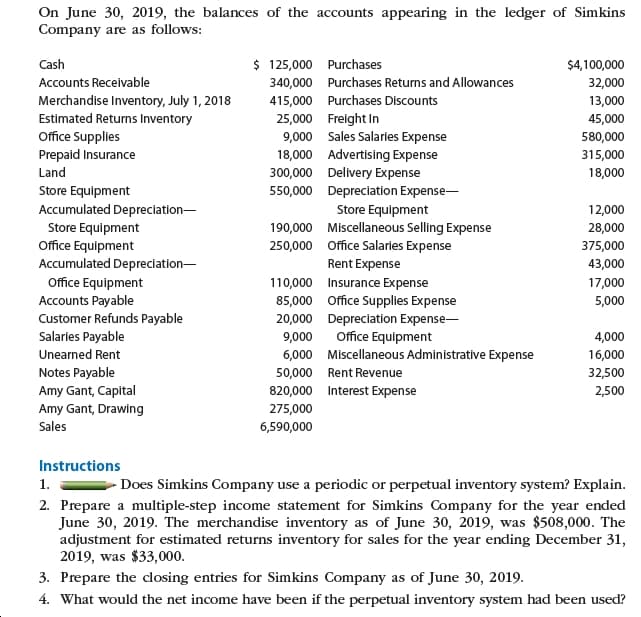

On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: $ 125,000 Purchases Cash $4,100,000 Accounts Recelvable Purchases Returns and Allowances 340,000 32,000 Merchandise Inventory, July 1, 2018 Estimated Returns Inventory Office Supplies Prepaid Insurance Purchases Discounts 13,000 45,000 415,000 Freight In Sales Salaries Expense Advertising Expense Delivery Expense Depreciation Expense- Store Equipment Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Office Supplies Expense Depreciation Expense- Office Equipment Miscellaneous Administrative Expense 25,000 9,000 580,000 18,000 315,000 Land 300,000 18,000 Store Equipment Accumulated Depreciation- 550,000 12,000 Store Equipment Office Equipment Accumulated Depreciation- Office Equipment Accounts Payable 190,000 28,000 250,000 375,000 43,000 110,000 17,000 5,000 85,000 Customer Refunds Payable Salaries Payable 20,000 4,000 16,000 9,000 Unearned Rent 6,000 Notes Payable Amy Gant, Capital Amy Gant, Drawing 50,000 Rent Revenue 32,500 2,500 820,000 Interest Expense 275,000 Sales 6,590,000 Instructions - Does Simkins Company use a periodic or perpetual inventory system? Explain. 1. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was $508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was $33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?

On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: $ 125,000 Purchases Cash $4,100,000 Accounts Recelvable Purchases Returns and Allowances 340,000 32,000 Merchandise Inventory, July 1, 2018 Estimated Returns Inventory Office Supplies Prepaid Insurance Purchases Discounts 13,000 45,000 415,000 Freight In Sales Salaries Expense Advertising Expense Delivery Expense Depreciation Expense- Store Equipment Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Office Supplies Expense Depreciation Expense- Office Equipment Miscellaneous Administrative Expense 25,000 9,000 580,000 18,000 315,000 Land 300,000 18,000 Store Equipment Accumulated Depreciation- 550,000 12,000 Store Equipment Office Equipment Accumulated Depreciation- Office Equipment Accounts Payable 190,000 28,000 250,000 375,000 43,000 110,000 17,000 5,000 85,000 Customer Refunds Payable Salaries Payable 20,000 4,000 16,000 9,000 Unearned Rent 6,000 Notes Payable Amy Gant, Capital Amy Gant, Drawing 50,000 Rent Revenue 32,500 2,500 820,000 Interest Expense 275,000 Sales 6,590,000 Instructions - Does Simkins Company use a periodic or perpetual inventory system? Explain. 1. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was $508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was $33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PB: On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as...

Related questions

Question

Transcribed Image Text:On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins

Company are as follows:

$ 125,000 Purchases

Cash

$4,100,000

Accounts Recelvable

Purchases Returns and Allowances

340,000

32,000

Merchandise Inventory, July 1, 2018

Estimated Returns Inventory

Office Supplies

Prepaid Insurance

Purchases Discounts

13,000

45,000

415,000

Freight In

Sales Salaries Expense

Advertising Expense

Delivery Expense

Depreciation Expense-

Store Equipment

Miscellaneous Selling Expense

Office Salaries Expense

Rent Expense

Insurance Expense

Office Supplies Expense

Depreciation Expense-

Office Equipment

Miscellaneous Administrative Expense

25,000

9,000

580,000

18,000

315,000

Land

300,000

18,000

Store Equipment

Accumulated Depreciation-

550,000

12,000

Store Equipment

Office Equipment

Accumulated Depreciation-

Office Equipment

Accounts Payable

190,000

28,000

250,000

375,000

43,000

110,000

17,000

5,000

85,000

Customer Refunds Payable

Salaries Payable

20,000

4,000

16,000

9,000

Unearned Rent

6,000

Notes Payable

Amy Gant, Capital

Amy Gant, Drawing

50,000 Rent Revenue

32,500

2,500

820,000 Interest Expense

275,000

Sales

6,590,000

Instructions

- Does Simkins Company use a periodic or perpetual inventory system? Explain.

1.

2. Prepare a multiple-step income statement for Simkins Company for the year ended

June 30, 2019. The merchandise inventory as of June 30, 2019, was $508,000. The

adjustment for estimated returns inventory for sales for the year ending December 31,

2019, was $33,000.

3. Prepare the closing entries for Simkins Company as of June 30, 2019.

4. What would the net income have been if the perpetual inventory system had been used?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College