Barbara DeMarco CPA

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 45P

Related questions

Question

K.

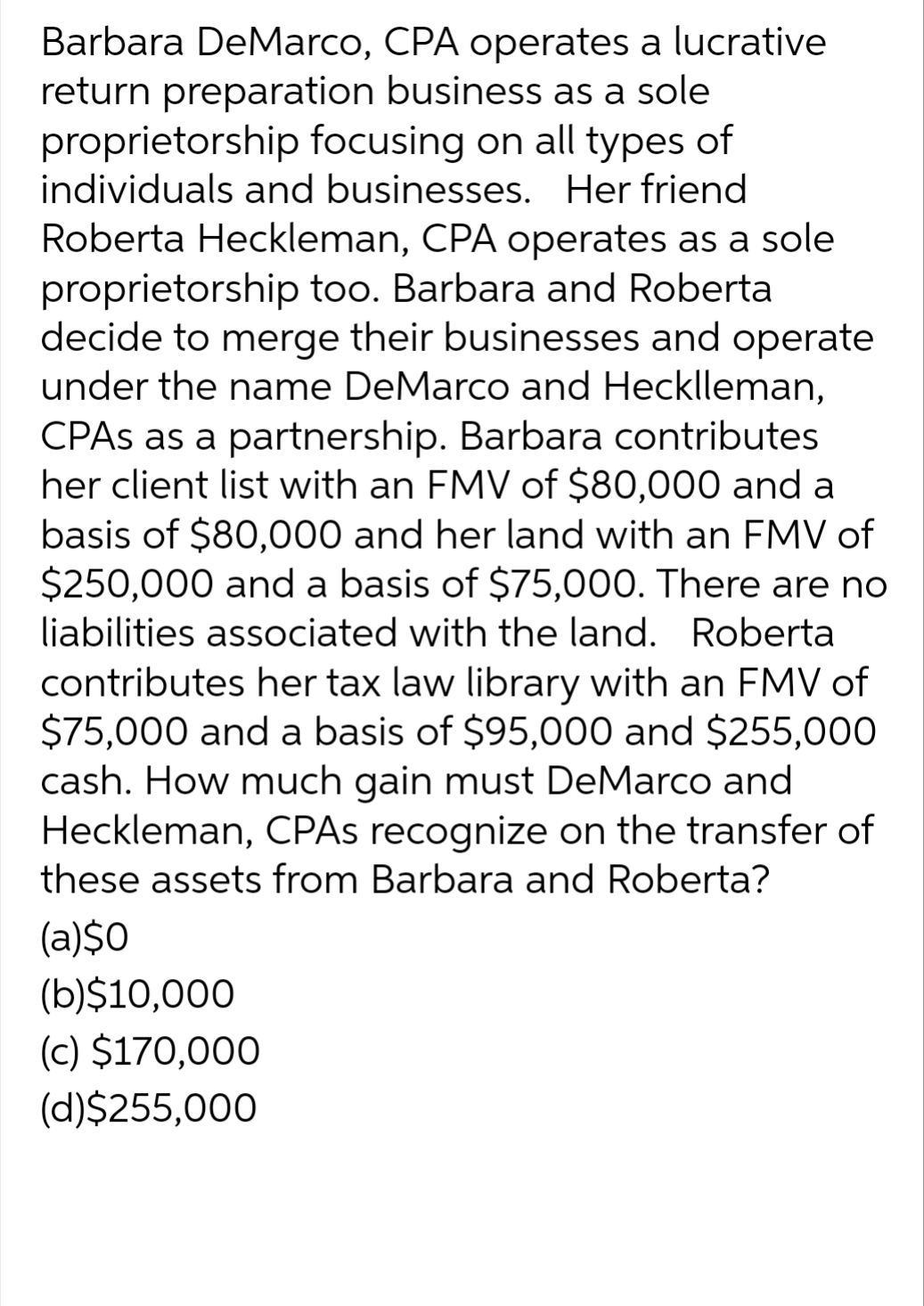

Transcribed Image Text:Barbara DeMarco, CPA operates a lucrative

return preparation business as a sole

proprietorship focusing on all types of

individuals and businesses. Her friend

Roberta Heckleman, CPA operates as a sole

proprietorship too. Barbara and Roberta

decide to merge their businesses and operate

under the name DeMarco and Hecklleman,

CPAS as a partnership. Barbara contributes

her client list with an FMV of $80,000 and a

basis of $80,000 and her land with an FMV of

$250,000 and a basis of $75,000. There are no

liabilities associated with the land. Roberta

contributes her tax law library with an FMV of

$75,000 and a basis of $95,000 and $255,000

cash. How much gain must DeMarco and

Heckleman, CPAs recognize on the transfer of

these assets from Barbara and Roberta?

(a)$0

(b)$10,000

(c) $170,000

(d)$255,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT