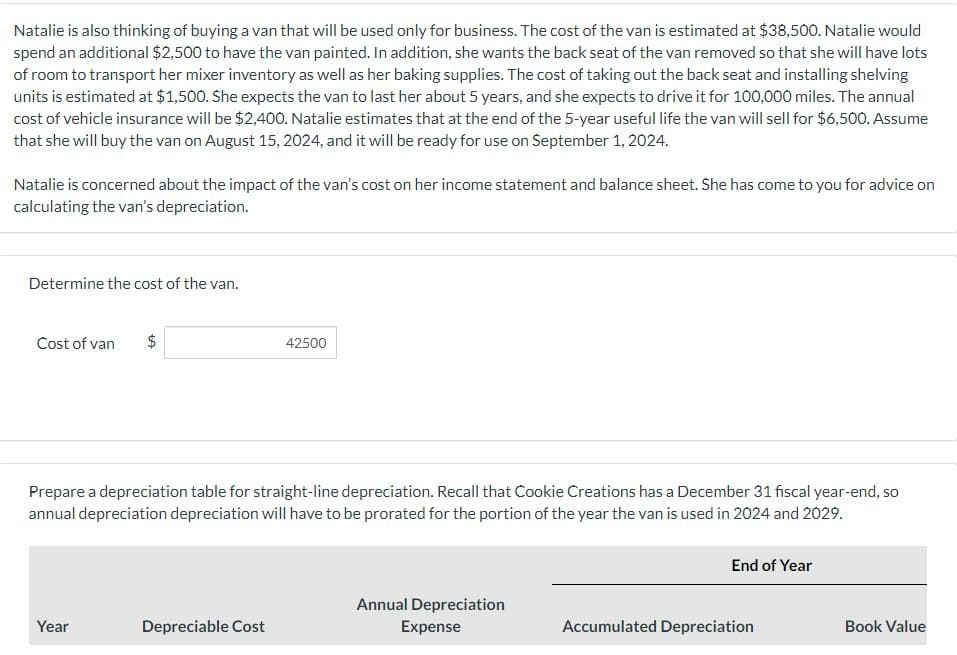

Natalie is also thinking of buying a van that will be used only for business. The cost of the van is estimated at $38,500. Natalie would spend an additional $2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mixer inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at $1,500. She expects the van to last her about 5 years, and she expects to drive it for 100,000 miles. The annual cost of vehicle insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van will sell for $6,500. Assume that she will buy the van on August 15, 2024, and it will be ready for use on September 1, 2024. Natalie is concerned about the impact of the van's cost on her income statement and balance sheet. She has come to you for advice on calculating the van's depreciation. Determine the cost of the van. Cost of van $ 42500 Prepare a depreciation table for straight-line depreciation. Recall that Cookie Creations has a December 31 fiscal year-end, so annual depreciation depreciation will have to be prorated for the portion of the year the van is used in 2024 and 2029.

Natalie is also thinking of buying a van that will be used only for business. The cost of the van is estimated at $38,500. Natalie would spend an additional $2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mixer inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at $1,500. She expects the van to last her about 5 years, and she expects to drive it for 100,000 miles. The annual cost of vehicle insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van will sell for $6,500. Assume that she will buy the van on August 15, 2024, and it will be ready for use on September 1, 2024. Natalie is concerned about the impact of the van's cost on her income statement and balance sheet. She has come to you for advice on calculating the van's depreciation. Determine the cost of the van. Cost of van $ 42500 Prepare a depreciation table for straight-line depreciation. Recall that Cookie Creations has a December 31 fiscal year-end, so annual depreciation depreciation will have to be prorated for the portion of the year the van is used in 2024 and 2029.

Chapter16: Tax Research

Section: Chapter Questions

Problem 64DNC

Related questions

Question

do not give answer in image format

Transcribed Image Text:Natalie is also thinking of buying a van that will be used only for business. The cost of the van is estimated at $38,500. Natalie would

spend an additional $2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots

of room to transport her mixer inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving

units is estimated at $1,500. She expects the van to last her about 5 years, and she expects to drive it for 100,000 miles. The annual

cost of vehicle insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van will sell for $6,500. Assume

that she will buy the van on August 15, 2024, and it will be ready for use on September 1, 2024.

Natalie is concerned about the impact of the van's cost on her income statement and balance sheet. She has come to you for advice on

calculating the van's depreciation.

Determine the cost of the van.

Cost of van $

Prepare a depreciation table for straight-line depreciation. Recall that Cookie Creations has a December 31 fiscal year-end, so

annual depreciation depreciation will have to be prorated for the portion of the year the van is used in 2024 and 2029.

Year

42500

Depreciable Cost

Annual Depreciation

Expense

End of Year

Accumulated Depreciation

Book Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning