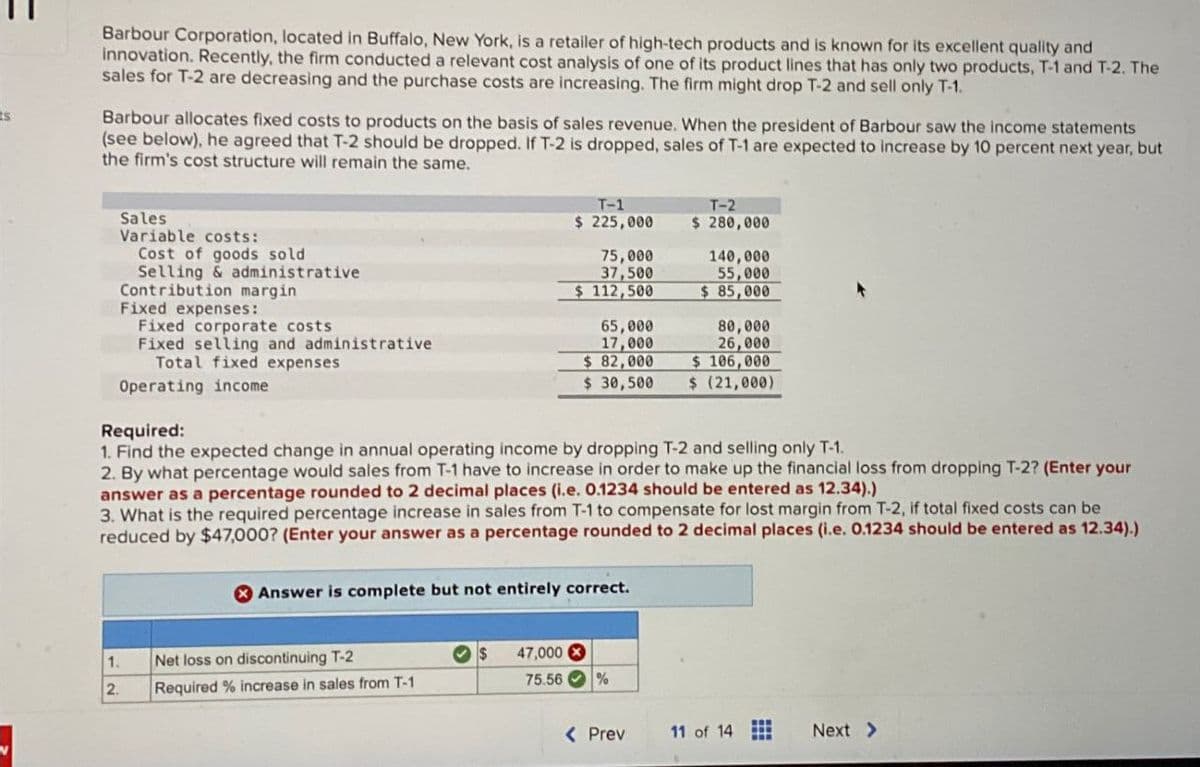

Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1. Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but the firm's cost structure will remain the same. Sales Variable costs: Cost of goods sold Selling & administrative Contribution margin Fixed expenses: Fixed corporate costs Fixed selling and administrative Total fixed expenses Operating income. Required: T-1 $225,000 T-2 $ 280,000 75,000 37,500 $112,500 140,000 55,000 $ 85,000 80,000 26,000 $ 106,000 $ 30,500 $ (21,000) 65,000 17,000 $82,000 1. Find the expected change in annual operating income by dropping T-2 and selling only T-1. 2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) 3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $47,000? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) Answer is complete but not entirely correct. 1. Net loss on discontinuing T-2 $ 47,000 2. Required % increase in sales from T-1 75.56 % < Prev 11 of 14 Next >

Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1. Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but the firm's cost structure will remain the same. Sales Variable costs: Cost of goods sold Selling & administrative Contribution margin Fixed expenses: Fixed corporate costs Fixed selling and administrative Total fixed expenses Operating income. Required: T-1 $225,000 T-2 $ 280,000 75,000 37,500 $112,500 140,000 55,000 $ 85,000 80,000 26,000 $ 106,000 $ 30,500 $ (21,000) 65,000 17,000 $82,000 1. Find the expected change in annual operating income by dropping T-2 and selling only T-1. 2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) 3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $47,000? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) Answer is complete but not entirely correct. 1. Net loss on discontinuing T-2 $ 47,000 2. Required % increase in sales from T-1 75.56 % < Prev 11 of 14 Next >

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.1SC: Scenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing...

Related questions

Question

None

Transcribed Image Text:Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for its excellent quality and

innovation. Recently, the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The

sales for T-2 are decreasing and the purchase costs are increasing. The firm might drop T-2 and sell only T-1.

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements

(see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10 percent next year, but

the firm's cost structure will remain the same.

Sales

Variable costs:

Cost of goods sold

Selling & administrative

Contribution margin

Fixed expenses:

Fixed corporate costs

Fixed selling and administrative

Total fixed expenses

Operating income.

Required:

T-1

$225,000

T-2

$ 280,000

75,000

37,500

$112,500

140,000

55,000

$ 85,000

80,000

26,000

$ 106,000

$ 30,500 $ (21,000)

65,000

17,000

$82,000

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Enter your

answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be

reduced by $47,000? (Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)

Answer is complete but not entirely correct.

1.

Net loss on discontinuing T-2

$ 47,000

2.

Required % increase in sales from T-1

75.56

%

< Prev

11 of 14

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning