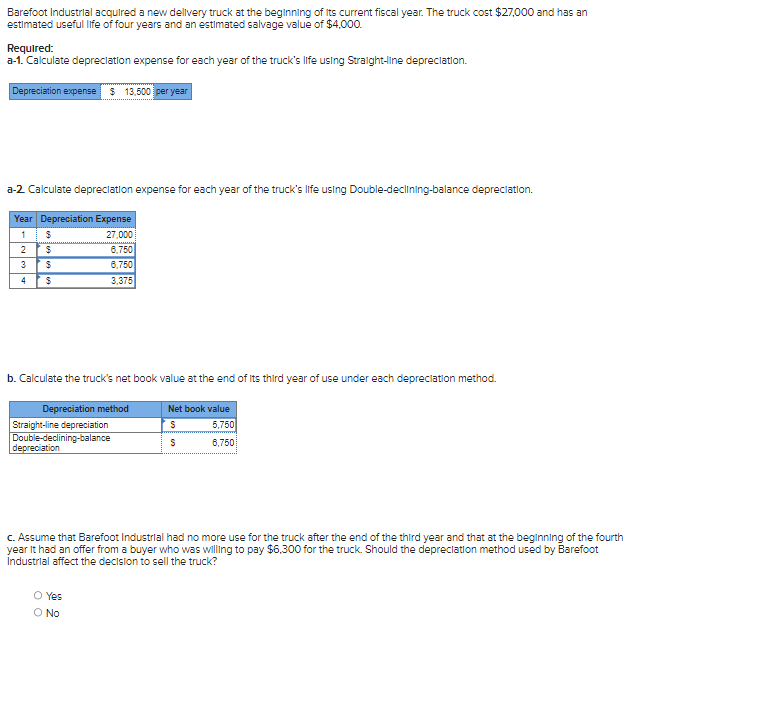

Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $27,000 and has an estimated useful life of four years and an estimated salvage value of $4,000. Required: a-1. Calculate depreciation expense for each year of the truck's life using Straight-line depreciation. Depreciation expense $ 13,500 per year a-2. Calculate depreciation expense for each year of the truck's life using Double-declining-balance depreciation. Year Depreciation Expense 1 2 3 4 $ $ $ $ b. Calculate the truck's net book value at the end of its third year of use under each depreciation method. 27,000 6,750 6,750 3,375 Depreciation method Straight-line depreciation Double-declining-balance depreciation O Yes O No Net book value S S 5,750 6,750 c. Assume that Barefoot Industrial had no more use for the truck after the end of the third year and that at the beginning of the fourth year it had an offer from a buyer who was willing to pay $6,300 for the truck. Should the depreciation method used by Barefoot Industrial affect the decision to sell the truck?

Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $27,000 and has an estimated useful life of four years and an estimated salvage value of $4,000. Required: a-1. Calculate depreciation expense for each year of the truck's life using Straight-line depreciation. Depreciation expense $ 13,500 per year a-2. Calculate depreciation expense for each year of the truck's life using Double-declining-balance depreciation. Year Depreciation Expense 1 2 3 4 $ $ $ $ b. Calculate the truck's net book value at the end of its third year of use under each depreciation method. 27,000 6,750 6,750 3,375 Depreciation method Straight-line depreciation Double-declining-balance depreciation O Yes O No Net book value S S 5,750 6,750 c. Assume that Barefoot Industrial had no more use for the truck after the end of the third year and that at the beginning of the fourth year it had an offer from a buyer who was willing to pay $6,300 for the truck. Should the depreciation method used by Barefoot Industrial affect the decision to sell the truck?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

Transcribed Image Text:Barefoot Industrial acquired a new delivery truck at the beginning of its current fiscal year. The truck cost $27,000 and has an

estimated useful life of four years and an estimated salvage value of $4,000.

Required:

a-1. Calculate depreciation expense for each year of the truck's life using Straight-line depreciation.

Depreciation expense $ 13,500 per year

a-2. Calculate depreciation expense for each year of the truck's life using Double-declining-balance depreciation.

Year Depreciation Expense

1

$

27,000

6,750

6,750

3,375

2

3

4

$

$

b. Calculate the truck's net book value at the end of its third year of use under each depreciation method.

Depreciation method

Straight-line depreciation

Double-declining-balance

depreciation

Net book value

S

5,750

S

6,750

c. Assume that Barefoot Industrial had no more use for the truck after the end of the third year and that at the beginning of the fourth

year It had an offer from a buyer who was willing to pay $6,300 for the truck. Should the depreciation method used by Barefoot

Industrial affect the decision to sell the truck?

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub