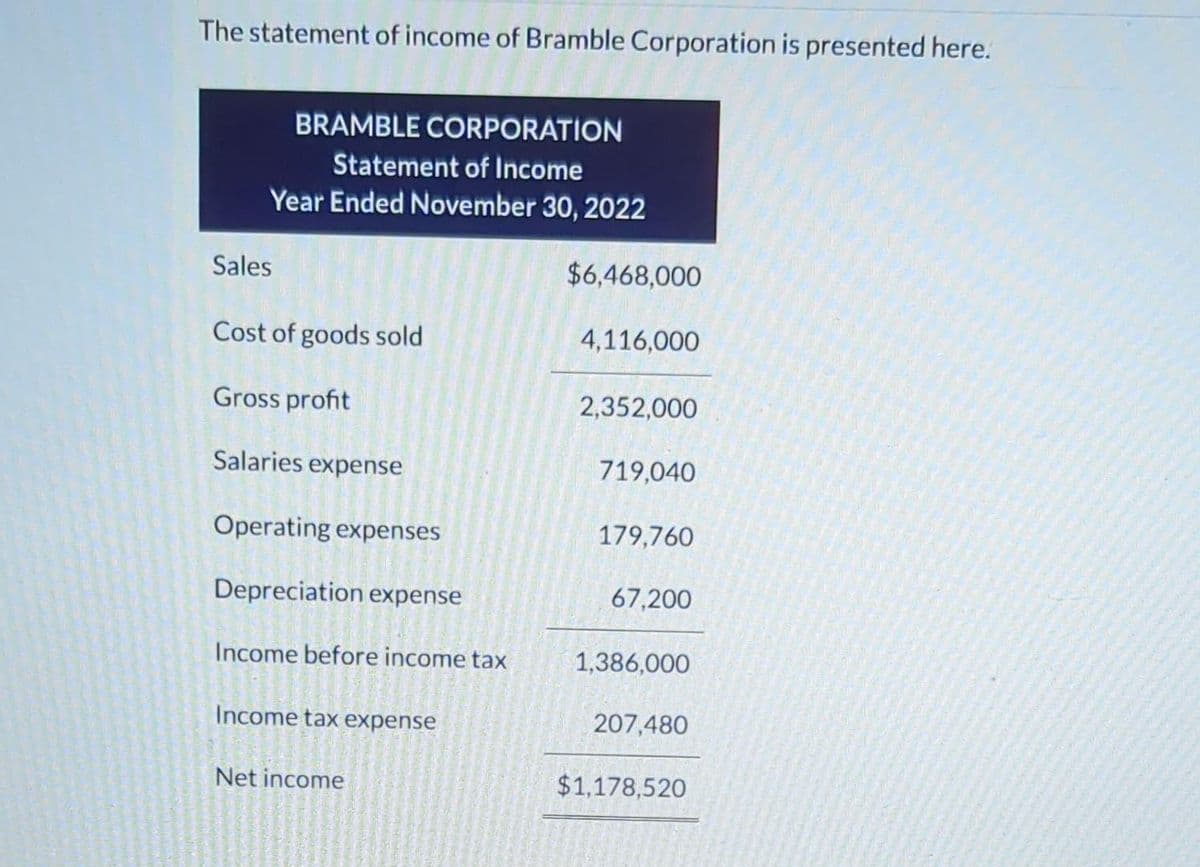

The statement of income of Bramble Corporation is presented here. BRAMBLE CORPORATION Statement of Income Year Ended November 30, 2022 Sales Cost of goods sold Gross profit Salaries expense Operating expenses Depreciation expense Income before income tax Income tax expense Net income $6,468,000 4,116,000 2,352,000 719,040 179,760 67,200 1,386,000 207,480 $1,178,520 Additional information: 1. 2. 3. 5. Accounts receivable increased $252,000 during the year, and inventory decreased $420,000. Prepaid expenses, which relate to administrative expenses, increased $126,000 during the year. Accounts payable to suppliers of merchandise decreased $294,000 during the year. Accrued salaries payable decreased $84,000 during the year. Income tax payable increased $54,600 during the year. Cash flows from operating activities Net income Adjustments to reconcile net income to Net cash provided by operating activities Depreciation expense Increase in accounts receivable BRAMBLE CORPORATION Statement of Cash Flows (Partial) For the Year Ended November 30, 2022 Decrease in inventory Increase in prepaid expenses Decrease in accounts payable Decrease in accrued salaries payable $ V $ 1178520 4

The statement of income of Bramble Corporation is presented here. BRAMBLE CORPORATION Statement of Income Year Ended November 30, 2022 Sales Cost of goods sold Gross profit Salaries expense Operating expenses Depreciation expense Income before income tax Income tax expense Net income $6,468,000 4,116,000 2,352,000 719,040 179,760 67,200 1,386,000 207,480 $1,178,520 Additional information: 1. 2. 3. 5. Accounts receivable increased $252,000 during the year, and inventory decreased $420,000. Prepaid expenses, which relate to administrative expenses, increased $126,000 during the year. Accounts payable to suppliers of merchandise decreased $294,000 during the year. Accrued salaries payable decreased $84,000 during the year. Income tax payable increased $54,600 during the year. Cash flows from operating activities Net income Adjustments to reconcile net income to Net cash provided by operating activities Depreciation expense Increase in accounts receivable BRAMBLE CORPORATION Statement of Cash Flows (Partial) For the Year Ended November 30, 2022 Decrease in inventory Increase in prepaid expenses Decrease in accounts payable Decrease in accrued salaries payable $ V $ 1178520 4

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

Do not give answer in image

Transcribed Image Text:The statement of income of Bramble Corporation is presented here.

BRAMBLE CORPORATION

Statement of Income

Year Ended November 30, 2022

Sales

Cost of goods sold

Gross profit

Salaries expense

Operating expenses

Depreciation expense

Income before income tax

Income tax expense

Net income

$6,468,000

4,116,000

2,352,000

719,040

179,760

67,200

1,386,000

207,480

$1,178,520

Transcribed Image Text:Additional information:

1.

2.

3.

5.

Accounts receivable increased $252,000 during the year, and inventory decreased $420,000.

Prepaid expenses, which relate to administrative expenses, increased $126,000 during the year.

Accounts payable to suppliers of merchandise decreased $294,000 during the year.

Accrued salaries payable decreased $84,000 during the year.

Income tax payable increased $54,600 during the year.

Cash flows from operating activities

Net income

Adjustments to reconcile net income to

Net cash provided by operating activities

Depreciation expense

Increase in accounts receivable

BRAMBLE CORPORATION

Statement of Cash Flows (Partial)

For the Year Ended November 30, 2022

Decrease in inventory

Increase in prepaid expenses

Decrease in accounts payable

Decrease in accrued salaries payable

$

V

$

1178520

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning