Based on the above information, kindly answer the following: 1. In the profit distribution schedule, the salary allowance of Tom will be? 2. Of the P1,404,000 net profit of the partnership, the share of Rey will be? 3. In the profit distribution schedule, the total salary allowance will be? Please answer complete required1,2,3

Based on the above information, kindly answer the following: 1. In the profit distribution schedule, the salary allowance of Tom will be? 2. Of the P1,404,000 net profit of the partnership, the share of Rey will be? 3. In the profit distribution schedule, the total salary allowance will be? Please answer complete required1,2,3

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 55P

Related questions

Question

Based on the above information, kindly answer the following:

1. In the profit distribution schedule, the salary allowance of Tom will be?

2. Of the P1,404,000 net profit of the partnership, the share of Rey will be?

3. In the profit distribution schedule, the total salary allowance will be? Please answer complete required1,2,3

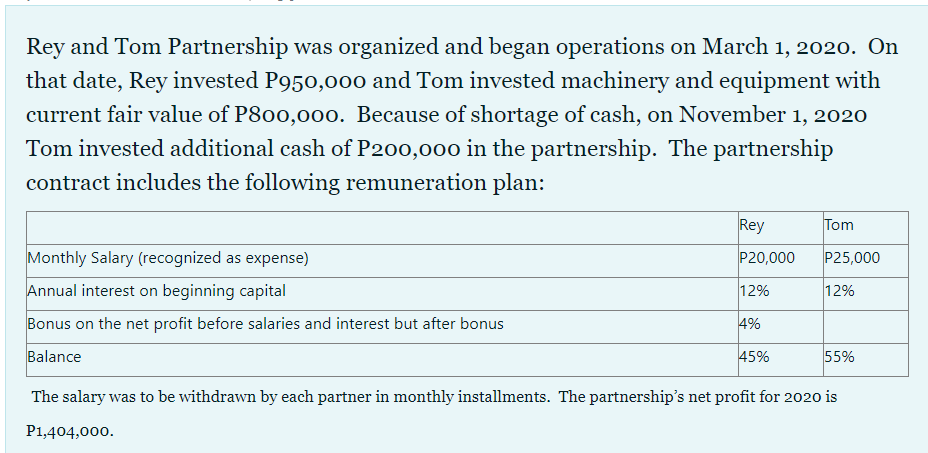

Transcribed Image Text:Rey and Tom Partnership was organized and began operations on March 1, 2020. On

that date, Rey invested P950,000 and Tom invested machinery and equipment with

current fair value of P800,00o. Because of shortage of cash, on November 1, 2020

Tom invested additional cash of P200,000 in the partnership. The partnership

contract includes the following remuneration plan:

Rey

Tom

Monthly Salary (recognized as expense)

P20,000

P25,000

Annual interest on beginning capital

12%

12%

Bonus on the net profit before salaries and interest but after bonus

4%

Balance

45%

55%

The salary was to be withdrawn by each partner in monthly installments. The partnership's net profit for 2020 is

P1,404,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College