Provision Moore Probst Tanski Interest on weighted-average capital after consideration of draws ... Annual salary Bonus as a percentage of income after the bonus Profit and loss percentage Capital balance at the beginning of the current year Drawings during current year:. March 31.... June 30 ... September 30 .... 10% 10% 10% $ 20,000 $75,000 $65,000 10% 10% .... 20% 40% 40% $250,000 $60,000 $40,000 .... ... $ 25,000 $ $ $40,000 $20,000 $20,000 $20,000 $20,000 $

Provision Moore Probst Tanski Interest on weighted-average capital after consideration of draws ... Annual salary Bonus as a percentage of income after the bonus Profit and loss percentage Capital balance at the beginning of the current year Drawings during current year:. March 31.... June 30 ... September 30 .... 10% 10% 10% $ 20,000 $75,000 $65,000 10% 10% .... 20% 40% 40% $250,000 $60,000 $40,000 .... ... $ 25,000 $ $ $40,000 $20,000 $20,000 $20,000 $20,000 $

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.1MBA

Related questions

Question

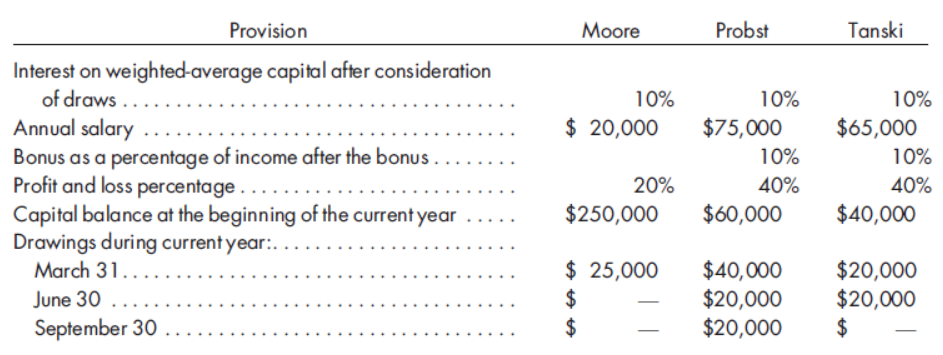

Moore, Probst, and Tanski formed a partnership whose

If the weighted-average capital is negative, interest at 10% will be charged against the partner’s profit allocation. All provisions of the profit and loss agreement should be satisfied and any resulting deficiency should be allocated based on the profit and loss percentages. Assuming current-year income of $168,000, determine how the income should be allocated to the partners.

Transcribed Image Text:Provision

Moore

Probst

Tanski

Interest on weighted-average capital after consideration

of draws ...

Annual salary

Bonus as a percentage of income after the bonus

Profit and loss percentage

Capital balance at the beginning of the current year

Drawings during current year:.

March 31....

June 30 ...

September 30 ....

10%

10%

10%

$ 20,000

$75,000

$65,000

10%

10%

....

20%

40%

40%

$250,000

$60,000

$40,000

....

...

$ 25,000

$

$

$40,000

$20,000

$20,000

$20,000

$20,000

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,