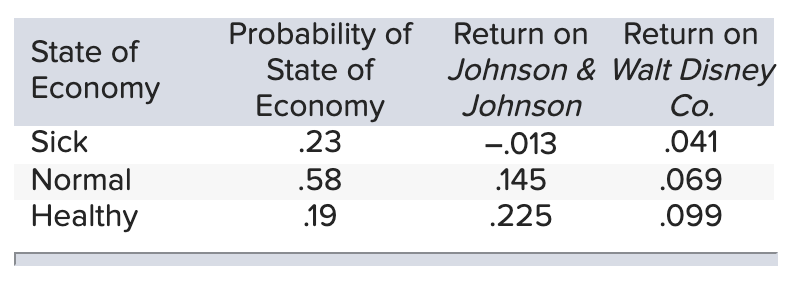

Based on the following stock return information for Johnson & Johnson and Walt Disney (see table), the correlation between the returns of the two stocks is: a. 0.9647 b. 0.0807 c. 0.0015 d. 0.0003 e. 0.0187

Q: Calculate the expected return for Stock media Prima and Stock Astro 2. Calculate the standard…

A: Probability (%) (1) Stock Media Prima(%) (2) Expected returns (3)=(1)×(2) Stock Astro (4)…

Q: A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 64.73 — 2…

A: Given information : Year Price Dividend 1 $ 64.73 $ - 2…

Q: Given the following information, determine the beta coefficient for Stock L that is consistent with…

A: The beta coefficient factor is the degree of volatility present with the stock investment in…

Q: Today, a firm has a stock price of $14.26 and an EPS of $1.15. Its close competitor has an EPS of…

A: The method of comparables is used to find the equity value of a company by equating its ratios to…

Q: 1. You are given the following information regarding prices for a sample of stocks. PRICE Stock…

A: Hi, as per our policy we will answer the first 3 sub-parts. Please repost the remaining parts…

Q: Calculate the range of returns that an investor would have expected to achieve 95 percent of the…

A: Given arithmetic means are normally distributed. We need to calculate the range of returns that an…

Q: Consider the three stocks in the following table. Pt represents price at time t, and Qt represents…

A:

Q: If the correlation of prices between two stocks is 0.35, then the price of one stock would be…

A: Correlation is the measure of the extend to which two different variable are related and measures…

Q: You are evaluating two stocks and trying to decide if they are underv You are given the following…

A: Alpha of stock shows that how is the performance of stock based on the risk involved in the stock so…

Q: If the covariance between two stocks is 115% and the standard deviation of both stocks are 23% and…

A: Answer 1. Information provided: covariance = 115% standard deviation of stock A = 23% standard…

Q: What is the standard deviation of Stock A returns given the information below about its returns…

A: Solution:- Standard deviation means the deviation of a value around its mean. Standard deviation in…

Q: the following table shows the beta and expected return for each of five stocks. Stocks Beta…

A: Capital Asset Pricing Model:- Capital Asset Pricing Model (CAPM) could be a measure of the…

Q: ou are given the following information regarding prices for a sample of stocks. a. Construct a…

A: Price-Weighted Index = Sum of All Prices/Number of Stock Value-weighted Index = Total Value of…

Q: The table below contains the covariance matrix of stock returns and the market. Assume that the…

A: Risk is the possibility of loss for an organization and risk management is one of the most important…

Q: A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 64.43 — 2…

A: The rate of return that an investor is expected to earn from the investment is term as the expected…

Q: Stocks A and B have the following returns: (Click on the following icon o in order to copy its…

A:

Q: What would be the expected price of UPS stock on this date, if estimated using the method of…

A: Earnings per share is the return for every share held by the shareholders. It is calculated by…

Q: Covariance of the returns of:

A: Correlation states the relationship between two variables. The relationship lies between +1 to -1…

Q: Following is information for two stocks: Investment r σ Stock X 8% 10%…

A: Relative risk can be judged by comparing the coefficient of variation (CV) of both the securities.…

Q: 1. Stock prices and stand-alone risk The S&P 500 Index is one of the most commonly used benchmark…

A: Price-earnings ratio is the ratio that compares the market price of the share in relation to its…

Q: Suppose you are given the following information about 2 stocks, what weight would you invest in…

A: Portfolio variance : When calculating portfolio variance, stocks in a portfolio are examined for…

Q: The following table shows the sensitivity of four stocks to the three Fama–French factors. Estimate…

A: According to Fama Fench model there are more factors to be considered other than market premium and…

Q: A4 2e The stocks on ABC Company and XYZ Company have the following returns over the last five…

A: Given, coefficient of variation = standard deviation/average return

Q: hen computing for book value per unit, which of the following is used as a denominator? a. All…

A: Book value per unit represent the minimum value of any company's shareholders' equity and it is…

Q: Use the following data for the Sara Company to calculate the cost of common stocks (Rs), the cost of…

A: given, Rf=7% Rm=25% beta=1.5 according to CAPM model: Rs=rf+beta×rm-rf=7%+1.5×25%-7%=34% answer: The…

Q: Over a certain period, large-company stocks had an average return of 12.79 percent, the average…

A: Given, Risk-free rate = 2.62% Return on given stock = 17.61% Risk premium = Return on given stock -…

Q: The standard deviation of stock returns of Park Corporation is60%. The standard deviation of the…

A: Given information: Standard deviation of Park Corporation is 60%, Standard deviation of market…

Q: The following table shows the mean and standard deviation of the prices of two shares in a stock…

A: In order to determine the price of stock A, we'll use X on Y regression equation. X-X_=rσxσyY-Y_…

Q: What will be the number of shares outstanding after the split? B) If the common stock had a market…

A: Stock split is a process of reducing the market price of the company by reducing par value. For this…

Q: Use the following data for the Sara Company to calculate the cost of common stocks (Rs), the cost of…

A: The cost of Preferred stocks = (Dividend + Floatation cost) / Price of Preferred stock The cost of…

Q: A stock has had returns of 16.72 percent, 12.20 percent, 5.90 percent, 26.86 percent, and -13.49…

A: Holding period return refers to the return on the portfolio over a period of time. Holding period…

Q: Suppose that the index model for stocks A and Bis estimated from excess returns with the following…

A: Covariance shows the relationship of two variables whenever there is a change in one variable.…

Q: Demonstrate the impact of different values on a market value weighted stock index with a…

A: Market value is the market value of stocks but for those stocks only which are the outstanding…

Q: Suppose you are given the following information about 2 stocks, what is the Sharpe Ratio of a…

A: Working Note #1 Expected return of portfolio= Wt. of stock A * Return of stock A + Wt. of stock B *…

Q: Calculate and interpret the correlations between the two assets

A: Correlation of two assets helps to determine the relation between the two assets. The correlation…

Q: The covariance between the returns on two stock is 0.0425. The standard deviations of stocks A and B…

A: Covariance = 0.0425 Standard deviation of stock A = 0.2041 Standard deviation of stock B = 0.2944

Q: Which of the following regarding the stock indices is true? O A. The divisor for Dow Jones…

A: Disclaimer:-Since you have asked multiple question, we will solve the first question for you. If you…

Q: Firm A's stock returns are correlated with market returns at 0.90, while Firm B's stock returns are…

A: Solution:- Beta means the sensitivity of stock with respect to market.

Q: Consider the three stocks in the following table. Pt represents price at time t, and Ot represents…

A: The price during year 0 (P0) is multiplied by the quantity in year 0 (Q0) to determine the market…

Q: A stock has had the following year-end prices and dividends: Year Price Dividend $ 64.33 71.20 1 2…

A: Return means earning additional investment amount during the period. Return can be in the form of…

Q: A prospective investor obtained the following information on XY stock: Date Stock Prices ($)…

A: The time-weighted rate of return (TWR) is a measurement of a portfolio's compound rate of growth.…

Q: Considering the following stock return information for Goya Foods and Bloomingdales, State…

A: given, state of economy return on Goya Foods return on Bloomingales bear 0.108 -0.051 normal…

Q: Consider the three stocks in the following table. Pt represents price at time t, and Qt represents…

A: A price-weighted stock index is an index in which every company that is included influences the…

Q: For the above shares if the expected inter correlations are given as follows: Investment…

A:

|

Based on the following stock return information for Johnson & Johnson and Walt Disney (see table), the correlation between the returns of the two stocks is: a. 0.9647

b. 0.0807

c. 0.0015

d. 0.0003

e. 0.0187

|

Step by step

Solved in 2 steps with 4 images

- 1. see image for the question and statmentchoices: a. 176,000b. 263,000c. 204,000d. 321,000Present and future values of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Debbie has $368,882 accumulated in a 401K plan. The fund…Present and future values of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Rosie's Florist borrows $300,000 to be paid off in six…

- Info for question in attached images Answer Choices for Q1 a. $7,500 b. $10,830 c. $7,400 d. $25,730Q12 You are required to compute the sum of Net social income to staff, community and general public as a whole, if: Net social income to General public is OMR 900 Net social income to staff is OMR 600 and Net social income to community is OMR 400. a. None of them is correct b. OMR 1,000 c. OMR 1,900 d. OMR 1,500Connorhas $58,024inasavingsaccount. Theinterestrateis 5%peryearandisnotcompounded. Tothenearestdollar, howmuchwillhehaveintotalin 3months?

- Whatiseachofthefollowinginvestmentsworthtodayassuminganannualdiscountrateof 7%? ABritishgovernmentConsolpaying£60annually.Q11: What is Music, Inc.’s 2021 Operating Income?D1 Retention: 50%, D7 Retention: %20, D30 Retention: 8% Interstitial Impressions per DAU: 4, Rewarded Impressions per DAU: 2 Interstitials eCPM: $30, Rewarded eCPM: $50 1) What is day 7 ARPU? 2) How would you estimate d30 ARPU?