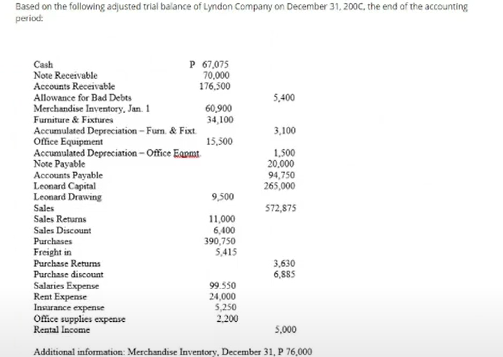

Based on the following adjusted trial balance of Lyndon Company on December 31, 20OC, the end of the accounting period: P 67,075 70,000 176,500 Cash Note Receivable Accounts Receivable Allowance for Bad Debts Merchandise Inventory, Jan. 1 Fumiture & Fixtures 5,400 60,900 34,100 Accumulated Depreciation - Fum. & Fixt Office Equipment Accumulated Depreciation - Office Eaomt Note Payable Accounts Payable Leonard Capital Leonard Drawing Sales Sales Returns 3,100 15,500 1,500 20,000 94,750 265,000 9,500 572,875 11,000 6,400 390,750 5,415 Sales Discount Purchases Freight in Purchase Retuns 3,630 6,885 Purchase discount Salaries Expense Rent Expense Insurance expense Office supplies expense Rental Income 99.550 24,000 5,250 2.200 5,000 21 D 76 000

Based on the following adjusted trial balance of Lyndon Company on December 31, 20OC, the end of the accounting period: P 67,075 70,000 176,500 Cash Note Receivable Accounts Receivable Allowance for Bad Debts Merchandise Inventory, Jan. 1 Fumiture & Fixtures 5,400 60,900 34,100 Accumulated Depreciation - Fum. & Fixt Office Equipment Accumulated Depreciation - Office Eaomt Note Payable Accounts Payable Leonard Capital Leonard Drawing Sales Sales Returns 3,100 15,500 1,500 20,000 94,750 265,000 9,500 572,875 11,000 6,400 390,750 5,415 Sales Discount Purchases Freight in Purchase Retuns 3,630 6,885 Purchase discount Salaries Expense Rent Expense Insurance expense Office supplies expense Rental Income 99.550 24,000 5,250 2.200 5,000 21 D 76 000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

HOW MUCH IS TEH NET INCOME

a. 53, 925

b. 63, 975

c. 48, 925

d. 58, 925

Transcribed Image Text:Based on the following adjusted trial balance of Lyndon Company on December 31, 200c, the end of the accounting

period:

P 67,075

70,000

176,500

Cash

Note Receivable

Accounts Receivable

Allowance for Bad Debts

Merchandise Inventory, Jan. 1

Fumiture & Fixtures

5,400

60,900

34,100

Accumulated Depreciation - Furn. & Fixt.

Office Equipment

3,100

15,500

Accumulated Depreciation - Office Eanmt

1,500

20,000

94,750

265,000

Note Payable

Accounts Payable

Leonard Capital

Leonard Drawing

Sales

Sales Returns

Sales Discount

Purchases

Freight in

9,500

572,875

11,000

6,400

390,750

5,415

Purchase Returns

3,630

6,885

Purchase discount

Salaries Expense

Rent Expense

Insurance expense

Ofice supplies expense

Rental Income

99.550

24,000

5,250

2,200

5,000

Additional information: Merchandise Inventory, December 31, P 76,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning