Based on the topic in the picture, what are the key points there that you think are important to analyze as a decision-maker?

Based on the topic in the picture, what are the key points there that you think are important to analyze as a decision-maker?

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Based on the topic in the picture, what are the key points there that you think are important to analyze as a decision-maker?

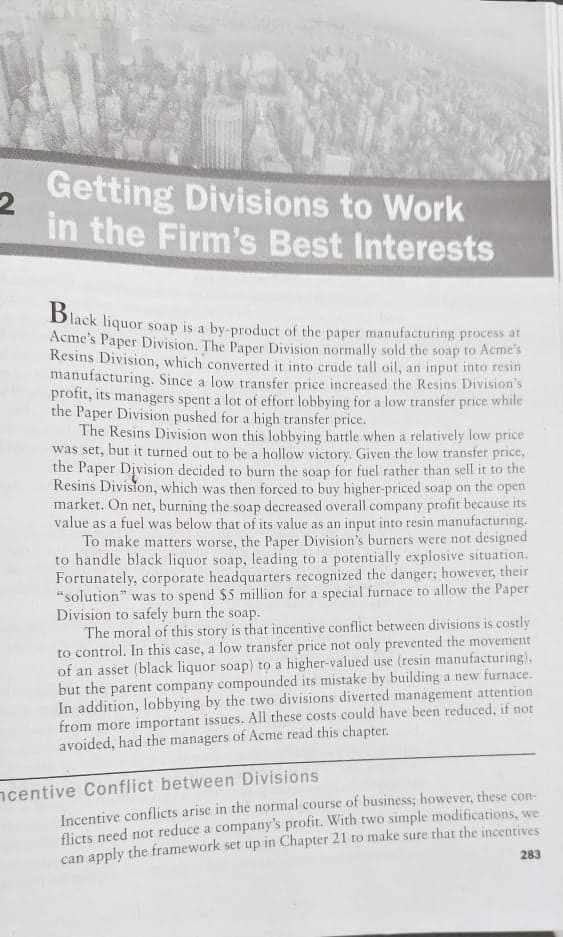

Transcribed Image Text:Getting Divisions to Work

in the Firm's Best Interests

Dlack liquor soap is a by-product of the paper manufacturing process at

Acme's Paper Division. The Paper Division normally sold the soap to Acme's

Resins Division, which converted it into crude tall oil, an input into resin

manufacturing. Since a low transfer price increased the Resins Division's

profit, its managers spent a lot of effort lobbying for a low transfer price while

the Paper Division pushed for a high transfer price.

The Resins Division won this lobbying battle when a relatively low price

was set, but it turned out to be a hollow victory. Given the low transfer price,

the Paper Division decided to burn the soap for fuel rather than sell it to the

Resins Division, which was then forced to buy higher-priced soap on the open

market. On net, burning the soap decreased overall company profit because its

value as a fuel was below that of its value as an input into resin manufacturing.

To make matters worse, the Paper Division's burners were not designed

to handle black liquor soap, leading to a potentially explosive situation.

Fortunately, corporate headquarters recognized the danger; however, their

"solution" was to spend $5 million for a special furnace to allow the Paper

Division to safely burn the soap.

The moral of this story is that incentive conflict between divisions is costly

to control. In this case, a low transfer price not only prevented the movement

of an asset (black liquor soap) to a higher-valued use (resin manufacturing),

but the parent company compounded its mistake by building a new furnace.

In addition, lobbying by the two divisions diverted management attention

from more important issues. All these costs could have been reduced, if not

avoided, had the managers of Acme read this chapter.

ncentive Conflict between Divisions

Incentive conflicts arise in the normal course of business; however, these con-

flicts need not reduce a company's profit. With two simple modifications, we

can apply the framework set up in Chapter 21 to make sure that the incentives

283

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON