Based on this information, compute (a) the current ratio, (b) the days sales outstanding (c) the inventory turnover ratio,(d) the debt to asset ratio (e) ROA and (f) ROE (01 each = 06)

Based on this information, compute (a) the current ratio, (b) the days sales outstanding (c) the inventory turnover ratio,(d) the debt to asset ratio (e) ROA and (f) ROE (01 each = 06)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.4ADM

Related questions

Question

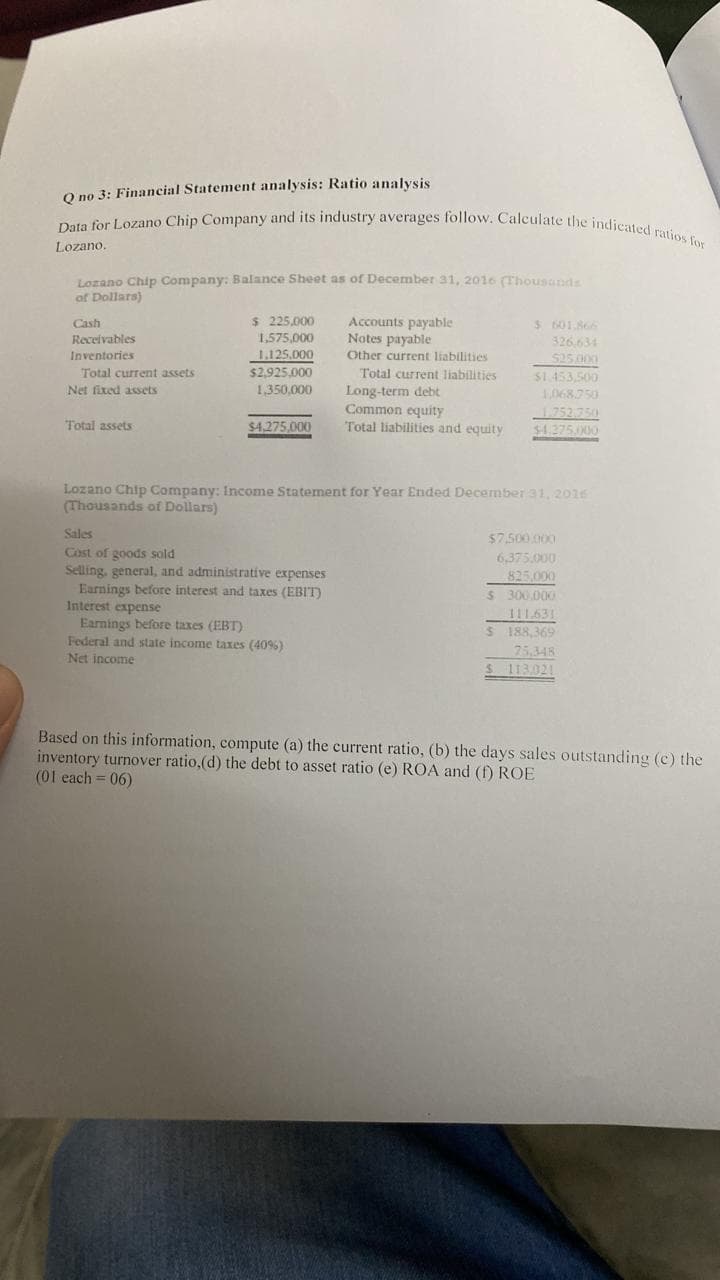

Transcribed Image Text:Q no 3: Financial Statement analysis: Ratio analysis

Data for Lozano Chip Company and its industry averages follow. Calculate the indicated ratios for

Lozano.

Lozano Chip Company: Balance Sheet as of December 31, 2016 (Thousands

of Dollars)

Cash

Receivables

Inventories

Total current assets

Net fixed assets

Total assets

$ 225,000

1,575,000

1.125,000

$2,925.000

1,350,000

$4,275,000

Sales

Cost of goods sold

Selling, general, and administrative expenses

Earnings before interest and taxes (EBIT)

Accounts payable

Notes payable

Other current liabilities

Interest expense

Earnings before taxes (EBT)

Federal and state income taxes (40%)

Net income

Total current liabilities

Long-term debt

Common equity

Total liabilities and equity

$ 601.866

326.634

525.000

Lozano Chip Company: Income Statement for Year Ended December 31, 2016

(Thousands of Dollars)

$1.453,500

1,068.750

1.752.750

$4.275,000

$7,500.000

6,375.000

825,000

$ 300.000

111.631

$ 188,369

75.348

$ 113,021

Based on this information, compute (a) the current ratio, (b) the days sales outstanding (c) the

inventory turnover ratio,(d) the debt to asset ratio (e) ROA and (f) ROE

(01 each = 06)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning