Basic Earnings per Share Monona Company reported net income of $29,975 for 2016. During all of 2016, Monona had 1,000 shares of 10%, $100 par, nonconvertible preferred stock outstanding, on which the year's dividends had been paid. At the beginning of 2016, the company had 7,000 shares of common stock outstanding. On April 2, 2016, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2016. Common dividends of $17,000 had been paid during 2016. At the end of 2016, the market price per share of common stock was $17.50. Required: 1. Compute Monona's basic earnings per share for 2016. If required, round your answer to two decimal places. per share 2. Compute the price/earnings ratio for 2016. If required, round your answer to one decimal place. times

Basic Earnings per Share Monona Company reported net income of $29,975 for 2016. During all of 2016, Monona had 1,000 shares of 10%, $100 par, nonconvertible preferred stock outstanding, on which the year's dividends had been paid. At the beginning of 2016, the company had 7,000 shares of common stock outstanding. On April 2, 2016, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2016. Common dividends of $17,000 had been paid during 2016. At the end of 2016, the market price per share of common stock was $17.50. Required: 1. Compute Monona's basic earnings per share for 2016. If required, round your answer to two decimal places. per share 2. Compute the price/earnings ratio for 2016. If required, round your answer to one decimal place. times

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 18E: Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares...

Related questions

Question

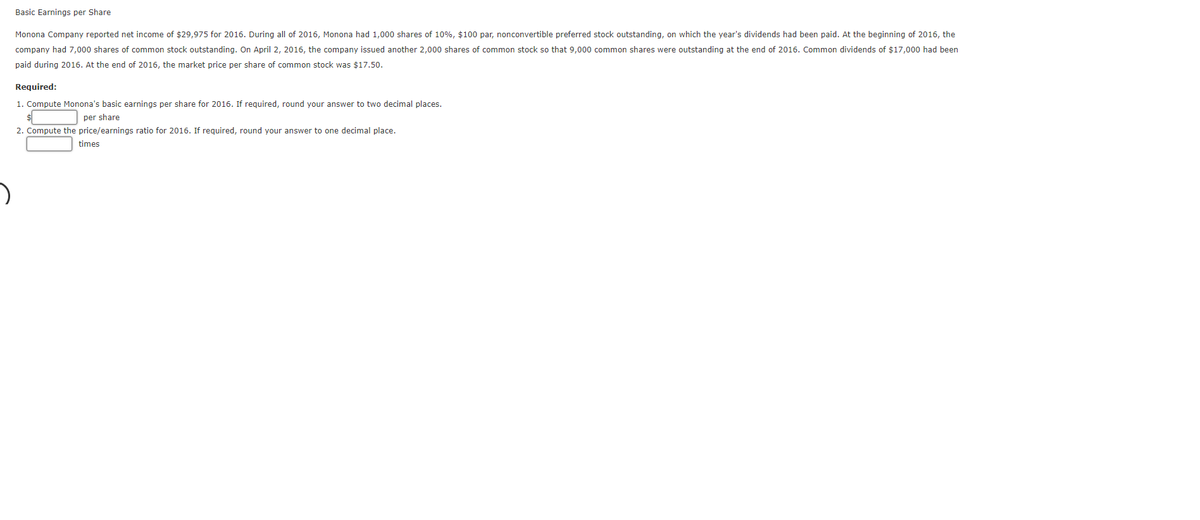

Transcribed Image Text:Basic Earnings per Share

Monona Company reported net income of $29,975 for 2016. During all of 2016, Monona had 1,000 shares of 10%, $100 par, nonconvertible preferred stock outstanding, on which the year's dividends had been paid. At the beginning of 2016, the

company had 7,000 shares of common stock outstanding. On April 2, 2016, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2016. Common dividends of $17,000 had been

paid during 2016. At the end of 2016, the market price per share of common stock was $17.50.

Required:

1. Compute Monona's basic earnings per share for 2016. If required, round your answer to two decimal places.

per share

2. Compute the price/earnings ratio for 2016. If required, round your answer to one decimal place.

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning