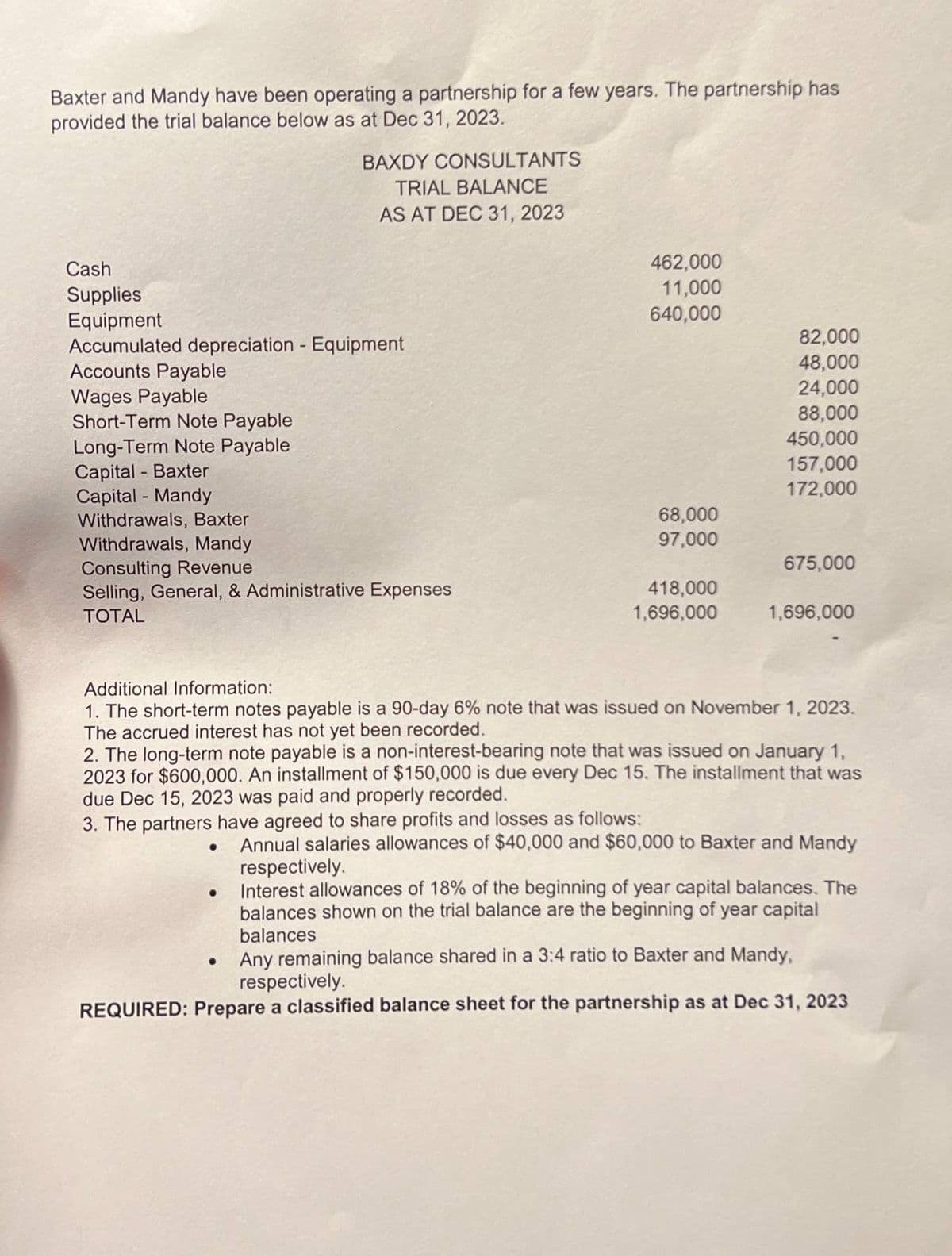

Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec 31, 2023. BAXDY CONSULTANTS TRIAL BALANCE AS AT DEC 31, 2023 Cash Supplies Equipment Accumulated depreciation - Equipment Accounts Payable Wages Payable Short-Term Note Payable Long-Term Note Payable Capital - Baxter Capital - Mandy Withdrawals, Baxter Withdrawals, Mandy Consulting Revenue Selling, General, & Administrative Expenses TOTAL 462,000 11,000 640,000 82,000 48,000 24,000 88,000 450,000 157,000 172,000 68,000 97,000 675,000 418,000 1,696,000 1,696,000 Additional Information: 1. The short-term notes payable is a 90-day 6% note that was issued on November 1, 2023. The accrued interest has not yet been recorded. 2. The long-term note payable is a non-interest-bearing note that was issued on January 1, 2023 for $600,000. An installment of $150,000 is due every Dec 15. The installment that was due Dec 15, 2023 was paid and properly recorded. 3. The partners have agreed to share profits and losses as follows: • Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy respectively. Interest allowances of 18% of the beginning of year capital balances. The balances shown on the trial balance are the beginning of year capital balances Any remaining balance shared in a 3:4 ratio to Baxter and Mandy, respectively. REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec 31, 2023. BAXDY CONSULTANTS TRIAL BALANCE AS AT DEC 31, 2023 Cash Supplies Equipment Accumulated depreciation - Equipment Accounts Payable Wages Payable Short-Term Note Payable Long-Term Note Payable Capital - Baxter Capital - Mandy Withdrawals, Baxter Withdrawals, Mandy Consulting Revenue Selling, General, & Administrative Expenses TOTAL 462,000 11,000 640,000 82,000 48,000 24,000 88,000 450,000 157,000 172,000 68,000 97,000 675,000 418,000 1,696,000 1,696,000 Additional Information: 1. The short-term notes payable is a 90-day 6% note that was issued on November 1, 2023. The accrued interest has not yet been recorded. 2. The long-term note payable is a non-interest-bearing note that was issued on January 1, 2023 for $600,000. An installment of $150,000 is due every Dec 15. The installment that was due Dec 15, 2023 was paid and properly recorded. 3. The partners have agreed to share profits and losses as follows: • Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy respectively. Interest allowances of 18% of the beginning of year capital balances. The balances shown on the trial balance are the beginning of year capital balances Any remaining balance shared in a 3:4 ratio to Baxter and Mandy, respectively. REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Baxter and Mandy have been operating a partnership for a few years. The partnership has

provided the trial balance below as at Dec 31, 2023.

BAXDY CONSULTANTS

TRIAL BALANCE

AS AT DEC 31, 2023

Cash

Supplies

Equipment

Accumulated depreciation - Equipment

Accounts Payable

Wages Payable

Short-Term Note Payable

Long-Term Note Payable

Capital - Baxter

Capital - Mandy

Withdrawals, Baxter

Withdrawals, Mandy

Consulting Revenue

Selling, General, & Administrative Expenses

TOTAL

462,000

11,000

640,000

82,000

48,000

24,000

88,000

450,000

157,000

172,000

68,000

97,000

675,000

418,000

1,696,000

1,696,000

Additional Information:

1. The short-term notes payable is a 90-day 6% note that was issued on November 1, 2023.

The accrued interest has not yet been recorded.

2. The long-term note payable is a non-interest-bearing note that was issued on January 1,

2023 for $600,000. An installment of $150,000 is due every Dec 15. The installment that was

due Dec 15, 2023 was paid and properly recorded.

3. The partners have agreed to share profits and losses as follows:

•

Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy

respectively.

Interest allowances of 18% of the beginning of year capital balances. The

balances shown on the trial balance are the beginning of year capital

balances

Any remaining balance shared in a 3:4 ratio to Baxter and Mandy,

respectively.

REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning