Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 1EA

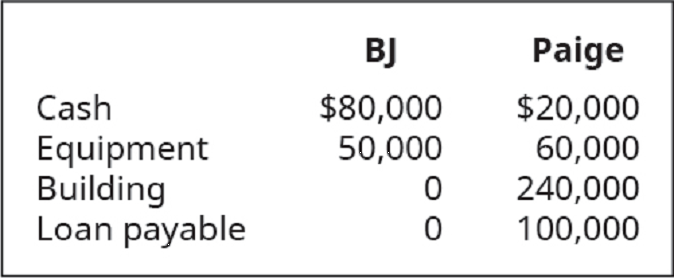

On May 1, 2017, BJ and Paige formed a

Prepare a separate

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On May 1, 2016, Peppa and Piggy formed a partnership and agreed to share profits and losses in the ration of 3:7, respectively. Peppa contributed a parcel of land that cost P10,000. Piggy contributed P40,000 cash. The land was sold for P18,000 on May 1, 2016, immediately after formation of the partnership. What amount should be recorded in Peppa’s capital account on formation of the partnership?

Claire,Dolly and Ellery formed the CDE Partnership on September 1, 2016, with the following assets, measured at book values in their respective records, contributed by each partner:

CLAIREDOLLYELLERYCash486,000460,107231,903Accounts Receivable109,620-141,000Property, Plant and Equipment 2,094,390450,000-

A part of Claire's cash contribution, P324,000, comes from personal borrowings. Also, PPE of Claire and Dolly are mortgaged with the bank for P1,458,000 and P108,000, respectively. The partnership is to assume responsibility for these PPE mortgages. The fair value of the accounts receivable contributed by Ellery is P137,000 while the PPE contributed by Dolly at this date is P510,300. The partners have agreed to share interests on a 5:3:2 ratio, to Claire, Dolly and Ellery, respectively.

Required: Use Bonus and Goodwill Method in computing the Capital balances of Claire, Dolly and Ellery.

Herbert and Ireneo are partners sharing profits and losses in the ratio of 60 % and 40% , respectively . The partnership balance sheet reveals that at August 30 , 2016 , the partners have the following capital balances:

Herbert , Capital 25,000

Ireneo , Capital 15,000

At this date , Joshua was admitted as a partner for a consideration of P45,000 cash for a 40 % interest in capital and in profits.

Assumptions:

A. Joshua is admitted by investment and Goodwill Method / Revaluation Method is used.

B. Joshua is admitted by investment and the adjusted capital after his admission is 90,000.

Required:

1. Make a table

Rows for Assumptions a and b must include Original Capital Interest Purchased and Adjusted Capital.

Rows for Assumptions c d and e must include Original Capital Bonus (there is any)Goodwill (there is any) and Adjusted Capital

2. The journal entry upon the admission of Joshua.

3. Answer the following questions for each assumption:

i. What will be the total capital of the…

Chapter 15 Solutions

Principles of Accounting Volume 1

Ch. 15 - A partnership ________. A. has one owner B. can...Ch. 15 - Any assets invested by a particular partner in a...Ch. 15 - Which of the following is a disadvantage of the...Ch. 15 - Mutual agency is defined as: A. a mutual agreement...Ch. 15 - Chani contributes equipment to a partnership that...Ch. 15 - Juan contributes marketable securities to a...Ch. 15 - Which one of the following would not be considered...Ch. 15 - A well written partnership agreement should...Ch. 15 - What type of assets may a partner not contribute...Ch. 15 - How does a newly formed partnership handle the...

Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - When a partnership dissolves, the first step in...Ch. 15 - When a partnership dissolves, the last step in the...Ch. 15 - Prior to proceeding with the liquidation, the...Ch. 15 - Does a partnership pay income tax?Ch. 15 - Can a partners personal assets in a limited...Ch. 15 - Can a partnership assume liabilities as part of...Ch. 15 - Does each partner have to contribute an equal...Ch. 15 - What types of bases for dividing partnership net...Ch. 15 - Angela and Agatha are partners in Double A...Ch. 15 - On February 3, 2016 Sam Singh invested $90,000...Ch. 15 - Why do partnerships dissolve?Ch. 15 - What are the four steps involved in liquidating a...Ch. 15 - When a partner withdraws from the firm, which...Ch. 15 - What is the first step in a partnership...Ch. 15 - When a partnership liquidates, do partners get...Ch. 15 - Coffee Partners decides to close due to the...Ch. 15 - On May 1, 2017, BJ and Paige formed a partnership....Ch. 15 - The partnership of Chase and Chloe shares profits...Ch. 15 - The partnership of Tasha and Bill shares profits...Ch. 15 - Cheese Partners has decided to close the store. At...Ch. 15 - The partnership of Michelle, Amal, and Maureen has...Ch. 15 - The partnership of Tatum and Brook shares profits...Ch. 15 - Arun and Margot want to admit Tammy as a third...Ch. 15 - When a partnership is liquidated, any gains or...Ch. 15 - The partnership of Magda and Sue shares profits...Ch. 15 - The partnership of Arun, Margot, and Tammy has...Ch. 15 - Match each of the following descriptions with the...Ch. 15 - While sole proprietorships and corporations are...Ch. 15 - A partnership is thriving. The three partners get...

Additional Business Textbook Solutions

Find more solutions based on key concepts

What strategic actions do you think a store like Macys can undertake to survive in the current retail industry?

Principles of Management

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Cost Accounting (15th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Prepare a production cost report and journal entries (Learning Objectives 4 5) Vintage Accessories manufacture...

Managerial Accounting (5th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Knowledge Booster

Similar questions

- On February 3, 2016 Sam Singh invested $90,000 cash for a 1/3 interest in a newly formed partnership. Prepare the journal entry to record the transaction.arrow_forwardLori and Peter enter into a partnership and decide to share profits and losses as follows: 1 The first allocation is a salary allowance with Lori receiving $16,000 and Peter receiving $18,000. 2 The second allocation is 15% of the partners capital balances at year end. On December 31, 2019 the capital balances for Lori and Peter are $90,000 and $20,000, respectively. 3. Any remaining profit or loss is allocated equally. For the year ending December 31, 2019, the partnership reported net Income of $55,000 What is Lori's share of the net income? A) $29,500 B) $20,250 C) $31,750 D) $23,250arrow_forwardGray, Stone, and Lawson open an accounting practice on January 1, 2016, in San Diego, California, to be operated as a partnership. Gray and Stone will serve as the senior partners because of their years of experience. To establish the business, Gray, Stone, and Lawson contribute cash and other properties valued at $210,000, $180,000, and $90,000, respectively. An articles of partnership agreement is drawn up. It has the following stipulations:∙ Personal drawings are allowed annually up to an amount equal to 10 percent of the beginning capital balance for the year.∙ Profits and losses are allocated according to the following plan:1. A salary allowance is credited to each partner in an amount equal to $8 per billable hour worked by that individual during the year.2. Interest is credited to the partners’ capital accounts at the rate of 12 percent of the average monthly balance for the year (computed without regard for current income or drawings).3. An annual bonus is to be credited to…arrow_forward

- Herbert and Ireneo are partners sharing profits and losses in the ratio of 60 % and 40% , respectively . The partnership balance sheet reveals that at August 30 , 2016 , the partners have the following capital balances: Herbert , Capital 25,000 Ireneo , Capital 15,000 At this date , Joshua was admitted as a partner for a consideration of P45,000 cash for a 40 % interest in capital and in profits. Assumptions: a. Joshua is admitted by purchase of interest. b. Joshua is admitted by purchase of interest from Herbert . c. Joshua is admitted by investment and Bonus Method is used. d. Joshua is admitted by investment and Goodwill Method / Revaluation Method is used. e. Joshua is admitted by investment and the adjusted capital after his admission is 90,000. Required: 1. Make a table Rows for Assumptions a and b must include Original Capital Interest Purchased and Adjusted Capital. Rows for Assumptions c d and e must include Original Capital Bonus (there is any)Goodwill (there is…arrow_forwardCastro and Falceso are partners who share profits and losses in a ratio of 2:3, respectively, and have the following capital balances on September 30, 2019: Castro, Capital P100,000 Cr. Falceso, Capital P150,000 Cr. The partners agreed to admit Garachico to the partnership. Calculate the capital balances of each partner after the admission of Garachico, assuming that bonuses are recorded when appropriate for each of the following assumptions: Garachico paid Castro P50,000 for 40% of his interest Garachico invested P50,000 for a one-sixth interest in the partnership Garachico invested P50,000 for a 25% interest in the partnershiparrow_forwardOn January 1, 2019, David and Enrile decided to form a partnership. At the end of the year, the partnership had a credit balance in its income summary account of P 120,000. The capital accounts of the partnership show the following transactions below. David Balance, January 1 P 300,000 Additional Investment, July 16 80,000 Withdrawal, September 15 ( 30,000) Enrile Balance, January 1 P 250,000 Additional Investment, May 8 100,000 Withdrawal, October 15 ( 75,000) Assuming that an interest if 20% per annum is given on average capital and the balance of the profits is divided equally, how much is the share of Enrile and David in profits for the year 2019?arrow_forward

- On October 1, 2021, Pamu and Kevin formed a partnership and agreed to share profits and lossesin the ratio of 3:7, respectively. Balances of capital accounts should be in accordance with the profitand loss percentage on the date of partnership formation. Pamu contributed a parcel of land that costher P200,000. Kevin contributed P300,000 cash. The land has a quoted price of P360,000 on October1, 2021. What amount should be recorded in Pamu’s capital account upon formation of thepartnership assuming the use of bonus method? a. P150,000b. P198,000c. P200,000d. P360,000arrow_forwardOn June 30, 2017, a partnership was formed by Ariston and Astoria. Ariston contributed cash. Astoria, previously a sole proprietor, contributed non-cash assets, including a reality subject to a mortgage, which was assumed by the partnership. Astoria’s capital account at June 30, 2017 should be recorded at a. The fair value of the property at June 30, 2017 b. Astoria’s carrying amount of the property at June 30, 2017 c. Astoria’s carrying amount of the property less the mortgage payable at June 30, 2017 d. The fair value of the property less the mortgage payable at June 30, 2017arrow_forwardOn September 13, 2016, AA and BB decided to combine their assets and form a partnership. The partnership is to take over the business assets and assume the business liabilities; and capitals are to be based on net assets and transferred after the following adjustments. 1. BB's inventory is to be valued at P140,000. 2. A 5% allowance for uncollectible accounts is to be established on the accounts receivable of each party. 3. Accrued liabilities of P8,000 are to be recognized in AA's books. The statements of financial position on September 13 before adjustments are given below. Required: 3. Prepare the statement of financial position as of September 13,2016arrow_forward

- On September 13, 2016, AA and BB decided to combine their assets and form a partnership. The partnership is to take over the business assets and assume the business liabilities; and capitals are to be based on net assets and transferred after the following adjustments. 1. BB's inventory is to be valued at P140,000. 2. A 5% allowance for uncollectible accounts is to be established on the accounts receivable of each party. 3. Accrued liabilities of P8,000 are to be recognized in AA's books. The statements of financial position on September 13 before adjustments are given below.arrow_forwardOn September 13, 2016, AA and BB decided to combine their assets and form a partnership. The partnership is to take over the business assets and assume the business liabilities; and capitals are to be based on net assets and transferred after the following adjustments. 1. BB's inventory is to be valued at P140,000. 2. A 5% allowance for uncollectible accounts is to be established on the accounts receivable of each party. 3. Accrued liabilities of P8,000 are to be recognized in AA's books. The statements of financial position on September 13 before adjustments are given below. Required: 1. Prepare the entries to adjust and close books of AA and BB. 2. Prepare the opening entries in the books of the partnership. 3. Prepare the statement of financial position as of September 13,2016arrow_forwardOn September 13, 2016, AA and BB decided to combine their assets and form a partnership. The partnership is to take over the business assets and assume the business liabilities; and capitals are to be based on net assets and transferred after the following adjustments. 1. BB's inventory is to be valued at P140,000. 2. A 5% allowance for uncollectible accounts is to be established on the accounts receivable of each party. 3. Accrued liabilities of P8,000 are to be recognized in AA's books. The statements of financial position on September 13 before adjustments are given below. Required: 1. Prepare the entries to adjust and close books of AA and BB.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning