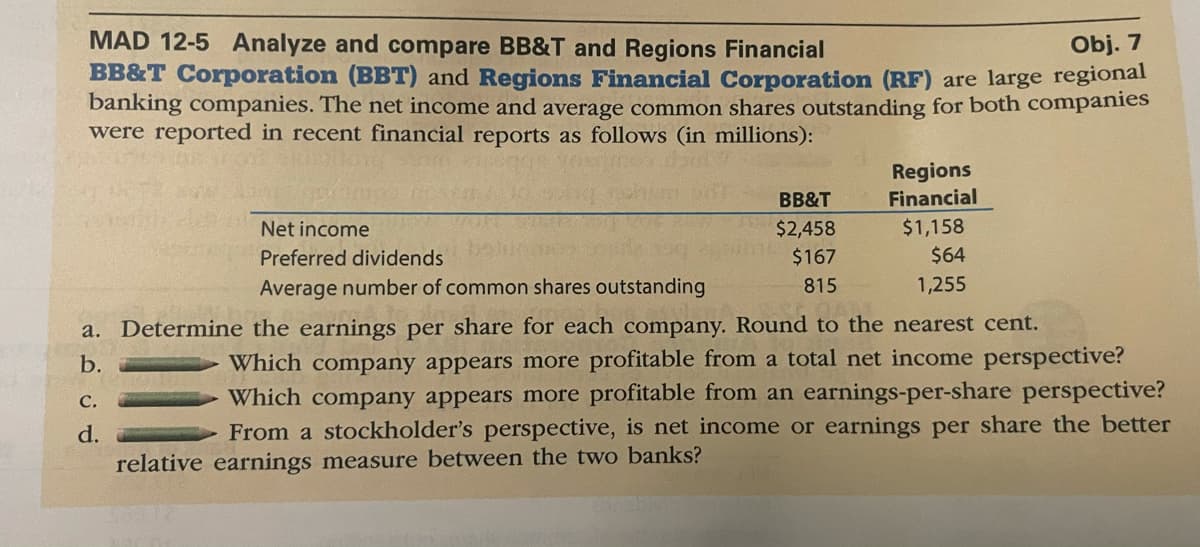

BB&T Corporation (BBT) and Regions Financial Corporation (RF) are large regional banking companies. The net income and average common shares outstanding for both companies were reported in recent financial reports as follows (in millions): Regions Financial BB&T Net income $2,458 $1,158 Preferred dividends $167 $64 Average number of common shares outstanding 815 1,255 a. Determine the earnings per share for each company. Round to the nearest cent. Which company appears more profitable from a total net income perspective? Which company appears more profitable from an earnings-per-share perspective? From a stockholder's perspective, is net income or earnings per share the better b. с. d. relative earnings measure between the two banks?

BB&T Corporation (BBT) and Regions Financial Corporation (RF) are large regional banking companies. The net income and average common shares outstanding for both companies were reported in recent financial reports as follows (in millions): Regions Financial BB&T Net income $2,458 $1,158 Preferred dividends $167 $64 Average number of common shares outstanding 815 1,255 a. Determine the earnings per share for each company. Round to the nearest cent. Which company appears more profitable from a total net income perspective? Which company appears more profitable from an earnings-per-share perspective? From a stockholder's perspective, is net income or earnings per share the better b. с. d. relative earnings measure between the two banks?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4ADM: BBT and Regions Financial: Earnings per share BBT Corporation and Regions Financial Corporation are...

Related questions

Question

Practice Pack

Transcribed Image Text:MAD 12-5 Analyze and compare BB&T and Regions Financial

BB&T Corporation (BBT) and Regions Financial Corporation (RF) are large regional

banking companies. The net income and average common shares outstanding for both companies

were reported in recent financial reports as follows (in millions):

Obj. 7

Regions

Financial

BB&T

$1,158

$64

Net income

$2,458

Preferred dividends

$167

Average number of common shares outstanding

815

1,255

a. Determine the earnings per share for each company. Round to the nearest cent.

Which company appears more profitable from a total net income perspective?

Which company appears more profitable from an earnings-per-share perspective?

From a stockholder's perspective, is net income or earnings per share the better

b.

с.

d.

relative earnings measure between the two banks?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,