BCS's management has set a strategic goal to improve both product and customer profitability. A related subgoal that supports this strategy is to identify profitable products and customers using an accurate cost-accounting system. BCS currently uses a simple cost-accounting system to calculate both product and customer profitability. The only direct costs are the purchase costs of footwear and equipment products. BCS allocates indirect costs to the product groups using a single indirect cost pool for all indirect costs with "pounds of product" as the cost allocation base. Cost and operating data accumulated for the most recent year follow:

BCS's management has set a strategic goal to improve both product and customer profitability. A related subgoal that supports this strategy is to identify profitable products and customers using an accurate cost-accounting system. BCS currently uses a simple cost-accounting system to calculate both product and customer profitability. The only direct costs are the purchase costs of footwear and equipment products. BCS allocates indirect costs to the product groups using a single indirect cost pool for all indirect costs with "pounds of product" as the cost allocation base. Cost and operating data accumulated for the most recent year follow:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 2CMA: The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the...

Related questions

Question

jj1

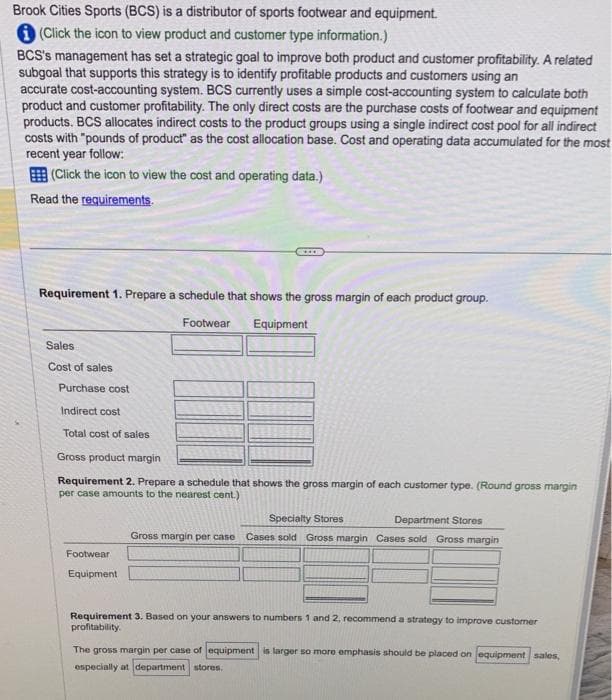

Transcribed Image Text:Brook Cities Sports (BCS) is a distributor of sports footwear and equipment.

(Click the icon to view product and customer type information.)

BCS's management has set a strategic goal to improve both product and customer profitability. A related

subgoal that supports this strategy is to identify profitable products and customers using an

accurate cost-accounting system. BCS currently uses a simple cost-accounting system to calculate both

product and customer profitability. The only direct costs are the purchase costs of footwear and equipment

products. BCS allocates indirect costs to the product groups using a single indirect cost pool for all indirect

costs with "pounds of product" as the cost allocation base. Cost and operating data accumulated for the most

recent year follow:

(Click the icon to view the cost and operating data.)

Read the requirements.

Requirement 1. Prepare a schedule that shows the gross margin of each product group.

Footwear

Equipment

Sales

Cost of sales

***

Purchase cost

Indirect cost

Total cost of sales

Gross product margin

Requirement 2. Prepare a schedule that shows the gross margin of each customer type. (Round gross margin

per case amounts to the nearest cent.)

Footwear

Equipment

Gross margin per case

Specialty Stores

Department Stores

Cases sold Gross margin Cases sold Gross margin

Requirement 3. Based on your answers to numbers 1 and 2, recommend a strategy to improve customer

profitability.

The gross margin per case of equipment is larger so more emphasis should be placed on equipment sales,

especially at department stores.

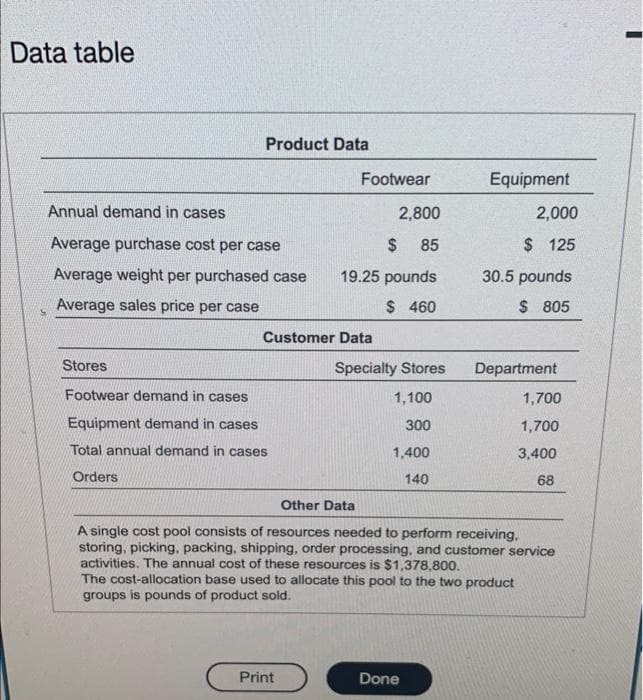

Transcribed Image Text:Data table

Product Data

Annual demand in cases

Average purchase cost per case

Average weight per purchased case

Average sales price per case

Stores

Footwear demand in cases

Equipment demand in cases

Total annual demand in cases

Orders

Footwear

Customer Data

2,800

$ 85

19.25 pounds

$ 460

Print

Specialty Stores

1,100

300

1,400

140

Equipment

Done

2,000

$ 125

30.5 pounds

$ 805

The cost-allocation base used to allocate this pool to the two product

groups is pounds of product sold.

Department

Other Data

A single cost pool consists of resources needed to perform receiving.

storing, picking, packing, shipping, order processing, and customer service

activities. The annual cost of these resources is $1,378,800.

1,700

1,700

3,400

68

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College