Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. The answer isn't 4300 debit and credit for Feb. 10 as I attempted.

Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. The answer isn't 4300 debit and credit for Feb. 10 as I attempted.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Topic Video

Question

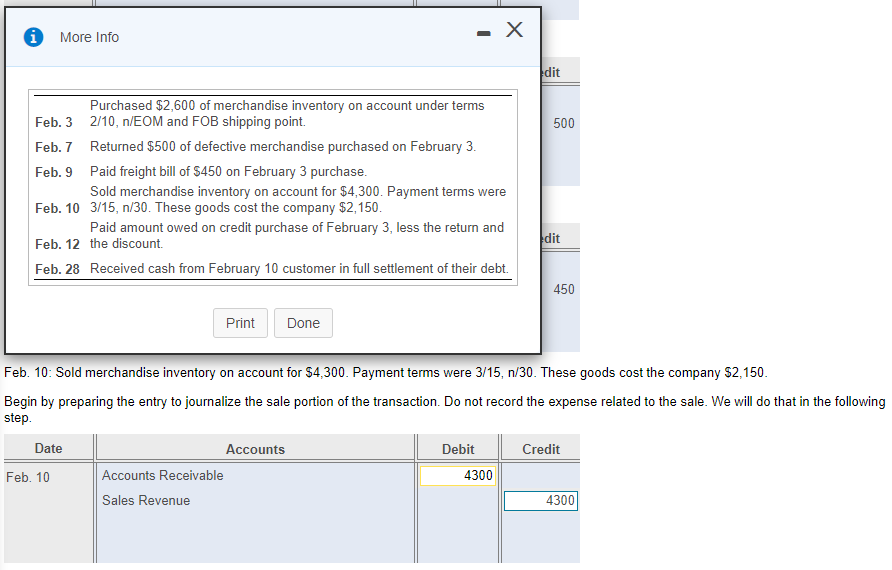

Feb 10: Sold merchandise inventory on account for $4,300. Payment terms were 3/15, n/30. These goods cost the company

$2,150.

Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step.

The answer isn't 4300 debit and credit for Feb. 10 as I attempted.

Transcribed Image Text:- X

More Info

dit

Purchased $2,600 of merchandise inventory on account under terms

Feb. 3 2/10, n/EOM and FOB shipping point.

500

Feb. 7 Returned $500 of defective merchandise purchased on February 3.

Feb. 9 Paid freight bill of $450 on February 3 purchase.

Sold merchandise inventory on account for $4,300. Payment terms were

Feb. 10 3/15, n/30. These goods cost the company $2,150.

Paid amount owed on credit purchase of February 3, less the return and

dit

Feb. 12 the discount.

Feb. 28 Received cash from February 10 customer in full settlement of their debt.

450

Print

Done

Feb. 10: Sold merchandise inventory on account for $4,300. Payment terms were 3/15, n/30. These goods cost the company $2,150.

Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following

step.

Date

Accounts

Debit

Credit

Feb. 10

Accounts Receivable

4300

Sales Revenue

4300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning