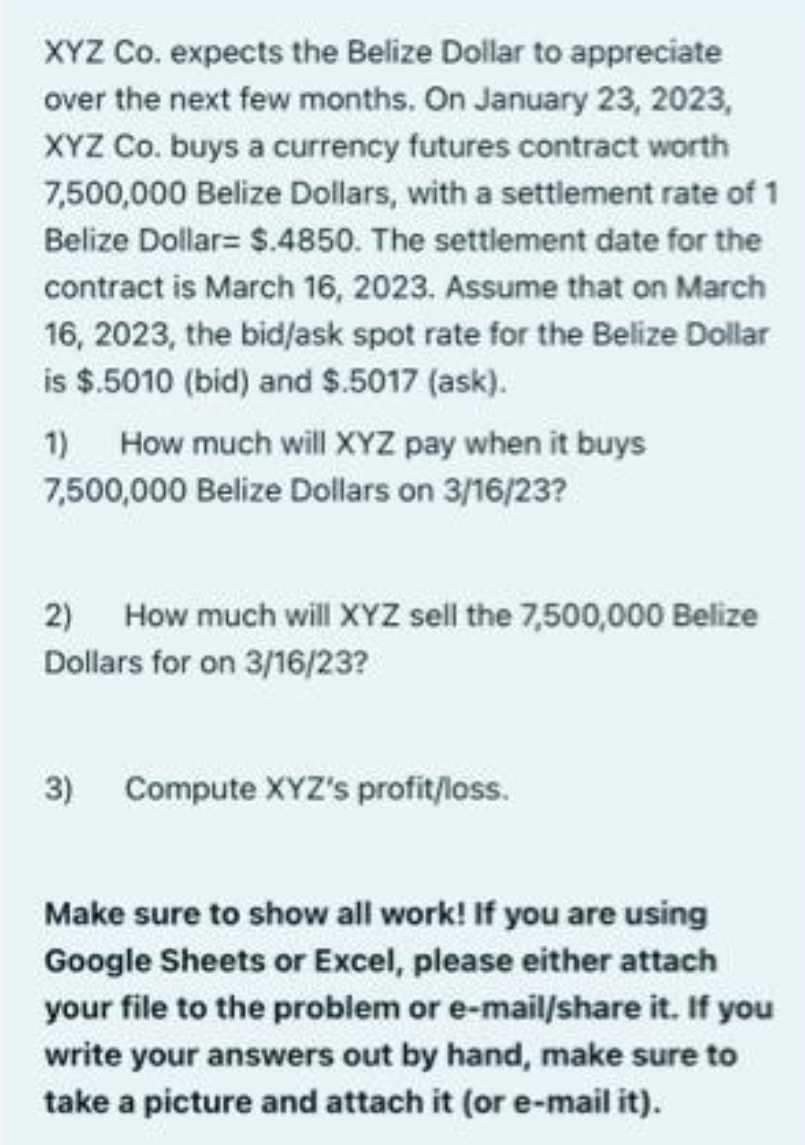

Belize Dollar= $.4850. The settlement date for the contract is March 16, 2023. Assume that on March 16, 2023, the bid/ask spot rate for the Belize Dollar is $.5010 (bid) and $.5017 (ask). 1) How much will XYZ pay when it buys 7,500,000 Belize Dollars on 3/16/23? 2) How much will XYZ sell the 7,500,000 Belize Dollars for on 3/16/23? 3) Compute XYZ's profit/loss.

Q: ush Gardens Co. bor own payment and fi ompany makes payr

A: Given the prevailing interest rate = 4.08% pa = 4.08/12= 0.34% The loan amount of 46280 will be…

Q: A firm is evaluating a proposal which has an initial investment of R250 000 and has cash flows of…

A: Payback period is an important capital budgeting tool. Essentially payback period is the time…

Q: Below are the NPVs of a particular investment at two discount rates: At 5%, NPV = $9,500 At 8%,…

A: IRR is the rate of return at which the net present value is 0. IRR is the minimum return a project…

Q: Consider the following information: Probability of State of Economy State of Economy Recession .20…

A: State of Economy Probability of State of Economy Rate of return if state Occurs Recession 0.2…

Q: You want a seat oin the board of directors of Four Keys. Inc. The company hase 290000 shares of…

A: Shares refer to the percentage of ownership in the form of equity. Shareholders are eligible for a…

Q: Lifeline, Inc., has sales of $928,589, costs of $498,849, depreciation expense of $62,374, interest…

A: Solution:- Net profit means the net earnings earned by a firm after taking into consideration the…

Q: Complete the following (If more than one discount, assume date of last discount): (Use Table 7.1)…

A: Trade discounts are provided to encourage early and timely payments. 2/10 indicates that if payments…

Q: Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following…

A: Dollars/shares in millions FCF1 $ -14.00 FCF2 $ 30.00 FCF3 $ 47.00 Constant…

Q: Scheduled payments of $1054, $789, and $508 are due in one-and-a-half years, four years, and six…

A: Here, Schedule payment (FV) $1,054.00 Time period (NPER) 1.50 Schedule payment (FV) $789.00…

Q: Dorati Inc. is considering two mutually exclusive projects. Dorati used a 15% required rate of…

A: Assumptions of Replacement method: Any project can be precisely replicated at its replication date,…

Q: Complete the following table: (Do not round net price equivalent rate and single equivalent discount…

A: The trade discount refers to the discount that a wholesaler provides to a retailer for the goods.…

Q: The two most pressing demands for liquidity from a bank come from, first, customers withdrawing…

A: Liquidity in banking refers to the capacity or the ability of the banks to give cash to customers on…

Q: ) Suppose that Smith is currently age 16. Smith’s parents pay $25,000 for the right to provide Smith…

A: The present value of annuity is equivalent amount that is needed today to pay for the future…

Q: Solving for Rates What annual rate of return is earned on a $2,600 investment when it grows to…

A: Initial amount (I) = $2,600 Future value (FV) = $5,700 Period (n) = 9 Years Annual rate of return…

Q: How will a firm's cash cycle be affected if one of the firm's suppliers that was only accepting cash…

A: concept. 1. account payable days or days payable outstanding. It takes into account the amount of…

Q: Is, Inc., has identified an investment project with the following Cash Flow $990 Year

A: Future value of cash include the amount that is being deposited and also the amount of interest…

Q: 4. How many years are the following zero coupon bonds, if they all yield 4% and have a face value of…

A: A zero coupon bond, as its name indicates, is a bond that has zero coupons. In other words, these…

Q: There are two companies manufacturing drones. Company A manufactures mass market drones, while…

A: Given Cost of Goods Sold for Company A =1870,000 Total Inventory - Ram Material 120000+Work in…

Q: Omicron Technologies made a before-tax profit of $50 million this year. The firm has no debt and 10…

A: A firm has surplus cash flows. It can pay special dividend or repurchase. We have to find various…

Q: Trading Corporation is considering issuing preferred stock. The preferred stock would have a par…

A: Preferred stock are type of hybrid security not debt and not equity and have both features. They do…

Q: he Face Value of a Bond is £1000, the Maturity is 4 years, Yield is 3%, the Frequency of yield is…

A: The price of bond is the present value of coupon payment and present value of par value of bond…

Q: A corporate bond with semi-annual interest payments has a yield to maturity of 6.05% and a current…

A: Solution:- Bond price means the price at which a bond is trading in the market. It is the summation…

Q: Over the past six months, Six Flags conducted a marketing study on improving their park experience.…

A: Given, Cost of roller coaster is $50 million Installation amount is $5 million

Q: Not having a credit may result in having a hard time finding an apartment. False True 199 What's the…

A: Several multiple choice questions appear on the screen. We have to find the correct answer for each…

Q: Should Tangshan Mining company accept a new project if its maximum payback is 3.5 years and its…

A: Solution:- Payback period is the period at which the initial investment of a project gets recovered…

Q: A $1000 par value 9% bond with semiannually coupons is callable 6 years after issue. The bond…

A: Par Value = $1,000 Coupon Rate = 9% Yield = 4% Time Period = 10 Years Callable = 6 Years

Q: Stock XYZ is trading at $42.60. The Oct 2020 40 call is selling at $2.8 and the 2020 40 put is…

A: The break even point indicates a point where the option neither makes a profit nor a loss. For a put…

Q: A 3M T-bill currently sells for 98:08 (what does this quotation mean?) Calculate its bond equivalent…

A: Time Period = 3 Months Selling = 98:08

Q: . How do rising interest rates affect the size of real estate loans that lenders will advance?

A: The central bank of a country changes the interest rates intermittently to control inflation or…

Q: 1 2 3 4 5 6 7 8 9 10 1. Find the Yield to Maturity (YTM) for the following government bonds Price…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve…

Q: respectively

A: C is risk-free so Beta =0, Take Wa as the Weight of A in the portfolio= 12000/50000=0.24 Weight…

Q: Compare the following 2 alternatives with a method of your choice. The market rate is 6% and…

A: The discount rate will consider inflation also will be equal to = 6+2.5=8.5% We will like to find…

Q: 55,374

A: 1. PAT (Profit After Tax) = dividend paid +retained earning =791+1498= 2289 Given tax is 26% means…

Q: You want to value a call option on Google stock (which does not pay dividends) with a strike price…

A: We have to price the call option on a non dividend paying stock. This can be done using Black…

Q: You are considering investing $10,000 in either U.S. Treasury bills or bank certificates-of-deposits…

A: Given: Interest rate = 4.5% Investment options: Treasury bills Bank CD's

Q: 4 eBook Print References Drill Problem 10-9 (Static) [LU 10-1 (2)] Complete the following, using…

A: Solution: An amount borrowed has to be paid along with interest. As per exact method, Interest…

Q: An investor shorts 1,000 shares of XYZ.com, a security eligible for reduced margin, at $48. The…

A: Margin is the amount of equity in an investor's brokerage account. To "margin" or "buy on margin"…

Q: the end of the year (D₁ = $1.50) You are considering an investment in Justus Corporation's stock,…

A: The relationship between the required return and the risk involved with an investment is described…

Q: You are getting a $100,000 mortgage and paying 2 points. What is the effective annual yield (in…

A: Here,

Q: Based on the sales forecast, the finance manager estimates the receipt of cash based on cash and…

A: In finance we often make a forecast of sales. This is done for the purpose of improved decision…

Q: When using profitability, liquidity and capital adequacy to assess a bank annual report what does it…

A: Whenever stakeholders need to measure the financial position or the credibility of any company, they…

Q: A7X Corp. just paid a dividend of $1.20 per share. The dividends are expected to grow 5 percent for…

A: To compute the price today we will need to apply the dividend discount model. The dividend…

Q: MacLoren Automotive. MacLoren Automotive manufactures British sports cars, a number of which are…

A: As per the given information: Invoice price of Car - £30,000Spot exchange rate - 1.6500Risk sharing…

Q: A 1000 par value 18-year bond with annual coupons is bought to yield an annual effective rate of 5%.…

A: Bond refers to the instrument that represents the loan taken by a borrower by an investor including…

Q: A zero coupon bond with a face value of $21,000 matures in 11 years. What should the bond be sold…

A: Zero Coupon bonds: Bonds that experience more fluctuations in market value than coupon bonds and…

Q: If the bank decides to cut down on interest expenses by reducing its dependence upon borrowed funds,…

A: We have to figure out the policy the bank must follow if it decides to cut down on interest expenses…

Q: Guelph Inc. would like you to assess the after-tax viability of a new machine using annual worth…

A: The annual worth analysis method is used to assess the viability of any asset by converting cash…

Q: Consider the following information about the various states of economy and the returns of various…

A: Here, State of the Economy Probability T-Bills Philips Pay-up Rubber-Made Market Index…

Q: Omicron Technologies made a before-tax profit of $50 million this year. The firm has no debt and 10…

A: We have to find the after-tax dividend and effective tax rate for shareholders: under a classical…

Q: Q 26 Create the amortization schedule for a loan of $5,300, paid monthly over two years using an…

A: Solution:- When an amount is borrowed, it can either be repaid as a lump sum payment or in…

Qa 02.

Step by step

Solved in 3 steps

- The nominal yield on 6-month T-bills is 7%, while default-free Japanese bonds that mature in 6 months have a nominal rate of 5.5%. In the spot exchange market, 1 yen equals $0,009. If interest rate parity holds, what is the 6-month forward exchange rate?On January 10, Volkswagen agrees to import auto parts worth $7 million from the U.S. The parts will be delivered on March 4 and are payable immediately in dollars. VW decides to hedge its dollar position by entering into IMM futures contracts. The spot rate is $1.3447/€ and the March futures price is $1.3502. On March 4, the spot rate turns out to be $1.3452/€, while the March futures price is $1.3468/€. Calculate VW’s net euro gain or loss on its futures position. $13,850 loss $13,850 gain $17,850 loss $17,850 gainOn December 12, 2022, Tin Company entered into a forward exchange contract to purchase 500,000 euros in 90 days.The relevant exchange rates are as follows: Spot rate Forward rate (for 3/12/2023)November 30, 2022 P0.56 P0.57December 12, 2022 P0.57 P0.58December 31, 2022 P0.61 P0.60March 12, 2023 P0.62 P0.62 The purpose of this forward contract is to hedge a purchase of inventory in November 30, 2022, payable in March 2023. How much is the net forex gain/loss December 31, 2022? (just encode the absolute amount)

- A firm in Germany expects to pay USD 900,000 in February. It is currently November and the Euro/USD spot rate is currently 1 Euro= USD 1.1400. (a) Suppose the price for euro currency futures is $1.1420 for December futures and $1.1450 for March futures,show how the firm might hedge its exposure using currency futures, (b) If the spot rate is USD 1.1200 when the dollar payment is made in February and the March Futures price is USD 1.1246, find the effective exchange rate obtained for the dollar payment as a result of the hedge. Note: Euro futures: Amount Euro125,000, tick size $0.0001, value per tick $12.50On January 11, the spot exchange rate for the U.S. dollar is $0.70 per Canadian dollar. In one year’s time, the Canadian dollar is expected to appreciate by 20 percent or depreciate by 15 percent. We have a European put option on U.S. dollars expiring in one year, with an exercise price of 1.39 CND$/US$, that is currently selling for a price of $2.93. Each put option gives the holder the right to sell 10,000 U.S. dollars. The current one-year Canadian Treasury Bill rate is 2 percent, while the one-year U.S. Treasury Bill rate is 3 percent, both compounded annually. Treat the Canadian dollar as the domestic currency. a. What is the estimated value of this put option by using the binomial model?On January 11, the spot exchange rate for the U.S. dollar is $0.70 per Canadian dollar. In one year’s time, the Canadian dollar is expected to appreciate by 20 percent or depreciate by 15 percent. We have a European put option on U.S. dollars expiring in one year, with an exercise price of 1.39 CND$/US$, that is currently selling for a price of $2.93. Each put option gives the holder the right to sell 10,000 U.S. dollars. The current one-year Canadian Treasury Bill rate is 2 percent, while the one-year U.S. Treasury Bill rate is 3 percent, both compounded annually. Treat the Canadian dollar as the domestic currency. b. Calculate the estimated value of this put option for U.S. T-Bill rates of 0%, 1%, 2%, 4%, 5%, and 6%. Plot these values in a graph (by hand or using Excel), with put option values on the y-axis and U.S. T-bill rates on the x-axis. What can we conclude about the relationship between foreign interest rates and foreign currency put option values?

- On January 11, the spot exchange rate for the U.S. dollar is $0.70 per Canadian dollar. In one year’s time, the Canadian dollar is expected to appreciate by 20 percent or depreciate by 15 percent. We have a European put option on U.S. dollars expiring in one year, with an exercise price of 1.39 CND$/US$, that is currently selling for a price of $2.93. Each put option gives the holder the right to sell 10,000 U.S. dollars. The current one-year Canadian Treasury Bill rate is 2 percent, while the one-year U.S. Treasury Bill rate is 3 percent, both compounded annually. Treat the Canadian dollar as the domestic currency. c. Calculate the estimated value of this put option for Canadian T-Bill rates of 0%, 1%, 2%, 4%, 5%, and 6%. Plot these values in a graph (by hand or using Excel), with put option values on the y-axis and Canadian T-bill rates on the x-axis. What can we conclude about the relationship between domestic interest rates and foreign currency put option values? xxxxOn January 11, the spot exchange rate for the U.S. dollar is $0.70 per Canadian dollar. In one year’s time, the Canadian dollar is expected to appreciate by 20 percent or depreciate by 15 percent. We have a European put option on U.S. dollars expiring in one year, with an exercise price of 1.39 CND$/US$, that is currently selling for a price of $2.93. Each put option gives the holder the right to sell 10,000 U.S. dollars. The current one-year Canadian Treasury Bill rate is 2 percent, while the one-year U.S. Treasury Bill rate is 3 percent, both compounded annually. Treat the Canadian dollar as the domestic currency. c. Calculate the estimated value of this put option for Canadian T-Bill rates of 0%, 1%, 2%, 4%, 5%, and 6%. Plot these values in a graph (by hand or using Excel), with put option values on the y-axis and Canadian T-bill rates on the x-axis. What can we conclude about the relationship between domestic interest rates and foreign currency put option values?On November 1, 2017, Dos Santos Company forecasts the purchase of raw materials from a Brazilian supplier on February 1, 2018, at a price of 200,000 Brazilian reals. On November 1, 2017, Dos Santos pays $1,500 for a three-month call option on 200,000 reals with a strike price of $0.40 per real. Dos Santos properly designates the option as a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2017, the option has a fair value of $1,100. The following spot exchange rates apply: Date U.S. Dollar per Brazilian real November 1, 2017 $0.40 December 31, 2017 0.38 February 1, 2018 0.41 What is the net impact on Dos Santos Company’s 2018 net income as a result of this hedge of a forecasted foreign currency transaction? Assume that the raw materials are consumed and become a part of the cost of goods sold in 2018. Choose the correct.a. $80,000 decrease in net income.b. $80,600 decrease in net income.c. $81,100 decrease in net income.d. $83,100 decrease in…

- On November 1, 2017, Dos Santos Company forecasts the purchase of raw materials from a Brazilian supplier on February 1, 2018, at a price of 200,000 Brazilian reals. On November 1, 2017, Dos Santos pays $1,500 for a three-month call option on 200,000 reals with a strike price of $0.40 per real. Dos Santos properly designates the option as a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2017, the option has a fair value of $1,100. The following spot exchange rates apply: Date U.S. Dollar per Brazilian real November 1, 2017 $0.40 December 31, 2017 0.38 February 1, 2018 0.41 What is the net impact on Dos Santos Company’s 2017 net income as a result of this hedge of a forecasted foreign currency transaction? Choose the correct.a. $–0–.b. $400 decrease in net income.c. $1,000 decrease in net income.d. $1,400 decrease in net income.On Monday morning, a trader takes a long position in Australian dollars (AUD) future currency contract that matures on Thursday afternoon. The agreed upon price is USD76691/AUD for a currency lot of AUD100,000. A trader needs AUD 175,000. At the close of trading on Monday, the futures price falls to USD0.76620 = 1 AUD. At Tuesday close, the price further falls down to USD0.76602 = 1 AUD. At Wednesday close, the price rises to USD0.76658 = 1 AUD. At Thursday close, the price further rises to USD0.76698 = 1 AUD and the contract matures. The trader takes delivery of the AUD at the prevailing price of USD0.76698 = 1 AUD. What will be the trader’s profit (loss)? Gain of USD 7 Gain of USD 70 Loss of USD 7 Loss of USD 70Market conditions are as follows; Exchange rate is USD 1 = JPY 130.00. USD market interest rate is 10% p.a. during the contract period, and JPY market interest rate is 6% p.a. during the contract period. The scheduled 'currency coupon' swap contract is as follows; the assumed principle amount is USD 100 million (JPY 13,000 million). Swap contract period is 2 years. You will pay 6.3 % in USD currency at the end of each year, and receive 6% in JPY currency at the end of each year. Calculate the NPV in JPY currency, using the original exchange rate of USD 1 = JPY 130.00.