Bell Limited ("Bell") owns 75% of the voting shares of Log Limited ("Log") and has control over Log. For the current year ended 31 March 2020, the following intra-group transaction occurred: On 1 November 2019, Log Limited issued 2,500 8% debentures of $100 at nominal value. Bell Limited acquired 30% of these debentures on the issuance date. Interest is payable half-yearly on 30 June and 31 December. Accruals have been recognized in the legal entities' accounts. Bell also owns 25% of Bronze Limited ("Bronze"). Bell has demonstrated significant influence in the financial and operating policy decisions of Bronze but not control or joint control over the company. On 1 April 2019, Bronze sold an item of plant to Bell for $24,000. At the date of transfer, the carrying amount of this plant in Bronze's records was $15,000. The plant has a remaining useful life of 5 years. Bronze's net profit for the year ended 31 March 2020 is $44,000. Required: (a) Prepare all necessary consolidation adjusting entries as at 31 March 2020 in relation to the intragroup transaction. (b) Compute Bell's share of Bronze's profit for the year ended 31 March 2020.

Bell Limited ("Bell") owns 75% of the voting shares of Log Limited ("Log") and has control over Log. For the current year ended 31 March 2020, the following intra-group transaction occurred: On 1 November 2019, Log Limited issued 2,500 8% debentures of $100 at nominal value. Bell Limited acquired 30% of these debentures on the issuance date. Interest is payable half-yearly on 30 June and 31 December. Accruals have been recognized in the legal entities' accounts. Bell also owns 25% of Bronze Limited ("Bronze"). Bell has demonstrated significant influence in the financial and operating policy decisions of Bronze but not control or joint control over the company. On 1 April 2019, Bronze sold an item of plant to Bell for $24,000. At the date of transfer, the carrying amount of this plant in Bronze's records was $15,000. The plant has a remaining useful life of 5 years. Bronze's net profit for the year ended 31 March 2020 is $44,000. Required: (a) Prepare all necessary consolidation adjusting entries as at 31 March 2020 in relation to the intragroup transaction. (b) Compute Bell's share of Bronze's profit for the year ended 31 March 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Dont provide handwritten answer thank you

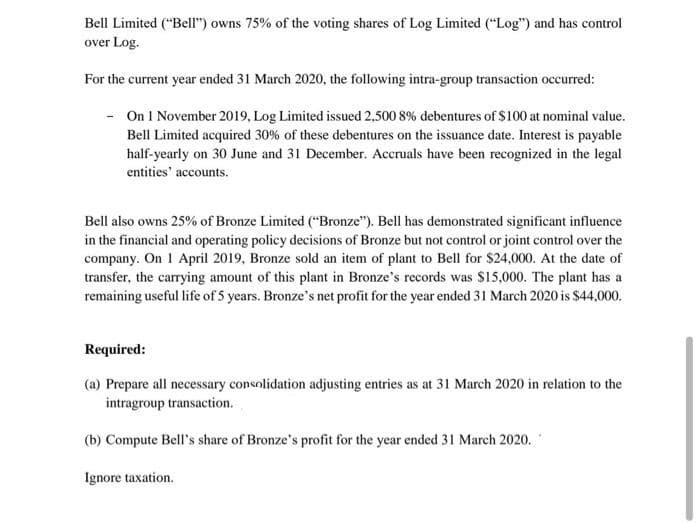

Transcribed Image Text:Bell Limited ("Bell") owns 75% of the voting shares of Log Limited ("Log") and has control

over Log.

For the current year ended 31 March 2020, the following intra-group transaction occurred:

-

On 1 November 2019, Log Limited issued 2,500 8% debentures of $100 at nominal value.

Bell Limited acquired 30% of these debentures on the issuance date. Interest is payable

half-yearly on 30 June and 31 December. Accruals have been recognized in the legal

entities' accounts.

Bell also owns 25% of Bronze Limited ("Bronze"). Bell has demonstrated significant influence

in the financial and operating policy decisions of Bronze but not control or joint control over the

company. On 1 April 2019, Bronze sold an item of plant to Bell for $24,000. At the date of

transfer, the carrying amount of this plant in Bronze's records was $15,000. The plant has a

remaining useful life of 5 years. Bronze's net profit for the year ended 31 March 2020 is $44,000.

Required:

(a) Prepare all necessary consolidation adjusting entries as at 31 March 2020 in relation to the

intragroup transaction.

(b) Compute Bell's share of Bronze's profit for the year ended 31 March 2020.

Ignore taxation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning