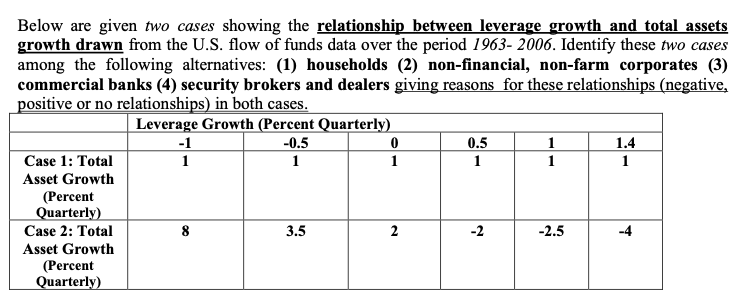

Below are given two cases showing the relationship between leverage growth and total assets growth drawn from the U.S. flow of funds data over the period 1963- 2006. Identify these two cases among the following alternatives: (1) households (2) non-financial, non-farm corporates (3) commercial banks (4) security brokers and dealers giving reasons for these relationships (negative, positive or no relationships) in both cases

Below are given two cases showing the relationship between leverage growth and total assets growth drawn from the U.S. flow of funds data over the period 1963- 2006. Identify these two cases among the following alternatives: (1) households (2) non-financial, non-farm corporates (3) commercial banks (4) security brokers and dealers giving reasons for these relationships (negative, positive or no relationships) in both cases

Chapter14: The Financial Crisis And The Great Recessio

Section: Chapter Questions

Problem 2TY

Related questions

Question

Below are given two cases showing the relationship between leverage growth and total assets growth drawn from the U.S. flow of funds data over the period 1963- 2006. Identify these two cases among the following alternatives: (1) households (2) non-financial, non-farm corporates (3) commercial banks (4) security brokers and dealers giving reasons for these relationships (negative, positive or no relationships) in both cases.

Transcribed Image Text:Below are given two cases showing the relationship between leverage growth and total assets

growth drawn from the U.S. flow of funds data over the period 1963- 2006. Identify these two cases

among the following alternatives: (1) households (2) non-financial, non-farm corporates (3)

commercial banks (4) security brokers and dealers giving reasons for these relationships (negative,

positive or no relationships) in both cases.

Leverage Growth (Percent Quarterly)

-0.5

1

-1

1

0.5

1

1.4

1

Case 1: Total

1

1

Asset Growth

(Percent

Quarterly)

Case 2: Total

8

3.5

2

-2

-2.5

-4

Asset Growth

(Percent

Quarterly)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you