below: Cash P96,000 Accounts Payable P178,000 Accounts Receivable 184,000 Annie Capital 266,000 Inventory 330,000 Betty Capital 216,000 Equipment-net 50,000 Total P660,000 Total P660,000 The terms of the agreement are that the assets and liabilities are to be restated as follows: • An allowance for possible uncollectible of P9,000 is established.

below: Cash P96,000 Accounts Payable P178,000 Accounts Receivable 184,000 Annie Capital 266,000 Inventory 330,000 Betty Capital 216,000 Equipment-net 50,000 Total P660,000 Total P660,000 The terms of the agreement are that the assets and liabilities are to be restated as follows: • An allowance for possible uncollectible of P9,000 is established.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

1. How much cash should be contributed by Cathy?

2. what capital/cash settlement should be made between Annie and Betty?

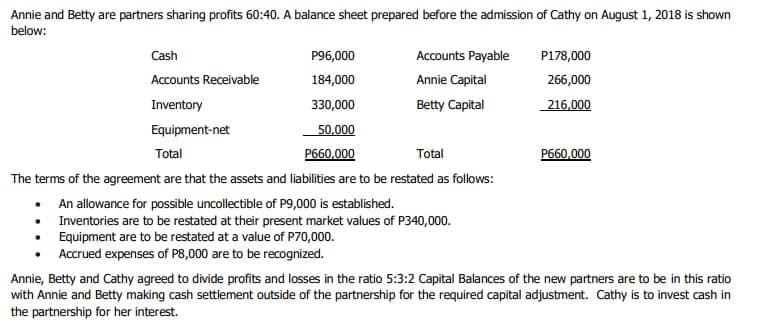

Transcribed Image Text:Annie and Betty are partners sharing profits 60:40. A balance sheet prepared before the admission of Cathy on August 1, 2018 is shown

below:

Cash

P96,000

Accounts Payable

P178,000

Accounts Receivable

184,000

Annie Capital

266,000

Inventory

330,000

Betty Capital

216,000

Equipment-net

50,000

Total

P660,000

Total

P660,000

The terms of the agreement are that the assets and liabilities are to be restated as follows:

• An allowance for possible uncollectible of P9,000 is established.

• Inventories are to be restated at their present market values of P340,000.

Equipment are to be restated at a value of P70,000.

Accrued expenses of P8,000 are to be recognized.

Annie, Betty and Cathy agreed to divide profits and losses in the ratio 5:3:2 Capital Balances of the new partners are to be in this ratio

with Annie and Betty making cash settlement outside of the partnership for the required capital adjustment. Cathy is to invest cash in

the partnership for her interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College