Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $33,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Book Value $ 12,800, 000 26, 800, e00 4, 400, 000 8, 800, 000 16, 200, 000 Fair Value $ 15, 800, 000 32, 800, e00 5, 400, 000 8, 800, 000 15, 200, 000 Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities Required: Calculate the amount paid for goodwilI. (Enter your answer in millions (i.e. 5,000,000 should be entered as 5).) Amount paid for goodwill million

Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $33,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Book Value $ 12,800, 000 26, 800, e00 4, 400, 000 8, 800, 000 16, 200, 000 Fair Value $ 15, 800, 000 32, 800, e00 5, 400, 000 8, 800, 000 15, 200, 000 Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities Required: Calculate the amount paid for goodwilI. (Enter your answer in millions (i.e. 5,000,000 should be entered as 5).) Amount paid for goodwill million

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

There are 2 questions, Please read and answer question carefully.

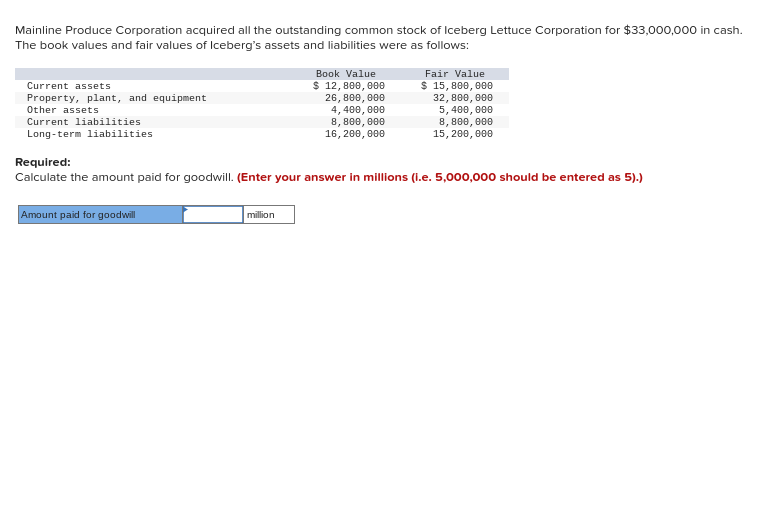

Transcribed Image Text:Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $33,000,000 in cash.

The book values and fair values of Iceberg's assets and liabilities were as follows:

Fair Value

$ 15,800, 000

32, 800, еее

5, 400, 000

8, 800, 000

15, 200, e00

Book Value

$ 12, 800, 000

26, 800, 000

4,400, в00

8, 800, 000

16, 200, 000

Current assets

Property, plant, and equipment

Other assets

Current liabilities

Long-term liabilities

Required:

Calculate the amount paid for goodwill. (Enter your answer in millions (i.e. 5,000,000 should be entered as 5).)

Amount paid for goodwill

million

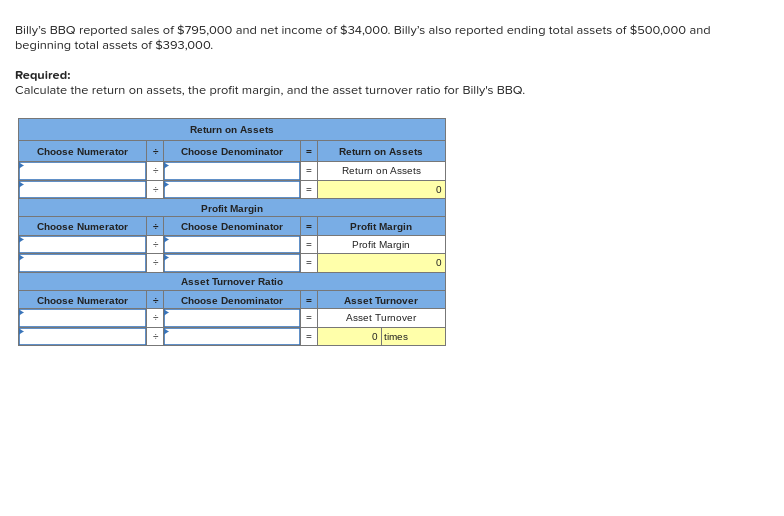

Transcribed Image Text:Billy's BBQ reported sales of $795,000 and net income of $34,000. Billy's also reported ending total assets of $500,000 and

beginning total assets of $393,00o.

Required:

Calculate the return on assets, the profit margin, and the asset turnover ratio for Billy's BBQ.

Return on Assets

Choose Numerator

Choose Denominator

Return on Assets

Return on Assets

Profit Margin

Choose Numerator

Choose Denominator

Profit Margin

Profit Margin

%3D

Asset Turnover Ratio

Choose Numerator

Choose Denominator

Asset Turnover

Asset Turnover

o times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub