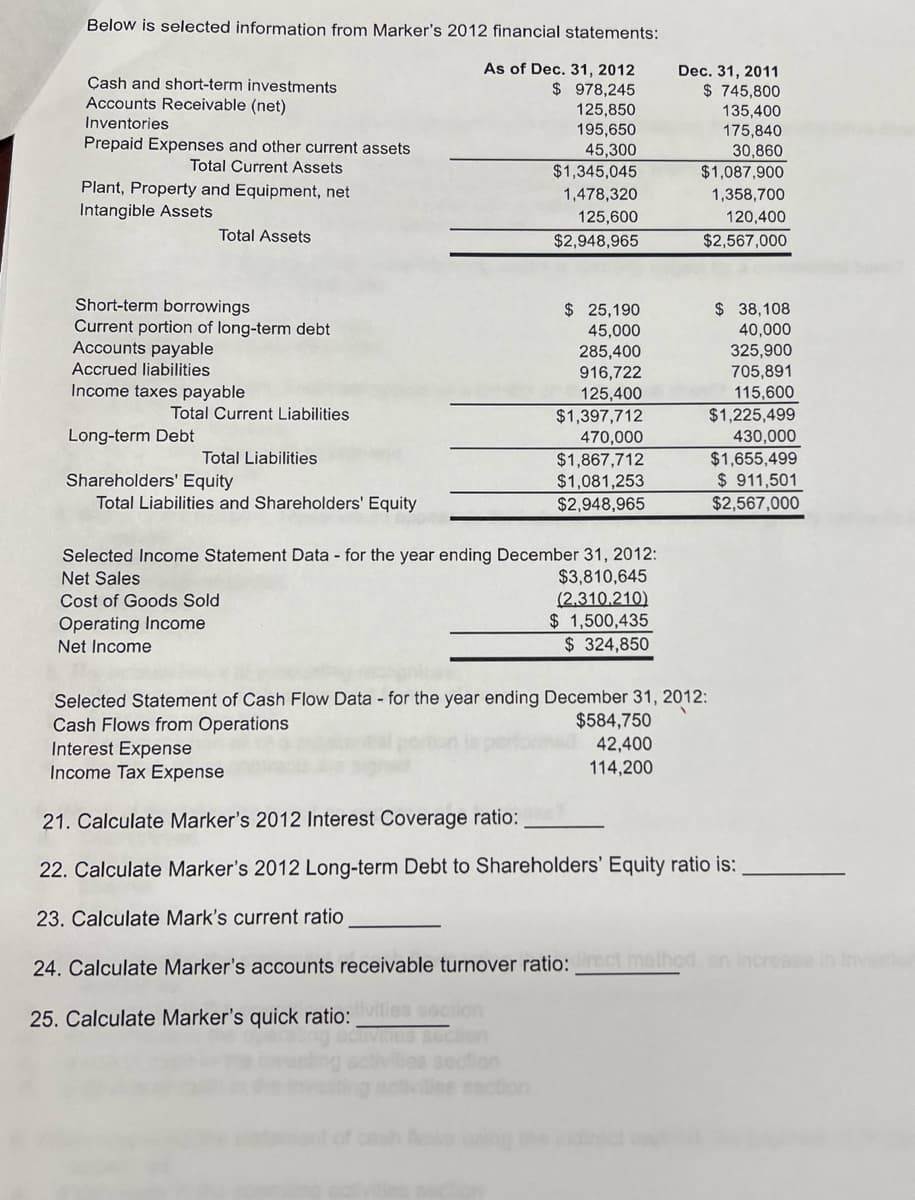

Below is selected information from Marker's 2012 financial statements: Cash and short-term investments Accounts Receivable (net) Inventories Prepaid Expenses and other current assets Total Current Assets Plant, Property and Equipment, net Intangible Assets Total Assets As of Dec. 31, 2012 Dec. 31, 2011 $ 978,245 125,850 $ 745,800 135,400 195,650 175,840 45,300 30,860 $1,345,045 $1,087,900 1,478,320 125,600 $2,948,965 1,358,700 120,400 $2,567,000 Short-term borrowings Current portion of long-term debt Accounts payable $ 25,190 45,000 $ 38,108 40,000 325,900 Accrued liabilities Income taxes payable Total Current Liabilities Long-term Debt Total Liabilities 285,400 916,722 705,891 125,400 115,600 $1,397,712 $1,225,499 470,000 430,000 $1,867,712 $1,655,499 $1,081,253 $2,948,965 $ 911,501 $2,567,000 Shareholders' Equity Total Liabilities and Shareholders' Equity Selected Income Statement Data - for the year ending December 31, 2012: Net Sales Cost of Goods Sold $3,810,645 (2,310,210) Operating Income Net Income $ 1,500,435 $ 324,850 Selected Statement of Cash Flow Data - for the year ending December 31, 2012: Cash Flows from Operations Interest Expense $584,750 42,400 114,200 Income Tax Expense 21. Calculate Marker's 2012 Interest Coverage ratio: 22. Calculate Marker's 2012 Long-term Debt to Shareholders' Equity ratio is: 23. Calculate Mark's current ratio 24. Calculate Marker's accounts receivable turnover ratio:rect method, an increase in Inverto 25. Calculate Marker's quick ratio:vities section

Below is selected information from Marker's 2012 financial statements: Cash and short-term investments Accounts Receivable (net) Inventories Prepaid Expenses and other current assets Total Current Assets Plant, Property and Equipment, net Intangible Assets Total Assets As of Dec. 31, 2012 Dec. 31, 2011 $ 978,245 125,850 $ 745,800 135,400 195,650 175,840 45,300 30,860 $1,345,045 $1,087,900 1,478,320 125,600 $2,948,965 1,358,700 120,400 $2,567,000 Short-term borrowings Current portion of long-term debt Accounts payable $ 25,190 45,000 $ 38,108 40,000 325,900 Accrued liabilities Income taxes payable Total Current Liabilities Long-term Debt Total Liabilities 285,400 916,722 705,891 125,400 115,600 $1,397,712 $1,225,499 470,000 430,000 $1,867,712 $1,655,499 $1,081,253 $2,948,965 $ 911,501 $2,567,000 Shareholders' Equity Total Liabilities and Shareholders' Equity Selected Income Statement Data - for the year ending December 31, 2012: Net Sales Cost of Goods Sold $3,810,645 (2,310,210) Operating Income Net Income $ 1,500,435 $ 324,850 Selected Statement of Cash Flow Data - for the year ending December 31, 2012: Cash Flows from Operations Interest Expense $584,750 42,400 114,200 Income Tax Expense 21. Calculate Marker's 2012 Interest Coverage ratio: 22. Calculate Marker's 2012 Long-term Debt to Shareholders' Equity ratio is: 23. Calculate Mark's current ratio 24. Calculate Marker's accounts receivable turnover ratio:rect method, an increase in Inverto 25. Calculate Marker's quick ratio:vities section

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 10PB: Use the following excerpts from Mountain Companys financial information to prepare a statement of...

Related questions

Question

23 and 24 please

Transcribed Image Text:Below is selected information from Marker's 2012 financial statements:

Cash and short-term investments

Accounts Receivable (net)

Inventories

Prepaid Expenses and other current assets

Total Current Assets

Plant, Property and Equipment, net

Intangible Assets

Total Assets

As of Dec. 31, 2012

Dec. 31, 2011

$ 978,245

125,850

$ 745,800

135,400

195,650

175,840

45,300

30,860

$1,345,045

$1,087,900

1,478,320

125,600

$2,948,965

1,358,700

120,400

$2,567,000

Short-term borrowings

Current portion of long-term debt

Accounts payable

$ 25,190

45,000

$ 38,108

40,000

325,900

Accrued liabilities

Income taxes payable

Total Current Liabilities

Long-term Debt

Total Liabilities

285,400

916,722

705,891

125,400

115,600

$1,397,712

$1,225,499

470,000

430,000

$1,867,712

$1,655,499

$1,081,253

$2,948,965

$ 911,501

$2,567,000

Shareholders' Equity

Total Liabilities and Shareholders' Equity

Selected Income Statement Data - for the year ending December 31, 2012:

Net Sales

Cost of Goods Sold

$3,810,645

(2,310,210)

Operating Income

Net Income

$ 1,500,435

$ 324,850

Selected Statement of Cash Flow Data - for the year ending December 31, 2012:

Cash Flows from Operations

Interest Expense

$584,750

42,400

114,200

Income Tax Expense

21. Calculate Marker's 2012 Interest Coverage ratio:

22. Calculate Marker's 2012 Long-term Debt to Shareholders' Equity ratio is:

23. Calculate Mark's current ratio

24. Calculate Marker's accounts receivable turnover ratio:rect method, an increase in Inverto

25. Calculate Marker's quick ratio:vities section

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College