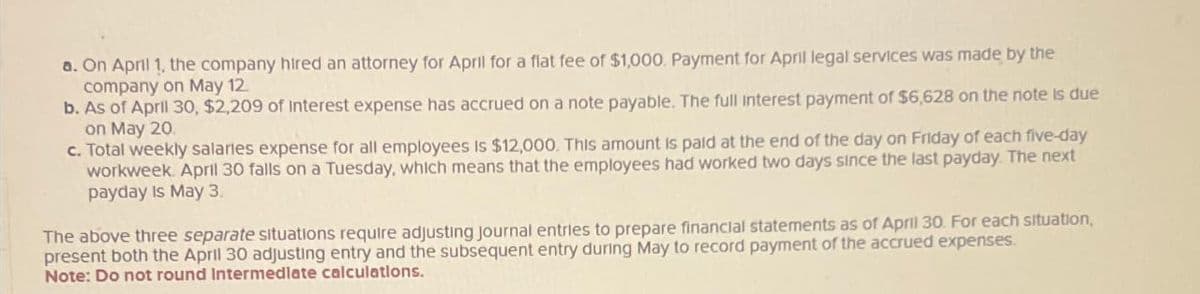

a. On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the company on May 12 b. As of April 30, $2,209 of Interest expense has accrued on a note payable. The full interest payment of $6,628 on the note is due on May 20 c. Total weekly salaries expense for all employees is $12,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation, present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses. Note: Do not round Intermediate calculations.

a. On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the company on May 12 b. As of April 30, $2,209 of Interest expense has accrued on a note payable. The full interest payment of $6,628 on the note is due on May 20 c. Total weekly salaries expense for all employees is $12,000. This amount is paid at the end of the day on Friday of each five-day workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next payday is May 3. The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation, present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses. Note: Do not round Intermediate calculations.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from...

Related questions

Question

Give me step by step solution and explanation.

Transcribed Image Text:a. On April 1, the company hired an attorney for April for a flat fee of $1,000. Payment for April legal services was made by the

company on May 12

b. As of April 30, $2,209 of Interest expense has accrued on a note payable. The full interest payment of $6,628 on the note is due

on May 20

c. Total weekly salaries expense for all employees is $12,000. This amount is paid at the end of the day on Friday of each five-day

workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next

payday is May 3.

The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation,

present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses.

Note: Do not round Intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage