Below

Q: Nurul and Fiza are partners of a day care centre called Happy Kids, which they formed on 1 January 2...

A: To record the investment by the partner in the partnership firm, the assets invested by the partners...

Q: Purple Company had sales of P4,000,000 during December of the current year. Experience has shown tha...

A: Introduction:- The following basic information as follows under:- Purple Company had sales of P4,00...

Q: Comprehensive income is defined as plus other * .comprehensive income Gains And Losses Net Income Ex...

A: Income means the amount earned by an entity after deducting the expenses.

Q: Q3 ; the following transaction of noor company.. 1/7 noor invests 25 000 D. cash in the business . 3...

A: Here in this question, we are required to prepare journal entry. Journal entry is passed to record t...

Q: The cash balance of the bank for that day was 500,000, and an advance was granted to the cashier of ...

A: Given, Cash balance of the bank for that day = 500,000, Advance to cashier = 150,000, Receipts = 400...

Q: National Bank granted a 10-year loan to BBB Company in the amount of P1,500,000 with a stated intere...

A: Notes can be defined as a financial security which provides interest to its holder. To deal in notes...

Q: under: 1. FIFO 2. Weighted Average

A: The periodic approach employs a physical count on a regular basis to determine the quantities of sto...

Q: Ben Marino, a seaman, opened a joint bank account, under the expanded foreign currency deposit syste...

A: Tax is collected by the government with a view to finance the different infrastructural and economic...

Q: Required: Post the following transactions to the appropriate accounts: (1) Issued share capital for ...

A: Introduction From the given information in the problem we hace to post the given transection in the ...

Q: 32 Some selected sales and cist data for ABC Manufacturing Company are given below: Direct ...

A: Solution: Conversion cost are costs incurred in the process of converting the raw material into fini...

Q: Fixed deposits are distinguished upon customer request. (A) The depositor has the right to withdraw ...

A: A Fixed deposit is a bank account that pays interest and has a predetermined maturity date. The most...

Q: e has violated

A: Sale value ($90,000 + $60,000) $150,000 Less Cost of purchase ($100,000) Gross profit $50,000 ...

Q: CCC Company took a physical inventory at the end of the year and determined that P2,600,000 of goods...

A: The inventory to be reported in balance sheet includes physical inventory, goods purchased under FOB...

Q: All of Definitions of the financial failure confirm the project's inability to pay its current and n...

A: Financial obligations: These include all the fixed financial commitments to be made at a specified t...

Q: Profit after Tax 160 370 Other Information Total Ordinary Dividend 125 200

A: Payout ratio is used to know the dividend distribution of the company. It shows the dividend paid to...

Q: WORKSHOP NO. 6 ADJUSTMENT LIFE SPAN DEPRECIATION DEPRECIATION PER MONTH PARTICULAR QUANTITY AMOUNT P...

A: Adjusted trial balance is the statement which is prepared after considering the year end adjustments...

Q: Problem 3-2 (AICPA Adapted) In 2020, Dare Company began selling a new calculator that carried a two-...

A: (1) As Per Expense as incurred approach, expense should be recognise in the books of account as and...

Q: cost t per unit an

A: Line of Best Fit A line of best fit can be defined as a straight line that denotes the best approxi...

Q: Turner Empire Co. employs 65 employees. The employees are paid every Monday for work done from the p...

A: Per day cost=Number of employees×Per day pay=65×$80=$5,200

Q: Canaro $2,300 S 21e 51,200 GTO Torino Cash Short-term Investents 500 Current receivables Inventory P...

A: Formula: Acid test ratio = ( Current Assets - Inventory - Prepaid expenses ) / Current liabilities

Q: The trial balance and additional information given below were extracted from the accounting records ...

A: Calculation of adjusted cost of sales: Cost of sales $240,000 Add: Decrease in trading invento...

Q: your dad wants to purchase a new house and lot in zamboanga city, so he decide to apply for housing ...

A: What is Loan Collateral Ratio? The Loan Collateral Ratio is the percentage of a loan that’s secured ...

Q: What exactly is an account?

A: Account is the term used in Accountancy . It's used to keep record of all financial activities of a ...

Q: Quantity discount grand to customers to encourage them to paid early O True O False

A: (1) The given statement is False. Quantity discount : Quantity discount is also known as Trade di...

Q: Branch accounts

A: the branch values the shipments from head office at 25 % markup. this is shown as allowance for over...

Q: What amount of total assets does the company report on its balance sheet? What amount of total liabi...

A: Balance sheet refers to the financial statement or sheet which is made by business for a period of o...

Q: When the guarantor (the guarantor) violates the terms of the guarantee in the case of a letter of gu...

A: Letter of guarantee means where the bank issue the letter to the third party giving out guarantee on...

Q: What is the difference between a nominal account and a real account?

A: There are three types of accounts in financial statements, Real Account Personal Account Nominal Ac...

Q: Rosenthal Company manufactures bowling balls through two processes: Molding and Packaging. In the Mo...

A: Particulars Physical Units Units to be accounted for: Work In Process, June 1 0 Started in t...

Q: Presented below are items taken from the unadjusted trial balance of the Company and its branch on D...

A: Here the branch is purchasing goods from HO as well as from ou...

Q: Buggs-Off Corporation produces and sells a line of mosquito repellants that are sold usually all yea...

A: Break-even Point=Fixed CostContribution margin per unit

Q: Unearned revenue adjustments are needed when cash is received before ?revenue is earned False ( True

A: The deferred revenue is the amount received by the business entity from customers before providing g...

Q: When a notification is received from the correspondent bank to branch 5- that the amount has been re...

A: When notification received from Bank to Branch that the amount has been recorded in favour.

Q: credit interest in the multiple-step statement will O Add to the gross profit on sales O Add to oper...

A: Solution Note : As per the Q&A guideline we are required to answer the first question only . Ple...

Q: When a notification is received from the correspondent bank to branch 5- that the amount has been re...

A: CORRECT

Q: Home Office Вooks Branch Books P 720,000 240,000 432,000 Sales Expenses Shipments from home office A...

A: SOLUTION INVENTORY IS THE GOOD AND MATERIALS A BUSINESS ACQUIRES , PRODUCES OR MANUFACTURES , FOR TH...

Q: 4- When selecting employees who meet customers carefully, the bank prefers to be male. true D Error ...

A: Bank: It implies to a financial institution that receives the deposits from the customers and also l...

Q: Indicate where management assertions are being validated by the below substantive audit procedures. ...

A: a. Inspect securities on hand and confirm securities held by custodian.-Existence/Occurrence (E/O) b...

Q: a. Total assets of Charter Company equal $760,000 and its equity is $450,000. What is the amount of ...

A: Formula: Accounting equation: Assets = Liabilities + Owners equity

Q: It is possible to withdraw from the savings account by transferring to other accounts a) only inside...

A: Here asked about the details of savings accounts money transfer to other accounts. Savings accounts...

Q: The Branch of the Company is billed for merchandise by the home office at 20% above cost. The branch...

A: Solution Information given in the question Shipmen...

Q: adjusted trial balance DEBIT Trial balance adjustment INCOME STATEMENT BALANCE SHEET ACCT ACCOUNT NA...

A: The income statement and balance sheet are the important financial statements of the business, which...

Q: Adjusting entries never involve which ?account Cash Expenses O

A: Lets understand the meaning of adjusting entry. Adjusting entry is passed to record the correct amou...

Q: Home Office Books P 1,060,000 Branch Books P 315,000 Sales Shipments to branch Beginning inventory 2...

A: a. P112,150 b. P41,150

Q: b. What is Sara's tax basis in the remaining 500 shares she owns in the company? Income tax basis of...

A: Given values, Wildcat company is owned equally by Evan Stone and his sister Sara Evan stone = 1000 s...

Q: During January of the current year, FFF Company which maintains a perpetual inventory system, record...

A: The FIFO stands for first in first out, where goods purchased first are to be sold first. The invent...

Q: Sinkoe’s Optometry Center purchases all raw materials (e.g. lenses, frames, etc.) on credit. During...

A: Purchases of raw material = P9,700 Labour = P24,000 Overhead = P35,000 Conversion Cost = P38,000 Sol...

Q: What exactly is a genuine account?

A: Introduction: Expenses reduce an owner's equity. Because the standard level of owner's equity is a c...

Q: Mcniff Corporation makes a range of products. The company's predetermined overhead rate is $20 per d...

A: SOLUTION CALCULATION OF VARIABLE PORTION OF PREDETERMINED OVERHEAD RATE = VARIABLE MANUFACTURING OVE...

Q: What is Nancy’s degree of operating leverage?

A: Formula used: Degree of operating leverage = contribution margin / Operating income

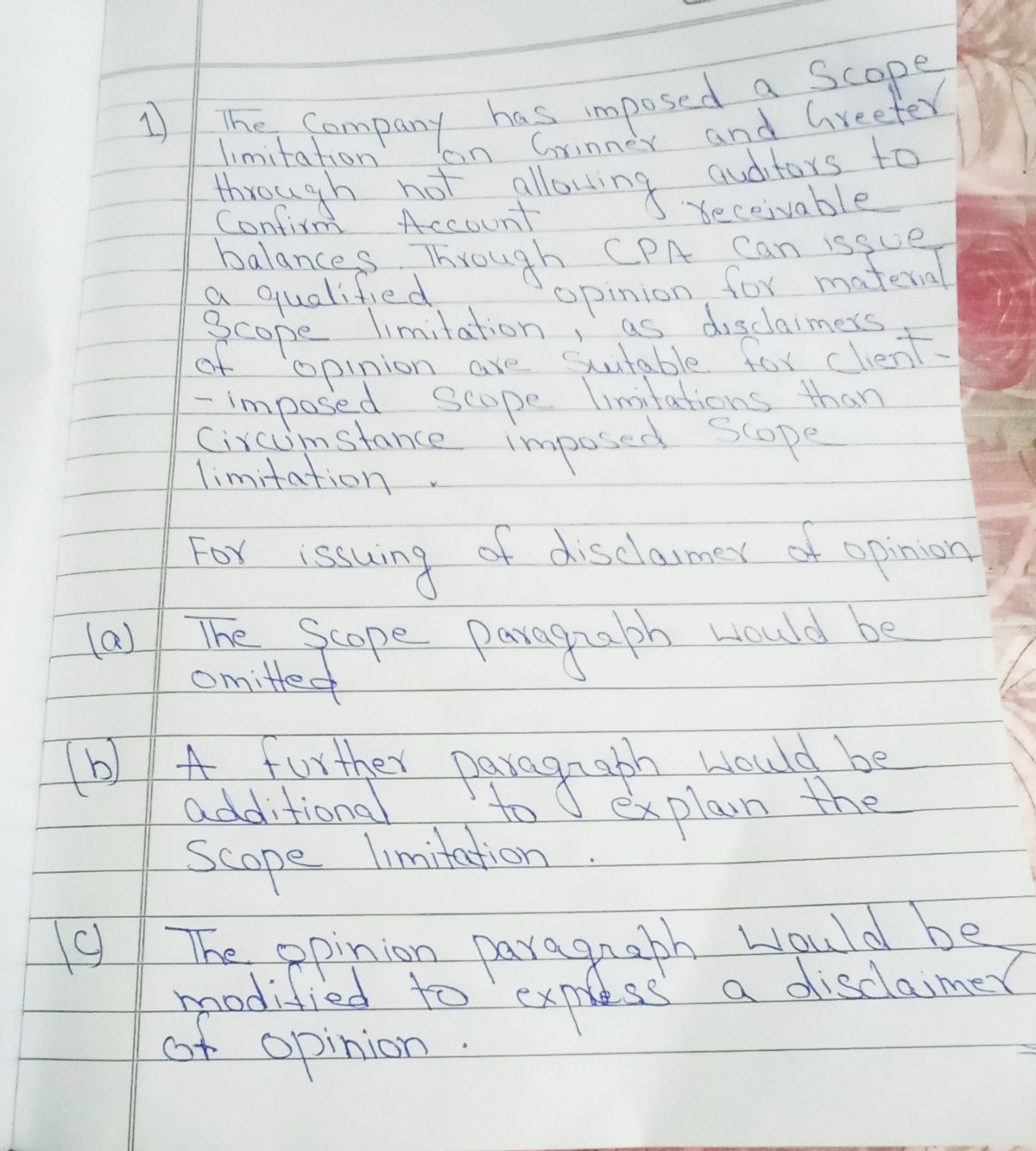

Below are two independent situations.

1: Grinner and Greeter, CPAs, were engaged to perform an audit of the financial statements of Happy, Inc. Happy's management would not allow Grinner and Greeter to confirm any of the

2: Tick and Tie, CPAs, were performing their annual audit of Johnson Manufacturing Company. Johnson is currently being sued for $2,000,000 related to an alleged defective product that they sold to a customer. Johnson's legal counsel has told Tick and Tie that it is probable that Johnson will lose the suit and have to pay the entire $2,000,000. Johnson's management has included information in the footnotes about the lawsuit. However, they have not recorded any loss or liability in the income statement or balance sheet.

Required:

For each of the independent situations presented above, state what type of opinion should be issued on the company's financial statements. Briefly explain your rationale. Finally, state what modifications, if any, would be required to the standard report.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- L. King, CPA, is auditing the financial statements of Cycle Company, a client that has receivables from customers arising from the sale of goods in the normal course of business. King is aware that the confirmation of accounts receivable is a generally accepted auditing procedure. Required: a. Under what circumstances could King justify omitting the confirmation of Cycle’s accounts receivable? b. In designing confirmation requests, what factors are likely to affect King’s assessment of the reliability of confirmations that King sends? c. What alternative procedures could King consider performing when replies to positive confirmation requests are not received?Kay & Lee LLP was retained as the auditor for Holligan Industries to audit the financial statements required by prospective banks as a prerequisite to extending a loan to the client. The auditor knows whichever bank lends money to the client is likely to rely on the audited statements. After the audit report is issued, the bank that ultimately made the loan discovers that the audit client’s inventory and accounts receivable were overstated. The client subsequently went bankrupt and defaulted on the loan. The bank alleged that the auditor failed to communicate about the inadequacy of the client’s internal recordkeeping and inventory control. Moreover, the bank claims that the auditors were grossly negligent in not discovering the overvaluation of inventory and accounts receivable. The auditors asserted that there was no way for them to know that the client included in the inventory account $1 million of merchandise in transit to a customer on December 31, 2015. The shipping terms…Kay & Lee LLP was retained as the auditor for Holligan Industries to audit the financial statements required by prospective banks as a prerequisite to extending a loan to the client. The auditor knows whichever bank lends money to the client is likely to rely on the audited statements. After the audit report is issued, the bank that ultimately made the loan discovers that the audit client’s inventory and accounts receivable were overstated. The client subsequently went bankrupt and defaulted on the loan. The bank alleged that the auditor failed to communicate about the inadequacy of the client’s internal recordkeeping and inventory control. Moreover, the bank claims that the auditors were grossly negligent in not discovering the overvaluation of inventory and accounts receivable. The auditors asserted that there was no way for them to know that the client included in the inventory account $1 million of merchandise in transit to a customer on December 31, 2015. The shipping terms…

- Kay & Lee LLP was retained as the auditor for Holligan Industries to audit the financial statements required by prospective banks as a prerequisite to extending a loan to the client. The auditor knows whichever bank lends money to the client is likely to rely on the audited statements. After the audit report is issued, the bank that ultimately made the loan discovers that the audit client’s inventory and accounts receivable were overstated. The client subsequently went bankrupt and defaulted on the loan. The bank alleged that the auditor failed to communicate about the inadequacy of the client’s internal recordkeeping and inventory control. Moreover, the bank claims that the auditors were grossly negligent in not discovering the overvaluation of inventory and accounts receivable. The auditors asserted that there was no way for them to know that the client included in the inventory account $1 million of merchandise in transit to a customer on December 31, 2015. The shipping terms…The financial records of the Movitz Company show that R. Dennis owes $4,100 on an account receivable. An independent audit is being carried out, and the auditors send a positive confirmation to R. Dennis. What is the most likely reason as to why a positive confirmation rather than a negative confirmation was used here?a. Control risk was particularly low for accounts receivable.b. Inherent risk was particularly high for accounts receivable.c. Dennis’s account was not yet due.d. Dennis’s account was not with a related party.Gordon & Moore, CPAs, were the auditors of Fox & Company, a brokerage firm. Gordon & Moore examined and reported on the financial statements of Fox, which were filed with the Securities and Exchange Commission. Several of Fox’s customers were swindled by a fraudulent scheme perpetrated by two key officers of the company. The facts establish that Gordon & Moore were negligent, but not reckless or grossly negligent, in the conduct of the audit, and neither participated in the fraudulent scheme nor knew of its existence. The customers are suing Gordon & Moore under the antifraud provisions of Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934 for aiding and abetting the fraudulent scheme of the officers. The customers’ suit for fraud is predicated exclusively on the negligence of the auditors in failing to conduct a proper audit, thereby failing to discover the fraudulent scheme. What is the probable outcome of the lawsuit? Explain. What other…

- Which of the following is most closely related to the relevance of audit evidence?a. Auditors decide to physically inspect investment securities held by a custodian instead of obtaining confirmations from the custodian.b. In addition to confirmations of accounts receivable, auditors perform an analysis of the aging of accounts receivable to evaluate the collectability of accounts receivable.c. In response to less effective internal control, auditors increase the number of customer accounts receivable confirmations mailed compared to that in the prior year.d. Because of a large number of transactions occurring near year-end, auditors decide to confirm a larger number of receivables following year-end instead of during the interim period.The following are examples of circumstances that may indicate the possibility that the financial statements may contain a material misstatement resulting from fraud, except Group of answer choices Last-minute adjustments that significantly affect financial results or unusual journal entries. Transactions that are recorded in a complete or timely manner or are properly recorded as to amount, accounting period, classification, or entity policy. Unsupported or unauthorized balances or transactions. Tips or complaints to the auditor about alleged fraud.You are the audit partner of ‘Power Auditors’ and you are auditing your client ‘FreefallIncorporated’.After finishing all the tests on the client’s financial information you determine that there is amaterial misstatement in the accounts receivable account of your client. This misstatementhas also caused the sales revenue account to be materially misstated. You have notified theclient about the misstatement but as of reporting date, client has not made any corrections.You also found misstatements in the fixed assets and accounts payable accounts, but theyare not material as per your assessment. You found no other misstatements in the otheraccounts.In addition to this, you also notice that the client has a large amount of debt which will bedue next year. As the business has suffered a loss this year and does not have enough cashflow at the end of the year to pay the debt next year, the client will need to secure someform of refinancing next year. Without this refinancing, there is a…

- The auditor should ordinarily send confirmation requests to all banks with whichthe client has conducted any business during the year, regardless of the year-endbalance, because(1) this procedure will detect kiting activities that would otherwise not be detected.(2) the confirmation form also seeks information about indebtedness to the bank.(3) the sending of confirmation requests to all such banks is required by auditingstandards.(4) this procedure relieves the auditor of any responsibility with respect to nondetection of forged checks.In connection with the examination of financial statements by applying PSA 240 & 300, an independent auditor could be responsible for failure to detect a material fraud if Select one: a. statistical sampling techniques were not used on the audit engagement. b. accountants performing important parts of the work failed to discover a close relationship between the treasurer and the cashier. c. the auditor planned the work in a hasty and inefficient manner. d. the fraud was perpetrated by one client employee, who circumvented the existing internal controls.Under common law, which of the following statements most accurately reflects the liability of a CPA who fraudulently gives an opinion on an audit of a client's financial statements? A. The CPA is liable only to third parties in privity of contract with the CPA B. The CPA is liable only to known users of the financial statements C. The CPA probably is liable to any person who suffered a loss as a result of the fraud D. The CPA probably is liable to the client even if the client was aware of the fraud and did not rely on the opinion