Benjamin and Ester file a joint return and have AGI of $165,000. Both are active participants in their employer's pension plan. They have one child, Emily, who is age 8. Emily's grandparents contributed $500 to a Coverdell Education Savings Account for Emily in 2022. What is the maximum permitted Coverdell Education Savings Account contribution that Benjamin and Ester can make in 2022? Multiple Choice $0. $500. $1,500.

Benjamin and Ester file a joint return and have AGI of $165,000. Both are active participants in their employer's pension plan. They have one child, Emily, who is age 8. Emily's grandparents contributed $500 to a Coverdell Education Savings Account for Emily in 2022. What is the maximum permitted Coverdell Education Savings Account contribution that Benjamin and Ester can make in 2022? Multiple Choice $0. $500. $1,500.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 65P

Related questions

Question

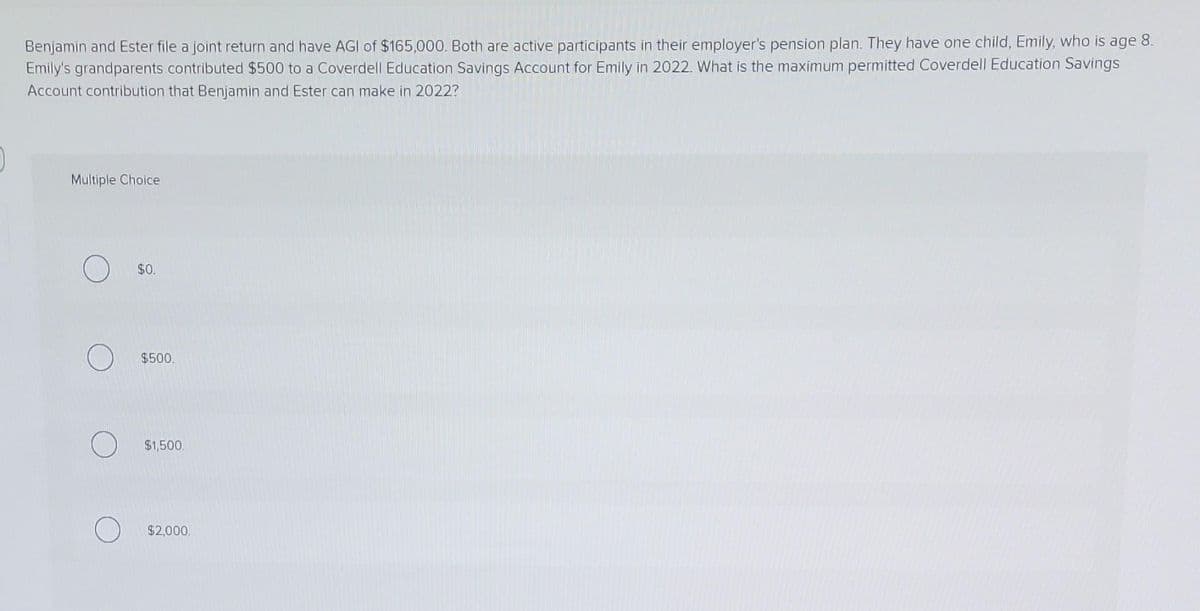

Transcribed Image Text:Benjamin and Ester file a joint return and have AGI of $165,000. Both are active participants in their employer's pension plan. They have one child, Emily, who is age 8.

Emily's grandparents contributed $500 to a Coverdell Education Savings Account for Emily in 2022. What is the maximum permitted Coverdell Education Savings

Account contribution that Benjamin and Ester can make in 2022?

Multiple Choice

O

$0.

$500.

$1,500

$2,000.

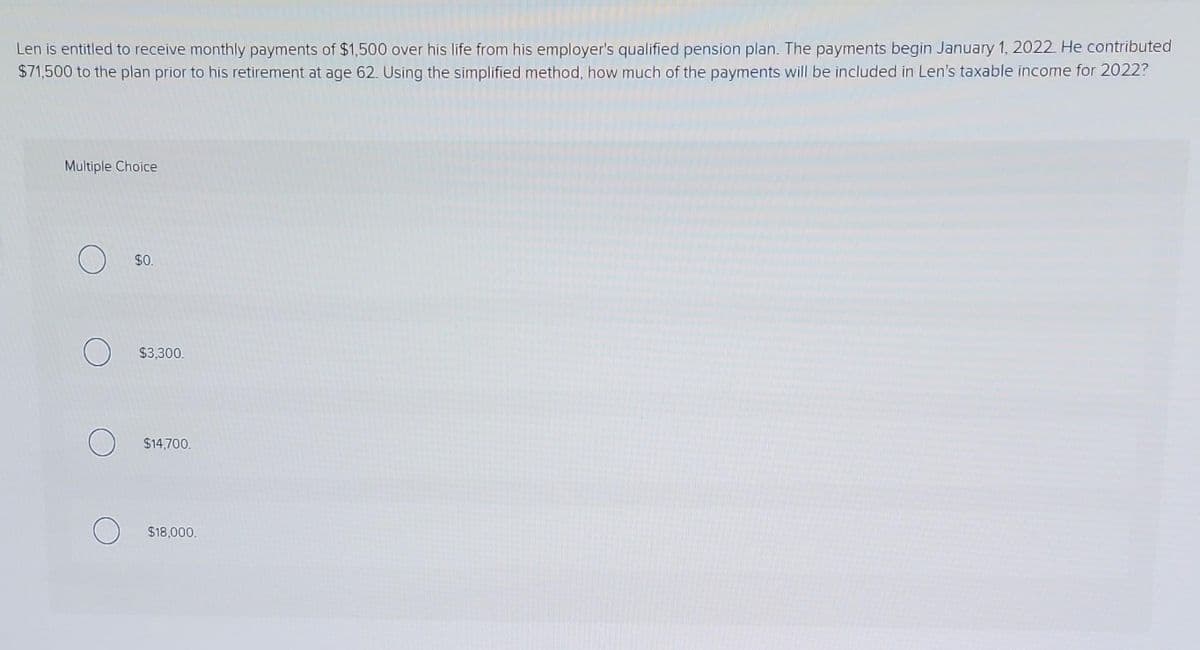

Transcribed Image Text:Len is entitled to receive monthly payments of $1,500 over his life from his employer's qualified pension plan. The payments begin January 1, 2022. He contributed

$71,500 to the plan prior to his retirement at age 62. Using the simplified method, how much of the payments will be included in Len's taxable income for 2022?

Multiple Choice

$0.

$3,300.

$14,700.

$18,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you