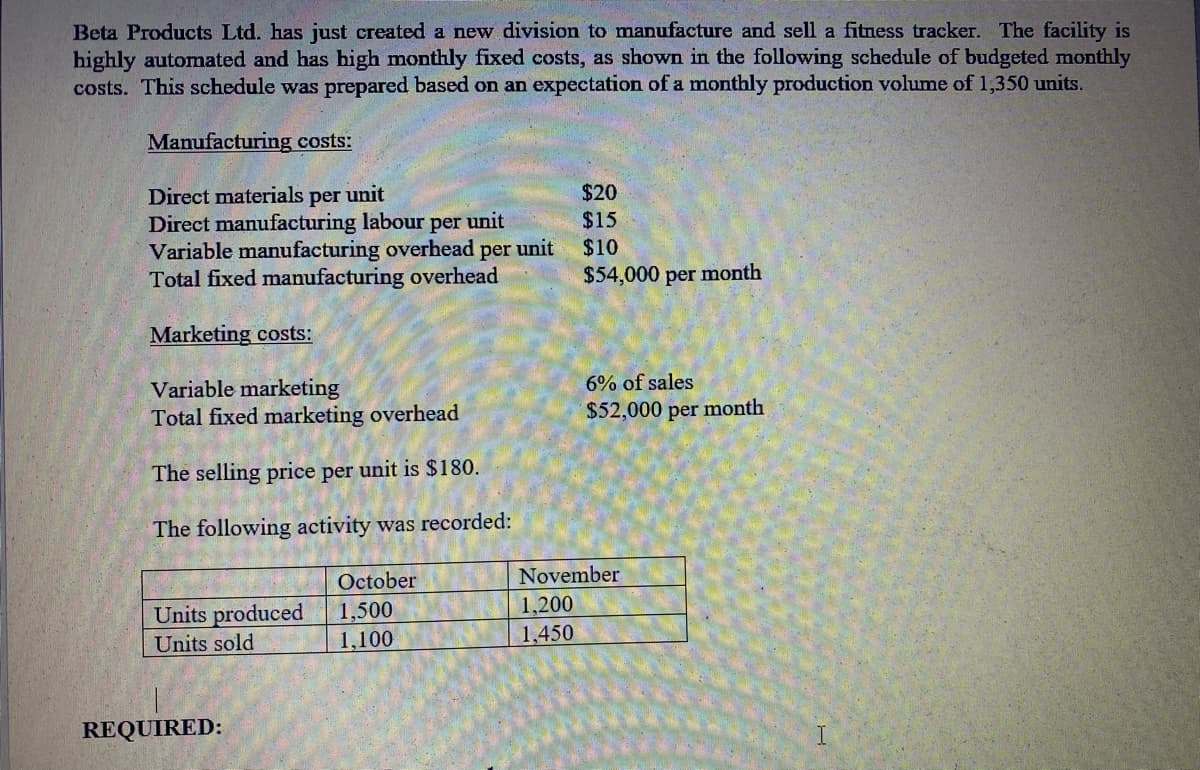

Beta Products Ltd. has just created a new division to manufacture and sell a fitness tracker. The facility is highly automated and has high monthly fixed costs, as shown in the following schedule of budgeted monthly costs. This schedule was prepared based on an expectation of a monthly production volume of 1,350 units. Manufacturing costs: $20 Direct materials per unit Direct manufacturing labour per unit Variable manufacturing overhead per unit Total fixed manufacturing overhead $15 $10 $54,000 per month Marketing costs: 6% of sales Variable marketing Total fixed marketing overhead $52,000 per month The selling price per unit is $180. The following activity was recorded: October November 1,500 1,100 1,200 1,450 Units produced Units sold REQUIRED: I.

Beta Products Ltd. has just created a new division to manufacture and sell a fitness tracker. The facility is highly automated and has high monthly fixed costs, as shown in the following schedule of budgeted monthly costs. This schedule was prepared based on an expectation of a monthly production volume of 1,350 units. Manufacturing costs: $20 Direct materials per unit Direct manufacturing labour per unit Variable manufacturing overhead per unit Total fixed manufacturing overhead $15 $10 $54,000 per month Marketing costs: 6% of sales Variable marketing Total fixed marketing overhead $52,000 per month The selling price per unit is $180. The following activity was recorded: October November 1,500 1,100 1,200 1,450 Units produced Units sold REQUIRED: I.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 4CMA: Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold...

Related questions

Question

N.B: I don’t need the attachment of excel file. Just the snap of excel with “show formula” will be good. Please help me with this.

Transcribed Image Text:Beta Products Ltd. has just created a new division to manufacture and sell a fitness tracker. The facility is

highly automated and has high monthly fixed costs, as shown in the following schedule of budgeted monthly

costs. This schedule was prepared based on an expectation of a monthly production volume of 1,350 units.

Manufacturing costs:

$20

Direct materials per unit

Direct manufacturing labour per unit

Variable manufacturing overhead per unit

Total fixed manufacturing overhead

$15

$10

$54,000 per month

Marketing costs:

6% of sales

Variable marketing

Total fixed marketing overhead

$52,000 per month

The selling price per unit is $180.

The following activity was recorded:

October

November

1,200

Units produced

Units sold

1,500

1,100

1,450

REQUIRED:

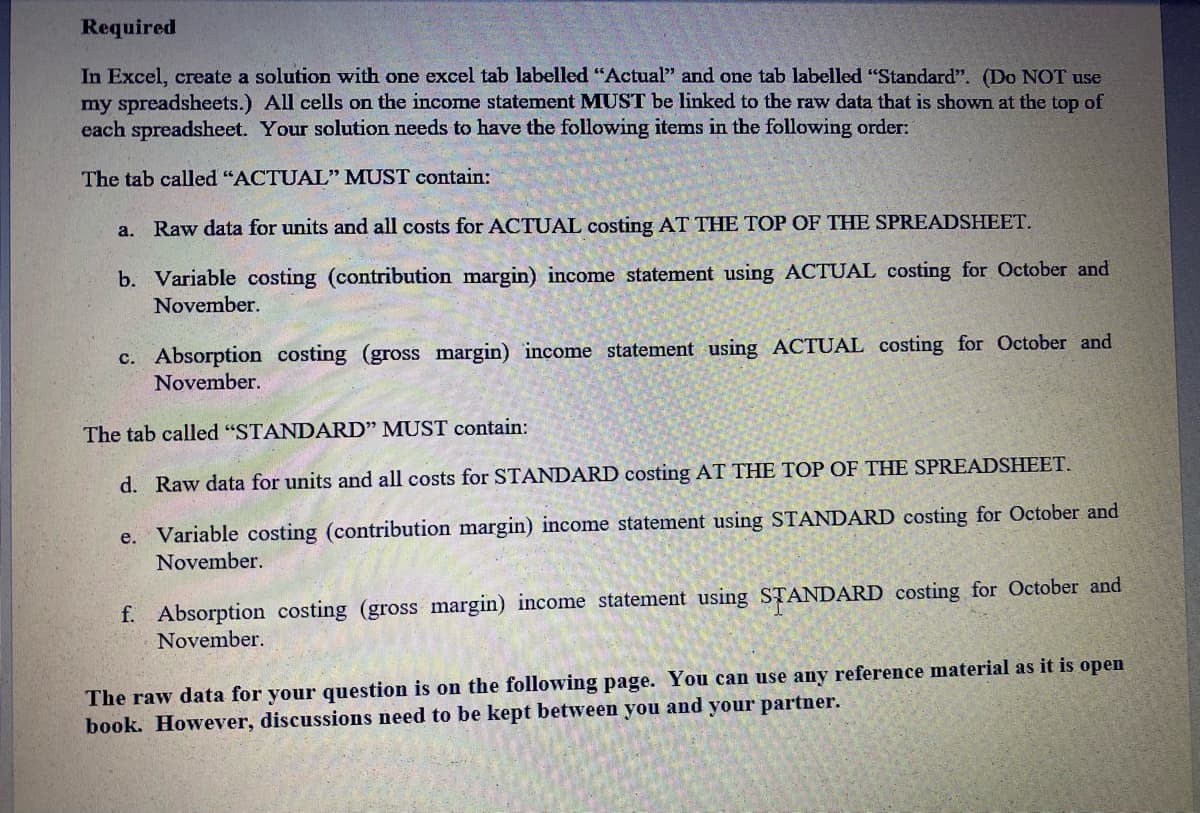

Transcribed Image Text:Required

In Excel, create a solution with one excel tab labelled “Actual" and one tab labelled "Standard". (Do NOT use

my spreadsheets.) All cells on the income statement MUST be linked to the raw data that is shown at the top of

each spreadsheet. Your solution needs to have the following items in the following order:

The tab called "ACTUAL" MUST contain:

a.

Raw data for units and all costs for ACTUAL costing AT THE TOP OF THE SPREADSHEET.

b. Variable costing (contribution margin) income statement using ACTUAL costing for October and

November.

c. Absorption costing (gross margin) income statement using ACTUAL costing for October and

November.

The tab called "STANDARD" MUST contain:

d. Raw data for units and all costs for STANDARD costing AT THE TOP OF THE SPREADSHEET.

e. Variable costing (contribution margin) income statement using STANDARD costing for October and

November.

f. Absorption costing (gross margin) income statement using STANDARD costing for October and

November.

The raw data for your question is on the following page. You can use any reference material as it is open

book. However, discussions need to be kept between you and your partner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning