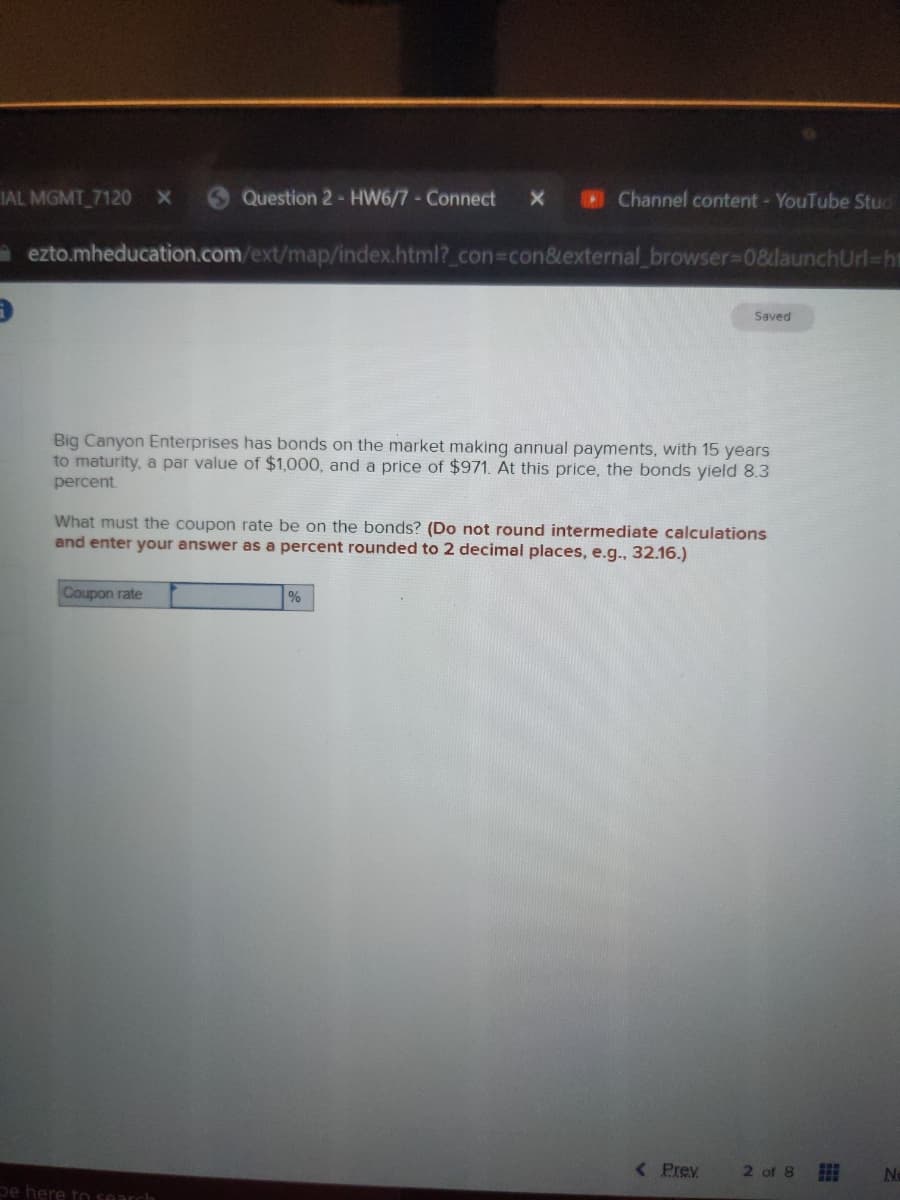

Big Canyon Enterprises has bonds on the market making annual payments, with 15 ye to maturity, a par value of $1,000, and a price of $971. At this price, the bonds yield percent What must the coupon rate be on the bonds? (Do not round intermediate calculatic and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate

Big Canyon Enterprises has bonds on the market making annual payments, with 15 ye to maturity, a par value of $1,000, and a price of $971. At this price, the bonds yield percent What must the coupon rate be on the bonds? (Do not round intermediate calculatic and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 5P: Bats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and...

Related questions

Concept explainers

Question

2. Find the coupon rate

Transcribed Image Text:IAL MGMT 7120

Question 2- HW6/7-Connect

Channel content- YouTube Stud

A ezto.mheducation.com/ext/map/index.html?_con%3con&external browser%-D0&launchUrl-ht

Saved

Big Canyon Enterprises has bonds on the market making annual payments, with 15 years

to maturity, a par value of $1,000, and a price of $971. At this price, the bonds yield 8.3

percent.

What must the coupon rate be on the bonds? (Do not round intermediate calculations

and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Coupon rate

%

< Prev

2 of 8

Ne

pe here tO search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning