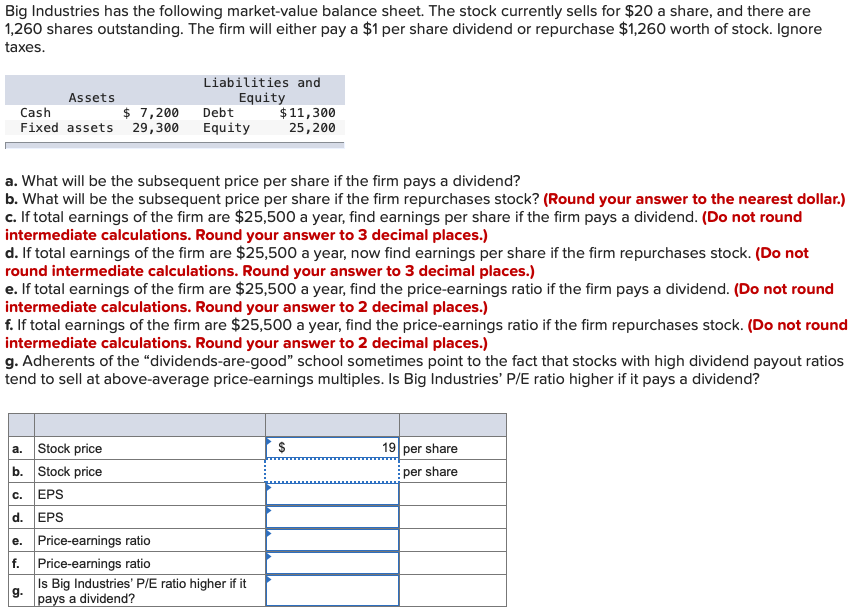

Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are 1,260 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,260 worth of stock. Ignore taxes. Liabilities and Assets $ 7,200 Fixed assets 29,300 Equity Equity $11,300 25,200 Cash Debt a. What will be the subsequent price per share if the firm pays a dividend? b. What will be the subsequent price per share if the firm repurchases stock? (Round your answer to the nearest dollar.) c. If total earnings of the firm are $25,500 a year, find earnings per share if the firm pays a dividend. (Do not round intermediate calculations. Round your answer to 3 decimal places.) d. If total earnings of the firm are $25,500 a year, now find earnings per share if the firm repurchases stock. (Do not round intermediate calculations. Round your answer to 3 decimal places.) e. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm pays a dividend. (Do not round intermediate calculations. Round your answer to 2 decimal places.) f. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm repurchases stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) g. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high dividend payout ratios tend to sell at above-average price-earnings multiples. Is Big Industries' P/E ratio higher if it pays a dividend? a. Stock price b. Stock price $ 19 per share per share c. EPS d. EPS

Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are 1,260 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,260 worth of stock. Ignore taxes. Liabilities and Assets $ 7,200 Fixed assets 29,300 Equity Equity $11,300 25,200 Cash Debt a. What will be the subsequent price per share if the firm pays a dividend? b. What will be the subsequent price per share if the firm repurchases stock? (Round your answer to the nearest dollar.) c. If total earnings of the firm are $25,500 a year, find earnings per share if the firm pays a dividend. (Do not round intermediate calculations. Round your answer to 3 decimal places.) d. If total earnings of the firm are $25,500 a year, now find earnings per share if the firm repurchases stock. (Do not round intermediate calculations. Round your answer to 3 decimal places.) e. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm pays a dividend. (Do not round intermediate calculations. Round your answer to 2 decimal places.) f. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm repurchases stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) g. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high dividend payout ratios tend to sell at above-average price-earnings multiples. Is Big Industries' P/E ratio higher if it pays a dividend? a. Stock price b. Stock price $ 19 per share per share c. EPS d. EPS

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

Practice Pack

Transcribed Image Text:Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are

1,260 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,260 worth of stock. Ignore

taxes.

Liabilities and

Assets

Equity

$ 7,200

Fixed assets 29,300

Debt

$11,300

25,200

Cash

Equity

a. What will be the subsequent price per share if the firm pays a dividend?

b. What will be the subsequent price per share if the firm repurchases stock? (Round your answer to the nearest dollar.)

c. If total earnings of the firm are $25,500 a year, find earnings per share if the firm pays a dividend. (Do not round

intermediate calculations. Round your answer to 3 decimal places.)

d. If total earnings of the firm are $25,500 a year, now find earnings per share if the firm repurchases stock. (Do not

round intermediate calculations. Round your answer to 3 decimal places.)

e. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm pays a dividend. (Do not round

intermediate calculations. Round your answer to 2 decimal places.)

f. If total earnings of the firm are $25,500 a year, find the price-earnings ratio if the firm repurchases stock. (Do not round

intermediate calculations. Round your answer to 2 decimal places.)

g. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high dividend payout ratios

tend to sell at above-average price-earnings multiples. Is Big Industries' P/E ratio higher if it pays a dividend?

a. Stock price

b. Stock price

c. EPS

d. EPS

e. Price-earnings ratio

f. Price-earnings ratio

Is Big Industries' P/E ratio higher if it

pays a dividend?

19 per share

per share

g.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 5 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning