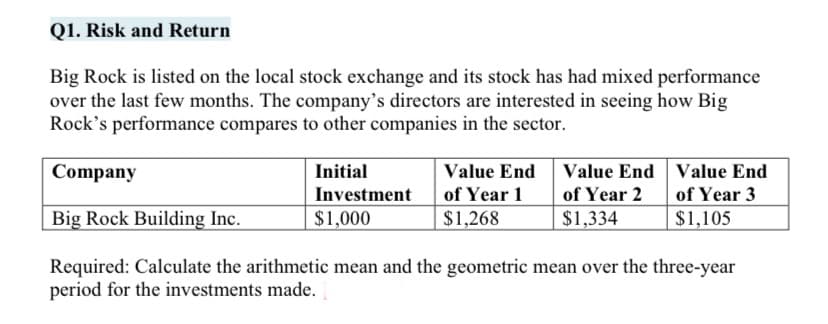

Big Rock is listed on the local stock exchange and its stock has had mixed performance over the last few months. The company's directors are interested in seeing how Big Rock's performance compares to other companies in the sector. Value End of Year 1 $1,268 Value End Value End of Year 2 $1,334 Company Initial of Year 3 $1,105 Investment Big Rock Building Inc. $1,000 Required: Calculate the arithmetic mean and the geometric mean over the three-year period for the investments made.

Q: Assume inflation is expected to be 3% next year, 4% the following year, and 6% thereafter. The matur...

A: Nominal interest rate It is the real interest rate along with inflation rate. In approximate term, n...

Q: Which factor below is causing many of the world's top financial institutions to consider movin their...

A: Several financial institutions are considering moving their global operations out of London and shif...

Q: nstruction: Show complete solution including the cash flow diagram if not given,Formula function, Fo...

A: The Equivalent Uniform Annual Cost is a term which defines the total cost of an asset which is incur...

Q: and sales. . $3,000,000.00 $2.500,000.00 $2.000,000.00 $1,500.000.00 $1.000.000.00 $500,000.00 Cash ...

A: Accounts receivables are the current assets for the firm as this is a situation where the goods are ...

Q: A put option with an exercise price of P90 was priced at P4. At expiration, the underlying stock is ...

A: A put option is a contract that grants the holder the right to sell a certain number of equity share...

Q: ompute the annuity of the money ompounded monthly at the rate o O 665 O 755 O 801

A: Future value of annuity includes the annuity amount deposited and compound interest accumulated over...

Q: Discuss the issues encountered in Enron Scandal and how the Sarbanes Oxley Act addressed those issue...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: The finance charge for this billing cycle is The account balance on the next billing is

A: A credit card is a type of payment card which is issued to the user by banks or financial institutio...

Q: Jie purchased a computer priced at $891.06, financing it by paying $60.38 on the date of purchase, a...

A: Finance amount (F) = $891.06 - $60.38 = $830.68 Number of payments (n) = 15 r = 11.9% per annum = 11...

Q: deposit function, the bank is the _____ and the depositors are the ______ a. drawee - payees b. de...

A: Banks do many function for customers and the one of the main function is the deposits made by the cu...

Q: An rrsp is now worth $229,000 after contributions of $3000 at the beginning of every six months for ...

A: Worth of rrsp"Future Value" is $229,000 Paymant type is begining of the period. Semi annual Contribu...

Q: How do development banks help to increase international trade?

A: The exchange of products, services, and capital across international restrictions or territories oc...

Q: 1. A man paid 10% down payment of P1,000,000 for a house and lot this month of January. The rate of ...

A: The present value of loan is equal to the sum of the present values of all future monthly installmen...

Q: Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 12 perc...

A: Profit depends on the expenses and if expenses decreases the profit will increase but if expenses in...

Q: To purchase a specialty guitar for his band, for the last three years JJ Morrison has made payments ...

A: Monthly saving is $92 Time period is 3 years Interest rate is 4.87% compounded monthly Interest rate...

Q: on the reasonableness of these assumptions. 7.5 Common versus Preferred Stock Suppose a company has ...

A: Dividend on preferred stock = Dividend on common stock = 2

Q: nt has a first cost of P 12,000 and a salvage value of P 500 at the end of x years. What is the val...

A: Sinking fund is a method of reducing the value of an asset while making a profit to return it when i...

Q: Why are UK government bonds considered a risk-free investment? Discuss the risk of exposed to market...

A: A bond is a fixed-income instrument that reflects a loan made by an investor to a borrower, and a bo...

Q: Which of the following events would make it more likely that a company would choose to call it’s out...

A: Bond price implies for the consideration paid by an investor for acquiring bond. In provided case, b...

Q: Find the term of the following ordinary general annuity. State your answer in years and months (from...

A: Future value (F) = $18,500 Interest rate (r) = 5.40% Number of compounding per year (m) = 4 Periodic...

Q: Compute the future value of $536 invested every year if the appropriate rate is 11.2% and you invest...

A: Annual deposit (A) = $536 r = 11.2% n = 4 years

Q: To pay off a loan of R7 000 due now and a loan of R2000 due in 14 months' time, Olorato agrees to ma...

A: 1st Loan Amount = R 7,000 2nd Loan Amount = R 2,000 Interest Rate = 16%

Q: The profit was first taxed in the corporate level and then taxed on the personal level. This is a. U...

A: A tax is a mandatory financial charge or other type of levy imposed on a taxpayer by a governmental ...

Q: A bank sets the loan rate on a prospective loan at 14%. This consists of a 12% base rate and a 2% cr...

A: A loan is a financial aid which is given by one party to another party. This transaction can take pl...

Q: calculate the capitalized cost of a project that has an initial cost of 8 000 000 and an additional ...

A: Initial Cost= 80,00,000 Additional Cost =250,000 n=8 Operating cost for first 5 years= 150,000 Opera...

Q: Explain what is risk decompositon

A: Risk is referred as the future uncertainty with reference to the deviation from an expected earnings...

Q: alue of the same annuity d

A: An annuity is defined as the fixed payment made at the beginning or the end of the period for a part...

Q: Depending on the demand for your product, your sales are expected as follows: Demand Prob. Sales Low...

A: Here, Market Value of Equity is 430 No. of Shares is 40 EBIT is 23% Sales Tax Rate is 34% After Reca...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: 11. For the bond in Problem 10 (a), find (a) the price, and (b) the price-plus-accrued, 4 mont hs af...

A: The price of a bond: The price of a bond can be computed at any point of time before maturity as the...

Q: Josh is out of work. He had worked $7,290 and also in June, July, and A Unemployment compensation in...

A: Unemployment compensation is given by the government to help unemployed people to help them in livin...

Q: You are able to sell 15 gallons of ghost pepper sauce per month at a price of $200 per gallon. Re- s...

A: Price per gallon (P) = $200 Number of gallons sold at price P (n) = 15 With every $9 reduction, 2 mo...

Q: A young couple has decided to make advance plans for financing their 5 year old daughter’s college e...

A: Number of deposits (n) = 10 First deposit one year after today r = 3% Let the annual deposit = A Wit...

Q: dream A person wants to triple a sum of money by investing it for 17 years, and is shopping around f...

A: Solution:- When an amount is invested somewhere, it earns interest on it. So, the amount at maturity...

Q: Choosing to commute to work by driving a hybrid vehicle will save $130 every quarter in fuel. If mon...

A: The present value method is a method of finding out the profitability of the project by discounting ...

Q: Mr. Lee purchased a small condominium. He paid P350,000 as a down payment and agreed to pay P35,000 ...

A: The price of an asset can be computed by the present value of future payments associated with the as...

Q: Selling price were sh. 40 per unit for A and sh. 20 per unit for B respectively. Average sales retur...

A: An estimate for a company's total revenue for the upcoming financial periods is called sales budget....

Q: If Inflation and the interest rate were both zero, would there still be a time value of money? State...

A: The concept of time value of money says that money today has more worth than the same amount of mone...

Q: Calculate the following Ratios: g) Accounts Payable Turnover Ratio h) Debt ratio i) Return on Ass...

A: The ratios mentioned in the question are financial ratios. We can calculate them using the provided ...

Q: You are required to assess whether the decision to renovate will be profitable by using a BCR.

A: Benefit-cost ratio (BCR) refers to the ratio which shows the relationship between present value of b...

Q: andez wishes to have $368,765 in a retirement account 15 years from now. What payment would Noime ha...

A: There is need of proper planning for the retirement and proper planning lead to have good money on r...

Q: te solution and box the fi

A: Since in this question, payments are not given, so we do by assuming it zero coupon discount bond.

Q: risk transformtion in banks

A: Risk is a term that is used for defining the uncertainty arising in the future from changes in expec...

Q: An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual co...

A: We need to calculate bond price by using excel PV function. The formula is =-PV(RATE,NPER,PMT,FV)

Q: A piece of machinery costs $7000 and has an anticipated $1200 salvage value at the end of its five-y...

A: Depreciation is the allocation of cost of asset over the useful life of the asset, because fixed ass...

Q: For the following ordinary annuity, determine the size of the periodic payment. Present Payment Peri...

A: The periodical payment can be calculated with the help of PMT function of Excel. The function can be...

Q: f. Calculate the crossover rate where the two projects' NPVS are equal. Do not round intermediate ca...

A: Crossover rate is the rate of return at which the Net present value of both projects is the same. It...

Q: Executing an order. Bid price was Php10.00 the price of the stock was Php10.80 9:05am 9.15am -the pr...

A: Solution:- When a limit buy order is placed, the order gets executed only when the market price reac...

Q: 1. Provide a Liquidity Ratio Analysis based on the current Ratio. 2. Provide a Profitability ratio ...

A: Ratio Analysis is the analysis of the financial statements of the company which determines the profi...

Q: Choose from liquidity premium, taxability premium, default risk premium, maturity premium.

A: Liquidity Premium: It represents the additional compensation paid for the investment that cannot be ...

Step by step

Solved in 2 steps with 2 images

- 1).Big Rock is listed on the local stock exchange and its stock has had mixed performanceover the last few months. The company’s directors are interested in seeing how BigRock’s performance compares to other companies in the sector. Company Initial Investment Value End of Year 1 Value Endof Year 2 Value Endof Year 3Big Rock Building Inc. $1,000 $1,268 $1334 $1,105 Required: Calculate the arithmetic mean and the geometric mean over the three-yearperiod for the investments made. 2).The company’s pension plan is managed by Castle Fund Managers, a leading provider ofpension services. It is a defined contribution plan, where the employees’ contributions arematched by the employer. Each employee had to choose one of the following investmentoptions for their individual plans: a. Preferred Accumulator (PA): Short-term focusb. Balanced Accumulator (BA): Medium-term focusc. Select…Question A .Consider the following firms: Net Income this Year Stock price at beginning of year Stock price at end of year Firm A $ 10,000,000 $ 20 $ 10 Firm B $ 8,000,000 $ 10 $ 20 a) The manager of firm A is doing a better job than B b) The manager of firm B is doing a better job than A c) Neither manager is doing a good job d) Both managers are doing a good job Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this lineq4- Gamma Ltd's net profit for the last financial year was $179,000 and it paid $113,000 in dividends. It expects net profit to grow at 2.6% p.a. in perpetuity and to maintain a constant dividend payout ratio. Its beta is 1.9, the risk-free rate is 2.1% and the equity risk premium is 6.8%. What is its justified forward P/E/ ratio? a. 5.08 b. 2.97 c. 3.05 d. 5.21 Clear my choice

- Dont use excel please DIRECTIONS: Compute the requirements of each problem. All computations must be handwritten. A. HYZEL Corporation, a domestic corporation, is expected to distribute P1.50 cash dividends at the end of the year. It is forecasted that the dividends will grow at a constant rate of 7% a year. The required rate of return of the common stock of HYZEL is 12.6%, Required: Using the constant growth stock valuation model, compute the current value per share where D1 = P1.50 B. IZZY Company paid dividends to its common stockholders at P2.75 per share on December 31, 2018. The common stock of IZZY is selling in the market at P67.90 per share. The dividend growth rate of the company is 5.6% and the required rate of return of the common stock is 7.5%. Required: 1. Using the discounted dividend model, how do you compute the market price of the common stock? 2. Will an investor consider buying the common stock of IZZY at 963.90 per share?Please provide solutions. Thank you. 1. A firm has common stock with a prevailing market price of P100 per share. New issue of stock is expected to be sold for P98, with P2 per share representing the under-pricing necessary in the competitive capital market. Flotation costs are expected to total P1 per share. The dividends paid on the outstanding stock over the past five years are as follows: Year Dividend1 P4.002 4.283 4.584 4.905 5.24 The cost of the firm’s new common stock equity is?QUESTION 1. The current year profits of Levelex Inc. is 1.000.000₺ and expected profits for thenext year is 1.250.000₺. The average profitability of its assets is 22% and the current year dividend per face valueof 1₺ is 30%.a) Compute the intrinsic value of a stock of this company for an investor whose minimum required rate ofreturn is 25 %. b) Compute the value of this stock under the same assumptions 2 years later.

- Question Please provide the solutions and the correct answers. thank you! 2. The Delta Company projects the following for the upcoming year: Earnings before interest and taxes = P40 millionInterest expense = P 5 millionPreferred stock dividends = P 4 millionCommon stock dividend payout ratio = 20%Average number of common shares outstanding = 2 millionEffective corporate income tax rate = 40% The expected dividend per share of common stock isa. P1.70b. P1.86c. P2.10d. P1.00 3. Following are selected data taken from the records of Jemson Company:Income before tax = P200,000Income tax rate = 40%Dividend payout ratio = 0.80Number of common shares outstanding = 10,000 shares How much dividends per share did the company pay during the year?a. P9.60b. P6.40c. P16d. P15Q-r Net income for the previous year was $400,000, of which $280,000 was paid out in dividends. Dividends are expected to grow at a constant rate. The company has 200,000 shares outstanding and the book value of equity is $4,000,000. The appropriate P/E ratio for this type of company is 8. What is the expected stock price 5 years from now?Subject: Financial strategy & policy Q.2) Bowles Sporting Inc. is prepared to report the following income statement (shown in thousands of dollars) for the year 2009. Sales $15,200 Operating costs including depreciation (11,900) EBIT $ 3,300 Interest (300) EBT $ 3,000 Taxes (40%) (1,200) Net income $ 1,800 Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 500,000 shares of stock outstanding, and its stock trades at $48 per share. d) As an alternative to maintaining the same dividend payout ratio, Bowles is considering maintaining the same per-share dividend in 2009 that it…

- If a firm has retained earnings of $3.4 million, a common shares account of $5.4 million, and additional paid-in capital of $10.8 million, how would these accounts change in response to a 10 percent stock dividend? Assume market value of equity is equal to book value of equity. (Enter your answers in dollars not in millions. Input all amounts as positive values. Indicate the direction of the effect by selecting "increase," "decrease," or "no change" from the drop-down menu.)Q2: Pak China Railroad reported net income of $770 millionafter interest expenses of $320 million in a recentfinancial year. (The corporate tax rate was 36%.) It reporteddepreciation of $960 million in that year, and capitalspending was $1.2 billion. The firm also had $4 billionin debt outstanding on the books, was rated AA (carryinga yield to maturity of 8%), and was trading at par(up from $3.8 billion at the end of the previous year).The beta of the stock is 1.05, and there were 200 millionshares outstanding (trading at $60 per share), witha book value of $5 billion. Union Pacific paid 40% of itsearnings as dividends and working capital requirementsare negligible. (The Treasury bond rate is 7%.) Estimate the value of equity and the value per share now.Q2: Pak China Railroad reported net income of $770 millionafter interest expenses of $320 million in a recentfinancial year. (The corporate tax rate was 36%.) It reporteddepreciation of $960 million in that year, and capitalspending was $1.2 billion. The firm also had $4 billionin debt outstanding on the books, was rated AA (carryinga yield to maturity of 8%), and was trading at par(up from $3.8 billion at the end of the previous year).The beta of the stock is 1.05, and there were 200 millionshares outstanding (trading at $60 per share), witha book value of $5 billion. Union Pacific paid 40% of itsearnings as dividends and working capital requirementsare negligible. (The Treasury bond rate is 7%.) Estimate the FCFF for the most recent financialyear. Do not use $ sign