Billy Brown, owner of Billy refrigeration unit. The van would cost $99,000, have an eight-year useful life, and generate cost savings of $19,500 per year compared to the van currently being used, Also, Billy estimates the new van would result in the sale of 1,800 more litres of ice cream each year, which has a contribution margin of $2 per litre. (Ignore income taxes) Required: 1. What would be the total annual cash inflows associated with the new van for capital budgeting purposes? Total annunl cash infiows 2. Calculate the IRR promised by the new van. (Hint. Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to one decimal place.) Internal rate of retun 3. Assume that in addition to the cash flows described above, the van will have a $18,000 salvage value at the end of eight years. Calculate the IRR. (Hint Use Microsoft Excel to calculate the discount factor(s)) (Do not round intermediate calculations and round your final answer to one decimal place.) Internal rate of retum

Billy Brown, owner of Billy refrigeration unit. The van would cost $99,000, have an eight-year useful life, and generate cost savings of $19,500 per year compared to the van currently being used, Also, Billy estimates the new van would result in the sale of 1,800 more litres of ice cream each year, which has a contribution margin of $2 per litre. (Ignore income taxes) Required: 1. What would be the total annual cash inflows associated with the new van for capital budgeting purposes? Total annunl cash infiows 2. Calculate the IRR promised by the new van. (Hint. Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to one decimal place.) Internal rate of retun 3. Assume that in addition to the cash flows described above, the van will have a $18,000 salvage value at the end of eight years. Calculate the IRR. (Hint Use Microsoft Excel to calculate the discount factor(s)) (Do not round intermediate calculations and round your final answer to one decimal place.) Internal rate of retum

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 5MAD: Home Garden Inc. is considering the construction of a distribution warehouse in West Virginia to...

Related questions

Question

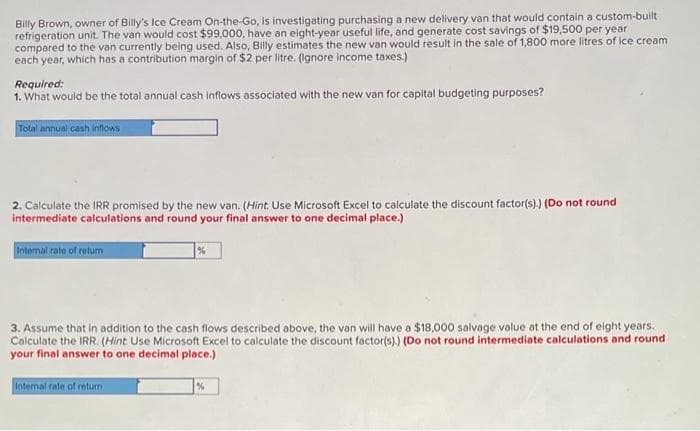

Transcribed Image Text:Billy Brown, owner of Billy's Ice Cream On-the-Go, is investigating purchasing a new delivery van that would contain a custom-built

refrigeration unit. The van would cost $99,000, have an eight-year useful life, and generate cost savings of $19,500 per year

compared to the van currently being used. Also, Billy estimates the new van would result in the sale of 1,800 more litres of ice cream

each year, which has a contribution margin of $2 per litre. (Ignore income taxes.)

Required:

1. What would be the total annual cash inflows associated with the new van for capital budgeting purposes?

Total annual cash infows

2. Calculate the IRR promised by the new van. (Hint Use Microsoft Excel to calculate the discount factor(s).) (Do not round

intermediate calculations and round your final answer to one decimal place.)

Internal rate of retum

3. Assume that in addition to the cash flows described above, the van will have a $18,000 salvage value at the end of eight years.

Calculate the IRR. (Hint Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round

your final answer to one decimal place.)

Internal rate of retum

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning