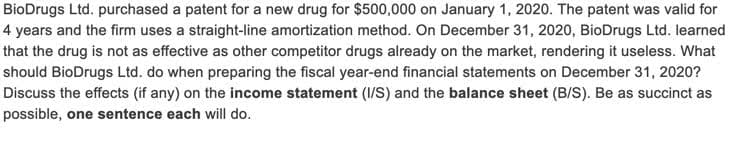

BioDrugs Ltd. purchased a patent for a new drug for $500,000 on January 1, 2020. The patent was valid for 4 years and the firm uses a straight-line amortization method. On December 31, 2020, BioDrugs Ltd. learned that the drug is not as effective as other competitor drugs already on the market, rendering it useless. What should BioDrugs Ltd. do when preparing the fiscal year-end financial statements on December 31, 2020? Discuss the effects (if any) on the income statement (1/S) and the balance sheet (B/S). Be as succinct as possible, one sentence each will do.

BioDrugs Ltd. purchased a patent for a new drug for $500,000 on January 1, 2020. The patent was valid for 4 years and the firm uses a straight-line amortization method. On December 31, 2020, BioDrugs Ltd. learned that the drug is not as effective as other competitor drugs already on the market, rendering it useless. What should BioDrugs Ltd. do when preparing the fiscal year-end financial statements on December 31, 2020? Discuss the effects (if any) on the income statement (1/S) and the balance sheet (B/S). Be as succinct as possible, one sentence each will do.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 6EB: Calico Inc. purchased a patent on a new drug it created. The patent cost $12,000. The patent has a...

Related questions

Question

Transcribed Image Text:BioDrugs Ltd. purchased a patent for a new drug for $500,000 on January 1, 2020. The patent was valid for

4 years and the firm uses a straight-line amortization method. On December 31, 2020, BioDrugs Ltd. learned

that the drug is not as effective as other competitor drugs already on the market, rendering it useless. What

should BioDrugs Ltd. do when preparing the fiscal year-end financial statements on December 31, 2020?

Discuss the effects (if any) on the income statement (1/S) and the balance sheet (B/S). Be as succinct as

possible, one sentence each will do.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning