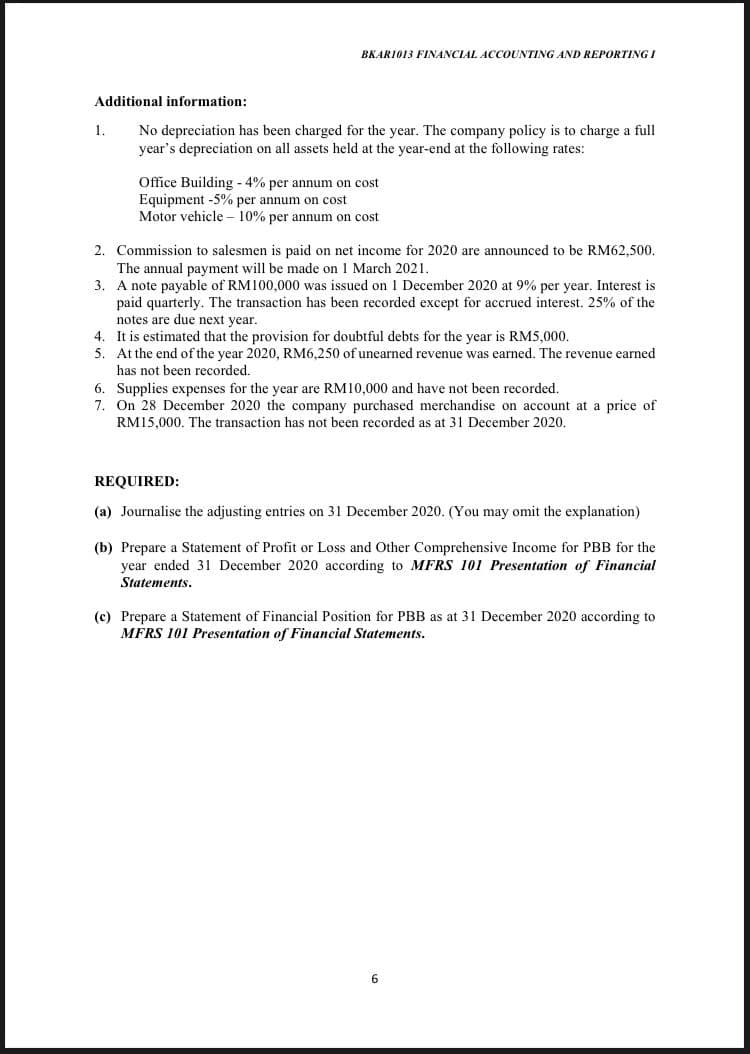

BKARIO13 FINANCIAL ACCOUNTING AND REPORTING I Additional information: 1. No depreciation has been charged for the year. The company policy is to charge a full year's depreciation on all assets held at the year-end at the following rates: Office Building - 4% per annum on cost Equipment -5% per annum on cost Motor vehicle – 10% per annum on cost 2. Commission to salesmen is paid on net income for 2020 are announced to be RM62,500. The annual payment will be made on 1 March 2021. 3. A note payable of RM100,000 was issued on 1 December 2020 at 9% per year. Interest is paid quarterly. The transaction has been recorded except for accrued interest. 25% of the notes are due next year. 4. It is estimated that the provision for doubtful debts for the year is RM5,000. 5. At the end of the year 2020, RM6,250 of unearned revenue was earned. The revenue earned has not been recorded. 6. Supplies expenses for the year are RM10,000 and have not been recorded. 7. On 28 December 2020 the company purchased merchandise on account at a price of RM15,000. The transaction has not been recorded as at 31 December 2020. REQUIRED: (a) Journalise the adjusting entries on 31 December 2020. (You may omit the explanation) (b) Prepare a Statement of Profit or Loss and Other Comprehensive Income for PBB for the year ended 31 December 2020 according to MFRS 101 Presentation of Financial Statements. (c) Prepare a Statement of Financial Position for PBB as at 31 December 2020 according to MFRS 101 Presentation of Financial Statements.

BKARIO13 FINANCIAL ACCOUNTING AND REPORTING I Additional information: 1. No depreciation has been charged for the year. The company policy is to charge a full year's depreciation on all assets held at the year-end at the following rates: Office Building - 4% per annum on cost Equipment -5% per annum on cost Motor vehicle – 10% per annum on cost 2. Commission to salesmen is paid on net income for 2020 are announced to be RM62,500. The annual payment will be made on 1 March 2021. 3. A note payable of RM100,000 was issued on 1 December 2020 at 9% per year. Interest is paid quarterly. The transaction has been recorded except for accrued interest. 25% of the notes are due next year. 4. It is estimated that the provision for doubtful debts for the year is RM5,000. 5. At the end of the year 2020, RM6,250 of unearned revenue was earned. The revenue earned has not been recorded. 6. Supplies expenses for the year are RM10,000 and have not been recorded. 7. On 28 December 2020 the company purchased merchandise on account at a price of RM15,000. The transaction has not been recorded as at 31 December 2020. REQUIRED: (a) Journalise the adjusting entries on 31 December 2020. (You may omit the explanation) (b) Prepare a Statement of Profit or Loss and Other Comprehensive Income for PBB for the year ended 31 December 2020 according to MFRS 101 Presentation of Financial Statements. (c) Prepare a Statement of Financial Position for PBB as at 31 December 2020 according to MFRS 101 Presentation of Financial Statements.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:BKARI013 FINANCIAL ACCOUNTING AND REPORTING I

Additional information:

1.

No depreciation has been charged for the year. The company policy is to charge a full

year's depreciation on all assets held at the year-end at the following rates:

Office Building - 4% per annum on cost

Equipment -5% per annum on cost

Motor vehicle – 10% per annum on cost

2. Commission to salesmen is paid on net income for 2020 are announced to be RM62,500.

The annual payment will be made on 1 March 2021.

3. A note payable of RM100,000 was issued on 1 December 2020 at 9% per year. Interest is

paid quarterly. The transaction has been recorded except for accrued interest. 25% of the

notes are due next year.

4. It is estimated that the provision for doubtful debts for the year is RM5,000.

5. At the end of the year 2020, RM6,250 of unearned revenue was earned. The revenue earned

has not been recorded.

6. Supplies expenses for the year are RM10,000 and have not been recorded.

7. On 28 December 2020 the company purchased merchandise on account at a price of

RM15,000. The transaction has not been recorded as at 31 December 2020.

REQUIRED:

(a) Journalise the adjusting entries on 31 December 2020. (You may omit the explanation)

(b) Prepare a Statement of Profit or Loss and Other Comprehensive Income for PBB for the

year ended 31 December 2020 according to MFRS 101 Presentation of Financial

Statements.

(c) Prepare a Statement of Financial Position for PBB as at 31 December 2020 according to

MFRS 101 Presentation of Financial Statements.

6

Transcribed Image Text:BKARI013 FINANCIAL ACCOUNTING AND REPORTING I

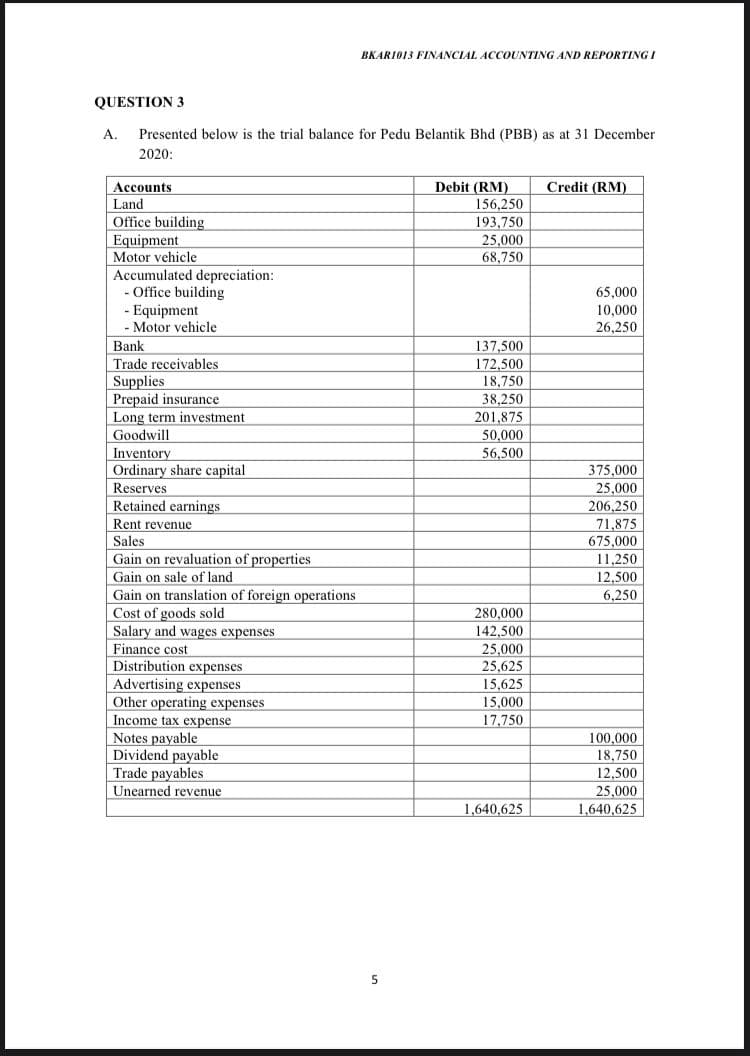

QUESTION 3

A.

Presented below is the trial balance for Pedu Belantik Bhd (PBB) as at 31 December

2020:

Accounts

Debit (RM)

Credit (RM)

Land

156,250

Office building

Equipment

Motor vehicle

Accumulated depreciation:

- Office building

- Equipment

193,750

25,000

68,750

65,000

10,000

26,250

- Motor vehicle

Bank

137,500

Trade receivables

Supplies

Prepaid insurance

Long term investment

Goodwill

172,500

18,750

38,250

201,875

50,000

Inventory

56,500

375,000

25,000

206,250

Ordinary share capital

Reserves

Retained earnings

71,875

675,000

Rent revenue

Sales

Gain on revaluation of properties

11,250

12,500

6,250

Gain on sale of land

Gain on translation of foreign operations

Cost of goods sold

Salary and wages expenses

Finance cost

Distribution expenses

Advertising expenses

Other operating expenses

280,000

142,500

25,000

25.625

15,625

15,000

Income tax expense

17,750

Notes payable

Dividend payable

Trade payables

100,000

18,750

12,500

25,000

1,640,625

Unearned revenue

1,640,625

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education