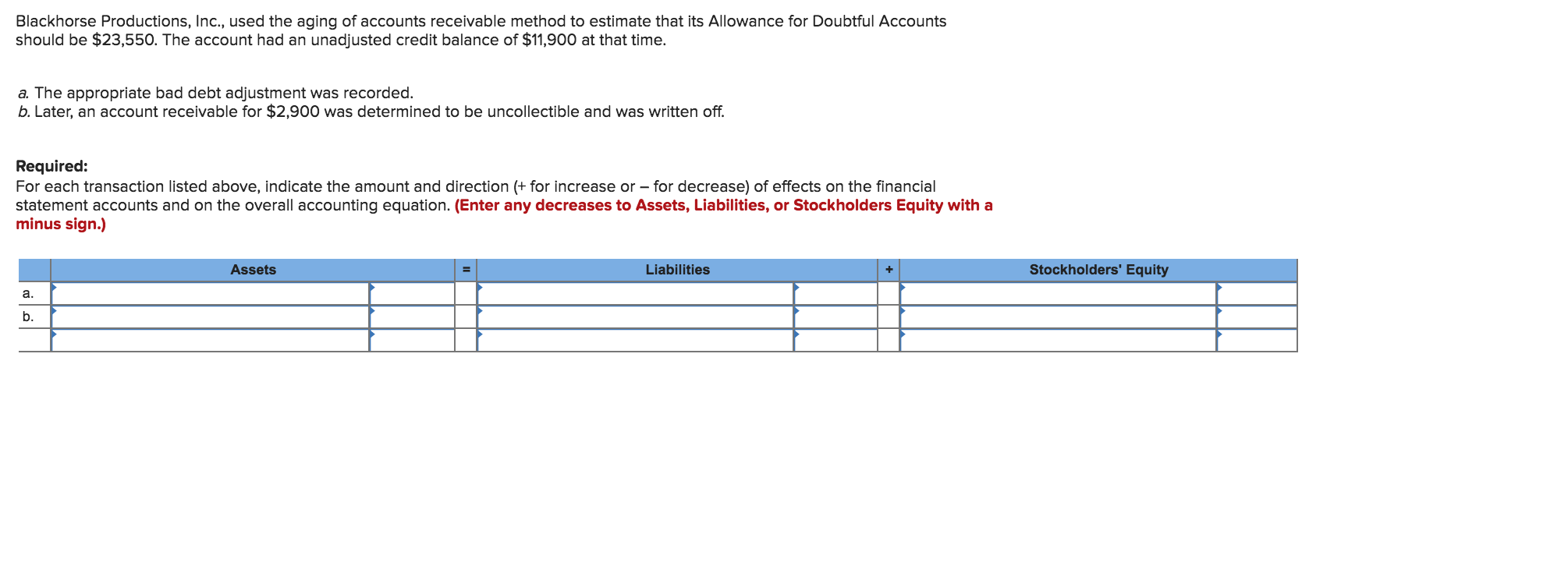

Blackhorse Productions, Inc., used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $23,550. The account had an unadjusted credit balance of $11,900 at that time. a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $2,900 was determined to be uncollectible and was written off. Required: For each transaction listed above, indicate the amount and direction +for increase or -for decrease) of effects on the financial statement accounts and on the overall accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Liabilities Stockholders' Equity

Blackhorse Productions, Inc., used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $23,550. The account had an unadjusted credit balance of $11,900 at that time. a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $2,900 was determined to be uncollectible and was written off. Required: For each transaction listed above, indicate the amount and direction +for increase or -for decrease) of effects on the financial statement accounts and on the overall accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Liabilities Stockholders' Equity

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4PB: Bristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts...

Related questions

Question

Transcribed Image Text:Blackhorse Productions, Inc., used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts

should be $23,550. The account had an unadjusted credit balance of $11,900 at that time.

a. The appropriate bad debt adjustment was recorded.

b. Later, an account receivable for $2,900 was determined to be uncollectible and was written off.

Required:

For each transaction listed above, indicate the amount and direction +for increase or -for decrease) of effects on the financial

statement accounts and on the overall accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a

minus sign.)

Assets

Liabilities

Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning