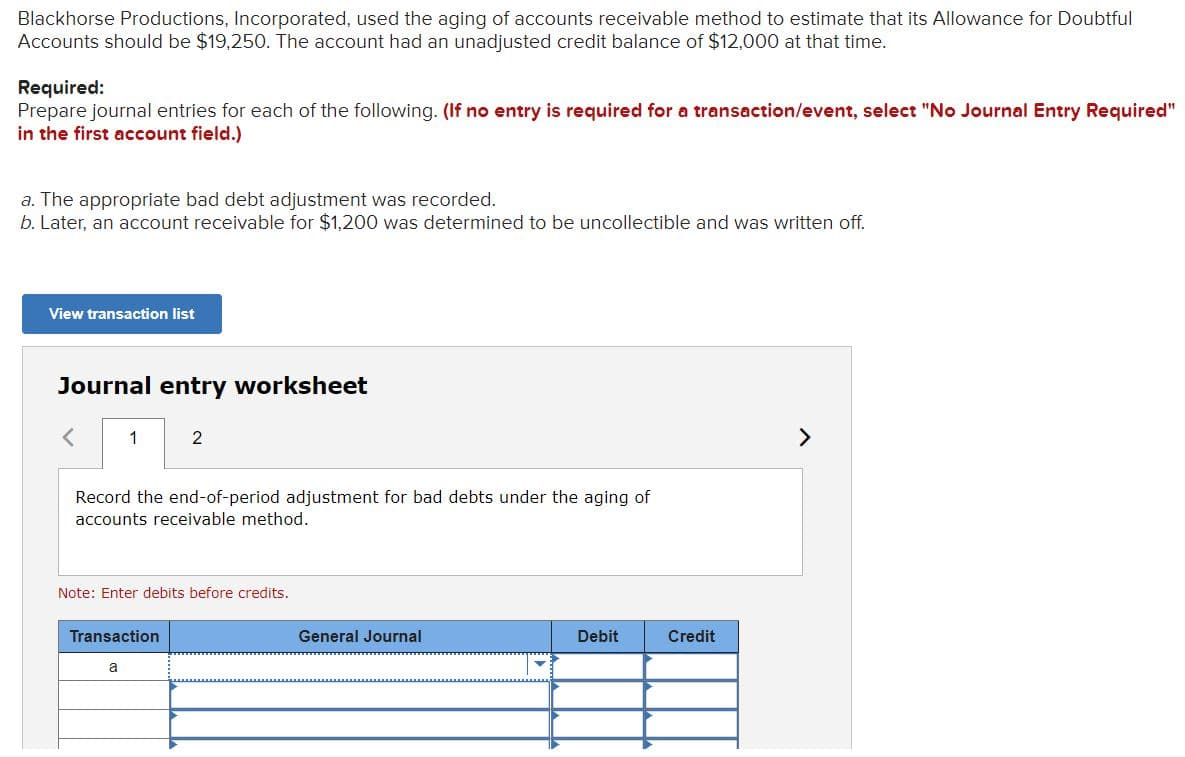

Blackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19,250. The account had an unadjusted credit balance of $12,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $1,200 was determined to be uncollectible and was written off.

Blackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19,250. The account had an unadjusted credit balance of $12,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $1,200 was determined to be uncollectible and was written off.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

Transcribed Image Text:Blackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful

Accounts should be $19,250. The account had an unadjusted credit balance of $12,000 at that time.

Required:

Prepare journal entries for each of the following. (If no entry is required for a transaction/event, select "No Journal Entry Required"

in the first account field.)

a. The appropriate bad debt adjustment was recorded.

b. Later, an account receivable for $1,200 was determined to be uncollectible and was written off.

View transaction list

Journal entry worksheet

く

1

2

<>

Record the end-of-period adjustment for bad debts under the aging of

accounts receivable method.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,