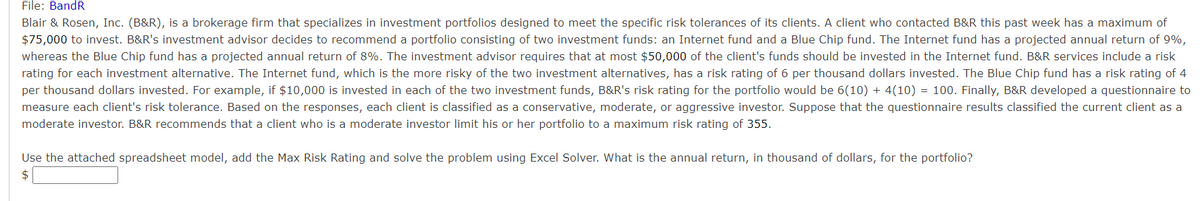

Blair & Rosen, Inc. (B&R), is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted B&R this past week has a maximum of $75,000 to invest. B&R's investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of 9%, whereas the Blue Chip fund has a projected annual return of 8%. The investment advisor requires that at most $50,000 of the client's funds should be invested in the Internet fund. B&R services include a risk rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per thousand dollars invested. The Blue Chip fund has a risk rating of 4 per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, B&R's risk rating for the portfolio would be 6(10) + 4(10) = 100. Finally, B&R developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. B&R recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of 355. Use the attached spreadsheet model, add the Max Risk Rating and solve the problem using Excel Solver. What is the annual return, in thousand of dollars, for the portfolio? $

Blair & Rosen, Inc. (B&R), is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted B&R this past week has a maximum of $75,000 to invest. B&R's investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of 9%, whereas the Blue Chip fund has a projected annual return of 8%. The investment advisor requires that at most $50,000 of the client's funds should be invested in the Internet fund. B&R services include a risk rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per thousand dollars invested. The Blue Chip fund has a risk rating of 4 per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, B&R's risk rating for the portfolio would be 6(10) + 4(10) = 100. Finally, B&R developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. B&R recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of 355. Use the attached spreadsheet model, add the Max Risk Rating and solve the problem using Excel Solver. What is the annual return, in thousand of dollars, for the portfolio? $

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter6: Optimization Models With Integer Variables

Section: Chapter Questions

Problem 46P

Related questions

Question

Qa 10.

Transcribed Image Text:File: BandR

Blair & Rosen, Inc. (B&R), is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted B&R this past week has a maximum of

$75,000 to invest. B&R's investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of 9%,

whereas the Blue Chip fund has a projected annual return of 8%. The investment advisor requires that at most $50,000 of the client's funds should be invested in the Internet fund. B&R services include a risk

rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per thousand dollars invested. The Blue Chip fund has a risk rating of 4

per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, B&R's risk rating for the portfolio would be 6(10) + 4(10) = 100. Finally, B&R developed a questionnaire to

measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a

moderate investor. B&R recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of 355.

Use the attached spreadsheet model, add the Max Risk Rating and solve the problem using Excel Solver. What is the annual return, in thousand of dollars, for the portfolio?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,