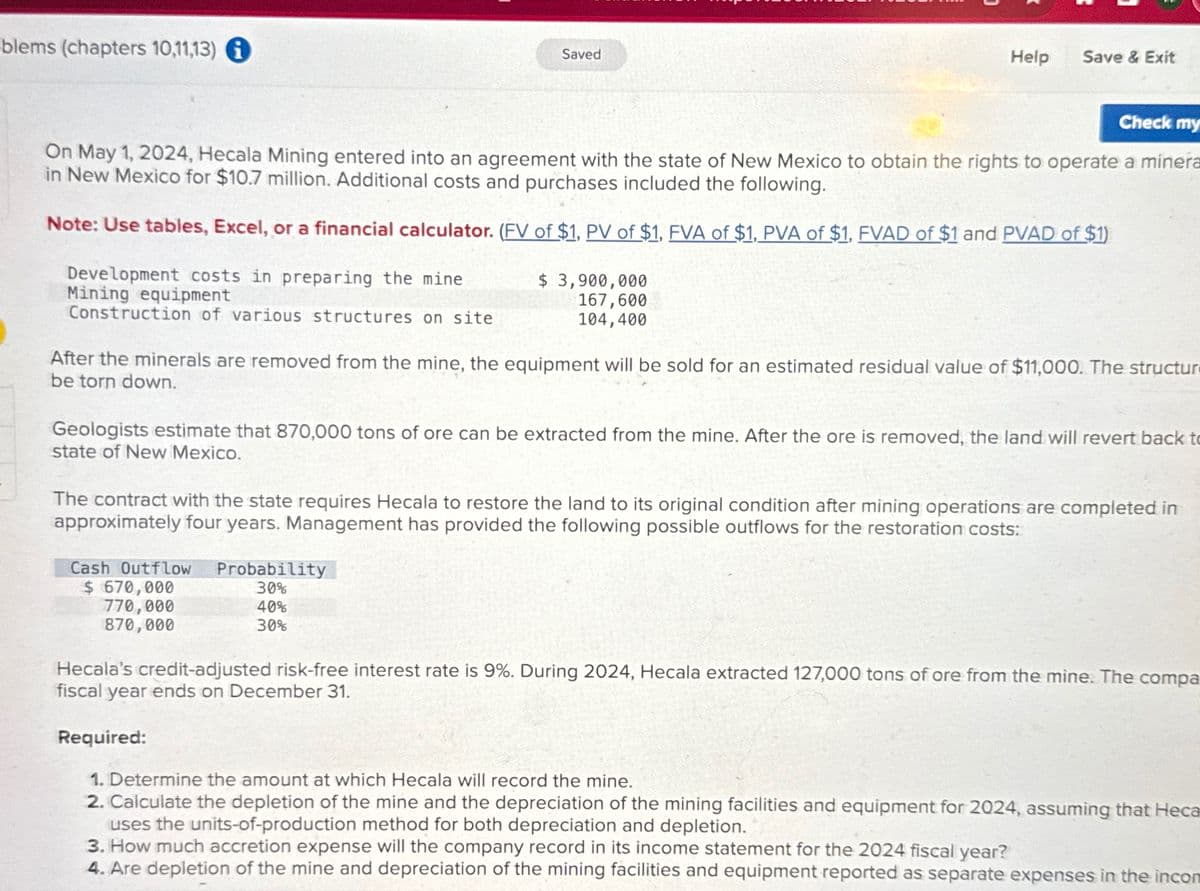

-blems (chapters 10,11,13) Saved Help Save & Exit Check my On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a minera in New Mexico for $10.7 million. Additional costs and purchases included the following. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Development costs in preparing the mine $ 3,900,000 Mining equipment Construction of various structures on site 167,600 104,400 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $11,000. The structur be torn down. Geologists estimate that 870,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow $ 670,000 770,000 870,000 Probability 30% 40% 30% Hecala's credit-adjusted risk-free interest rate is 9%. During 2024, Hecala extracted 127,000 tons of ore from the mine. The compa fiscal year ends on December 31. Required: 1. Determine the amount at which Hecala will record the mine. 2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Heca uses the units-of-production method for both depreciation and depletion. 3. How much accretion expense will the company record in its income statement for the 2024 fiscal year? 4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the incon

-blems (chapters 10,11,13) Saved Help Save & Exit Check my On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a minera in New Mexico for $10.7 million. Additional costs and purchases included the following. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Development costs in preparing the mine $ 3,900,000 Mining equipment Construction of various structures on site 167,600 104,400 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $11,000. The structur be torn down. Geologists estimate that 870,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow $ 670,000 770,000 870,000 Probability 30% 40% 30% Hecala's credit-adjusted risk-free interest rate is 9%. During 2024, Hecala extracted 127,000 tons of ore from the mine. The compa fiscal year ends on December 31. Required: 1. Determine the amount at which Hecala will record the mine. 2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Heca uses the units-of-production method for both depreciation and depletion. 3. How much accretion expense will the company record in its income statement for the 2024 fiscal year? 4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the incon

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 75P

Related questions

Question

Transcribed Image Text:-blems (chapters 10,11,13)

Saved

Help

Save & Exit

Check my

On May 1, 2024, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a minera

in New Mexico for $10.7 million. Additional costs and purchases included the following.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Development costs in preparing the mine

$ 3,900,000

Mining equipment

Construction of various structures on site

167,600

104,400

After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $11,000. The structur

be torn down.

Geologists estimate that 870,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to

state of New Mexico.

The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in

approximately four years. Management has provided the following possible outflows for the restoration costs:

Cash Outflow

$ 670,000

770,000

870,000

Probability

30%

40%

30%

Hecala's credit-adjusted risk-free interest rate is 9%. During 2024, Hecala extracted 127,000 tons of ore from the mine. The compa

fiscal year ends on December 31.

Required:

1. Determine the amount at which Hecala will record the mine.

2. Calculate the depletion of the mine and the depreciation of the mining facilities and equipment for 2024, assuming that Heca

uses the units-of-production method for both depreciation and depletion.

3. How much accretion expense will the company record in its income statement for the 2024 fiscal year?

4. Are depletion of the mine and depreciation of the mining facilities and equipment reported as separate expenses in the incon

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you