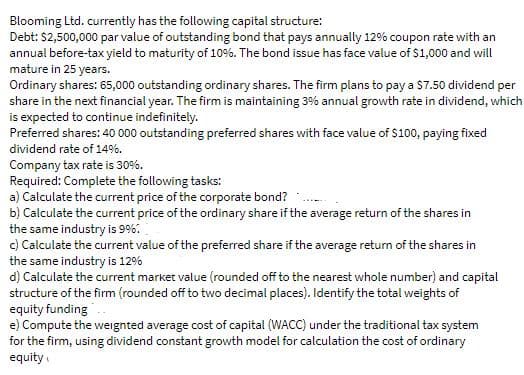

Blooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 149%. Company tax rate is 30%. Required: Complete the following tasks: a) Calculate the current price of the corporate bond? b) Calculate the current price of the ordinary share if the average return of the shares in the same industry is 99%6. c) Calculate the current value of the preferred share if the average retum of the shares in the same industry is 12% d) Calculate the current market value (rounded off to the nearest whole number) and capital structure of the firm (rounded off to two decimal places). Identify the total weights of equity funding e) Compute the weignted average cost of capital (WACC) under the traditional tax system for the firm, using dividend constant growth model for calculation the cost of ordinary equity

Blooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 149%. Company tax rate is 30%. Required: Complete the following tasks: a) Calculate the current price of the corporate bond? b) Calculate the current price of the ordinary share if the average return of the shares in the same industry is 99%6. c) Calculate the current value of the preferred share if the average retum of the shares in the same industry is 12% d) Calculate the current market value (rounded off to the nearest whole number) and capital structure of the firm (rounded off to two decimal places). Identify the total weights of equity funding e) Compute the weignted average cost of capital (WACC) under the traditional tax system for the firm, using dividend constant growth model for calculation the cost of ordinary equity

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 15P

Related questions

Question

Transcribed Image Text:Blooming Ltd. currently has the following capital structure:

Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an

annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will

mature in 25 years.

Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per

share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which

is expected to continue indefinitely.

Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed

dividend rate of 149%.

Company tax rate is 30%.

Required: Complete the following tasks:

a) Calculate the current price of the corporate bond?

b) Calculate the current price of the ordinary share if the average return of the shares in

the same industry is 99%6.

c) Calculate the current value of the preferred share if the average retum of the shares in

the same industry is 12%

d) Calculate the current market value (rounded off to the nearest whole number) and capital

structure of the firm (rounded off to two decimal places). Identify the total weights of

equity funding

e) Compute the weignted average cost of capital (WACC) under the traditional tax system

for the firm, using dividend constant growth model for calculation the cost of ordinary

equity

Expert Solution

Step 1

Since you have posted a question with multiple sub-parts, we will solve first three subparts for you. To get remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

Step by step

Solved in 2 steps with 6 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning