. Sondob Dairies has a capital structure that consists of 60 percent long-term debt and 40 percent ordinary shares. The company's CFO has obtained the following information: The before-tax yield to maturity on the company's bonds is 8 percent. The company's ordinary share is expected to pay a P3.00 dividend at year-end (D1 = P3.00), and the dividend is expected to grow at a constant rate of 7 percent a year. The ordinary shares are currently sells for P60 a share. Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget. The company's tax rate is 40 percent. What is the company's weighted average cost of capital (WACC)? . Gateway Inc. has a weighted average cost of capital of 11.5 percent. Its target capital structure is 55 percent equity and 45 percent debt. The company has sufficient retained earnings to fund the equity portion of its capital budget. The before-tax cost of debt is 9 percent, and the company's tax rate is 30 percent. If the expected dividend next period is P5 and the current share price is P45, what is the company's growth rate? . A company with cost of capital of 15% plans to finance an investment with debt that bears 10% interest. The rate it should use to discount the cash flows is

. Sondob Dairies has a capital structure that consists of 60 percent long-term debt and 40 percent ordinary shares. The company's CFO has obtained the following information: The before-tax yield to maturity on the company's bonds is 8 percent. The company's ordinary share is expected to pay a P3.00 dividend at year-end (D1 = P3.00), and the dividend is expected to grow at a constant rate of 7 percent a year. The ordinary shares are currently sells for P60 a share. Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget. The company's tax rate is 40 percent. What is the company's weighted average cost of capital (WACC)? . Gateway Inc. has a weighted average cost of capital of 11.5 percent. Its target capital structure is 55 percent equity and 45 percent debt. The company has sufficient retained earnings to fund the equity portion of its capital budget. The before-tax cost of debt is 9 percent, and the company's tax rate is 30 percent. If the expected dividend next period is P5 and the current share price is P45, what is the company's growth rate? . A company with cost of capital of 15% plans to finance an investment with debt that bears 10% interest. The rate it should use to discount the cash flows is

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 15PROB

Related questions

Question

100%

Please show the solution. Thank you.

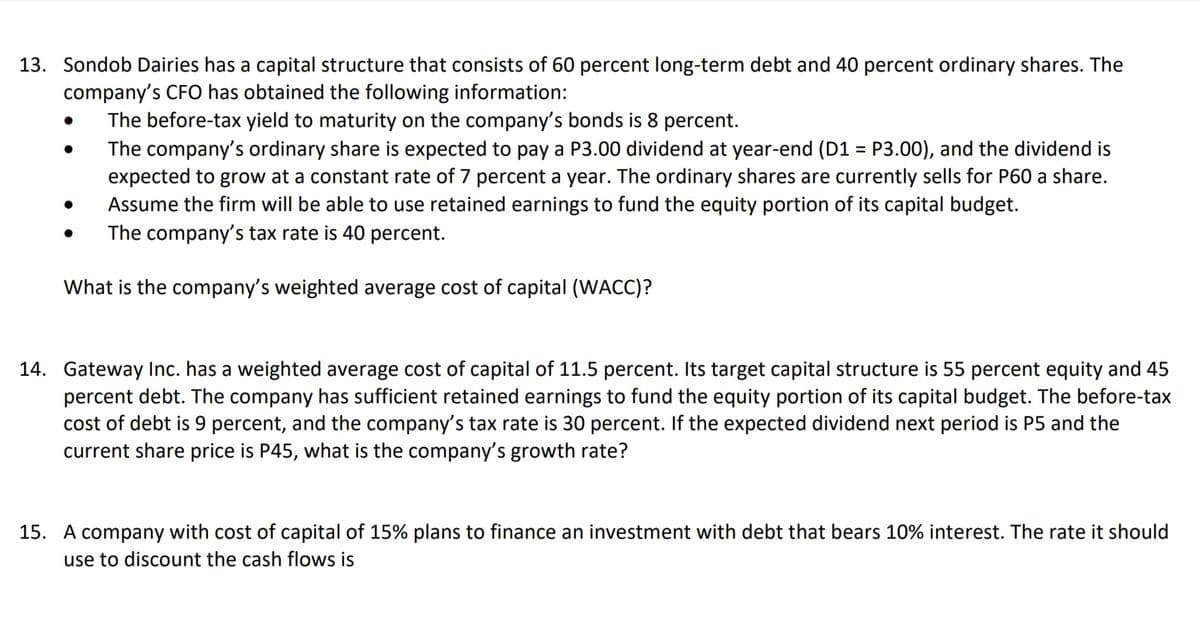

Transcribed Image Text:13. Sondob Dairies has a capital structure that consists of 60 percent long-term debt and 40 percent ordinary shares. The

company's CFO has obtained the following information:

The before-tax yield to maturity on the company's bonds is 8 percent.

The company's ordinary share is expected to pay a P3.00 dividend at year-end (D1 = P3.00), and the dividend is

expected to grow at a constant rate of 7 percent a year. The ordinary shares are currently sells for P60 a share.

Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget.

The company's tax rate is 40 percent.

%3D

What is the company's weighted average cost of capital (WACC)?

14. Gateway Inc. has a weighted average cost of capital of 11.5 percent. Its target capital structure is 55 percent equity and 45

percent debt. The company has sufficient retained earnings to fund the equity portion of its capital budget. The before-tax

cost of debt is 9 percent, and the company's tax rate is 30 percent. If the expected dividend next period is P5 and the

current share price is P45, what is the company's growth rate?

15. A company with cost of capital of 15% plans to finance an investment with debt that bears 10% interest. The rate it should

use to discount the cash flows is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning