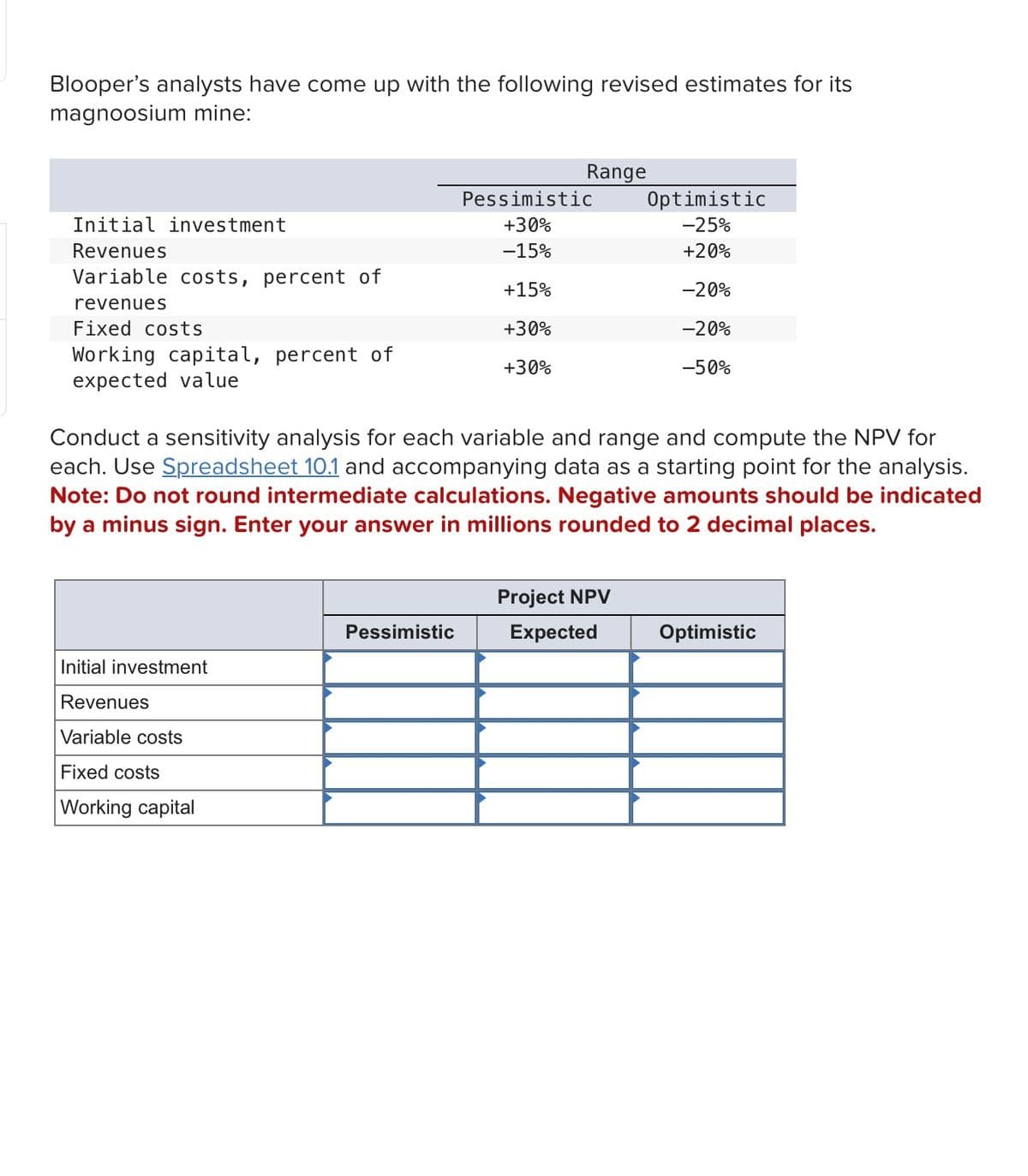

Blooper's analysts have come up with the following revised estimates for its magnoosium mine: Range Pessimistic Optimistic Initial investment +30% -25% Revenues -15% +20% Variable costs, percent of +15% -20% revenues Fixed costs +30% -20% Working capital, percent of +30% -50% expected value Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. Note: Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answer in millions rounded to 2 decimal places. Pessimistic Project NPV Expected Optimistic Initial investment Revenues Variable costs Fixed costs Working capital

Blooper's analysts have come up with the following revised estimates for its magnoosium mine: Range Pessimistic Optimistic Initial investment +30% -25% Revenues -15% +20% Variable costs, percent of +15% -20% revenues Fixed costs +30% -20% Working capital, percent of +30% -50% expected value Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. Note: Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answer in millions rounded to 2 decimal places. Pessimistic Project NPV Expected Optimistic Initial investment Revenues Variable costs Fixed costs Working capital

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 19P

Related questions

Question

Vijay

Transcribed Image Text:Blooper's analysts have come up with the following revised estimates for its

magnoosium mine:

Range

Pessimistic

Optimistic

Initial investment

+30%

-25%

Revenues

-15%

+20%

Variable costs, percent of

+15%

-20%

revenues

Fixed costs

+30%

-20%

Working capital, percent of

+30%

-50%

expected value

Conduct a sensitivity analysis for each variable and range and compute the NPV for

each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis.

Note: Do not round intermediate calculations. Negative amounts should be indicated

by a minus sign. Enter your answer in millions rounded to 2 decimal places.

Pessimistic

Project NPV

Expected

Optimistic

Initial investment

Revenues

Variable costs

Fixed costs

Working capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,