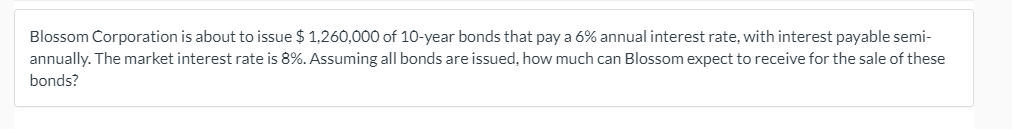

Blossom Corporation is about to issue $ 1,260,000 of 10-year bonds that pay a 6% annual interest rate, with interest payable semi- annually. The market interest rate is 8%. Assuming all bonds are issued, how much can Blossom expect to receive for the sale of these bonds?

Blossom Corporation is about to issue $ 1,260,000 of 10-year bonds that pay a 6% annual interest rate, with interest payable semi- annually. The market interest rate is 8%. Assuming all bonds are issued, how much can Blossom expect to receive for the sale of these bonds?

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 2PB: Charleston Inc. issued $200,000 bonds with a stated rate of 10%. The bonds had a 10-year maturity...

Related questions

Question

100%

please solve this question, thanks

Transcribed Image Text:Blossom Corporation is about to issue $ 1,260,000 of 10-year bonds that pay a 6% annual interest rate, with interest payable semi-

annually. The market interest rate is 8%. Assuming all bonds are issued, how much can Blossom expect to receive for the sale of these

bonds?

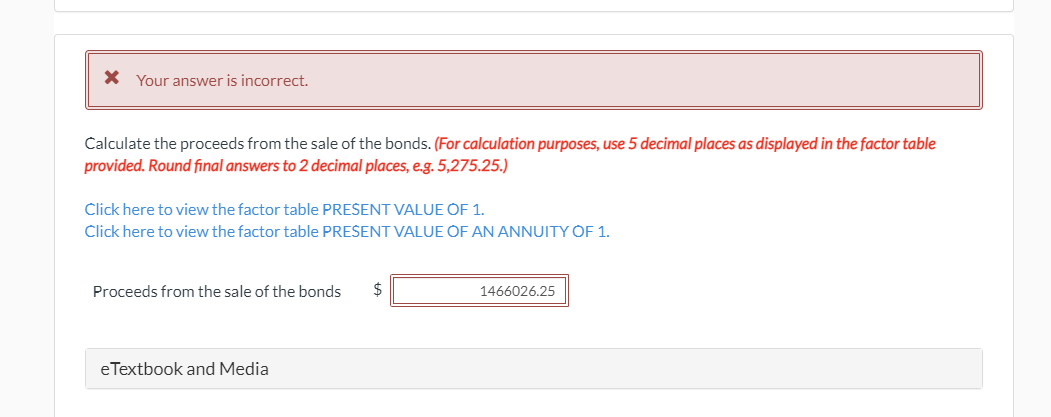

Transcribed Image Text:X Your answer is incorrect.

Calculate the proceeds from the sale of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table

provided. Round final answers to 2 decimal places, e.g. 5,275.25.)

Click here to view the factor table PREŠENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

Proceeds from the sale of the bonds

1466026.25

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,