Cybernetics Inc. issued $60 million of 5% three-year bonds, with coupon paid at the end of every year. The effective interest rate at the beginning of Years 1, 2, and 3 was 8%, 5%, and 2%. Required: a. Determine what Cybernetics would have raised from the bond issue. b. Assume Cybernetics decides to account for the bonds using the amortized cost method. Determine the interest and bond amortization for each of the three years. c. Assume Cybernetics decides to account for the bonds using the fair value method. Determine the interest, un- realized gain/loss, and total expense for each of the three years. d. Explain why the amounts charged to income every year differ under the two methods.

Cybernetics Inc. issued $60 million of 5% three-year bonds, with coupon paid at the end of every year. The effective interest rate at the beginning of Years 1, 2, and 3 was 8%, 5%, and 2%. Required: a. Determine what Cybernetics would have raised from the bond issue. b. Assume Cybernetics decides to account for the bonds using the amortized cost method. Determine the interest and bond amortization for each of the three years. c. Assume Cybernetics decides to account for the bonds using the fair value method. Determine the interest, un- realized gain/loss, and total expense for each of the three years. d. Explain why the amounts charged to income every year differ under the two methods.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

100%

Hello! I have this finance/accounting problem. Looking forward!

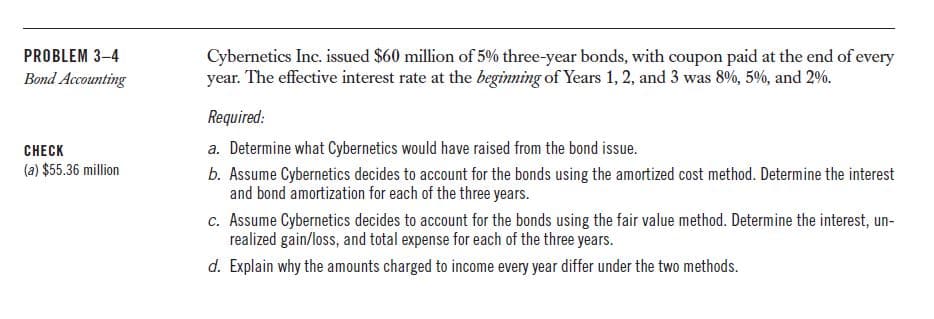

Transcribed Image Text:Cybernetics Inc. issued $60 million of 5% three-year bonds, with coupon paid at the end of every

year. The effective interest rate at the beginning of Years 1, 2, and 3 was 8%, 5%, and 2%.

PROBLEM 3–4

Bond Accounting

Required:

a. Determine what Cybernetics would have raised from the bond issue.

CHECK

(a) $55.36 million

b. Assume Cybernetics decides to account for the bonds using the amortized cost method. Determine the interest

and bond amortization for each of the three years.

c. Assume Cybernetics decides to account for the bonds using the fair value method. Determine the interest, un-

realized gain/loss, and total expense for each of the three years.

d. Explain why the amounts charged to income every year differ under the two methods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning