Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200,000 if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the

Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200,000 if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:View Policies

Show Attempt History

Current Attempt in Progress

Your answer is partially correct.

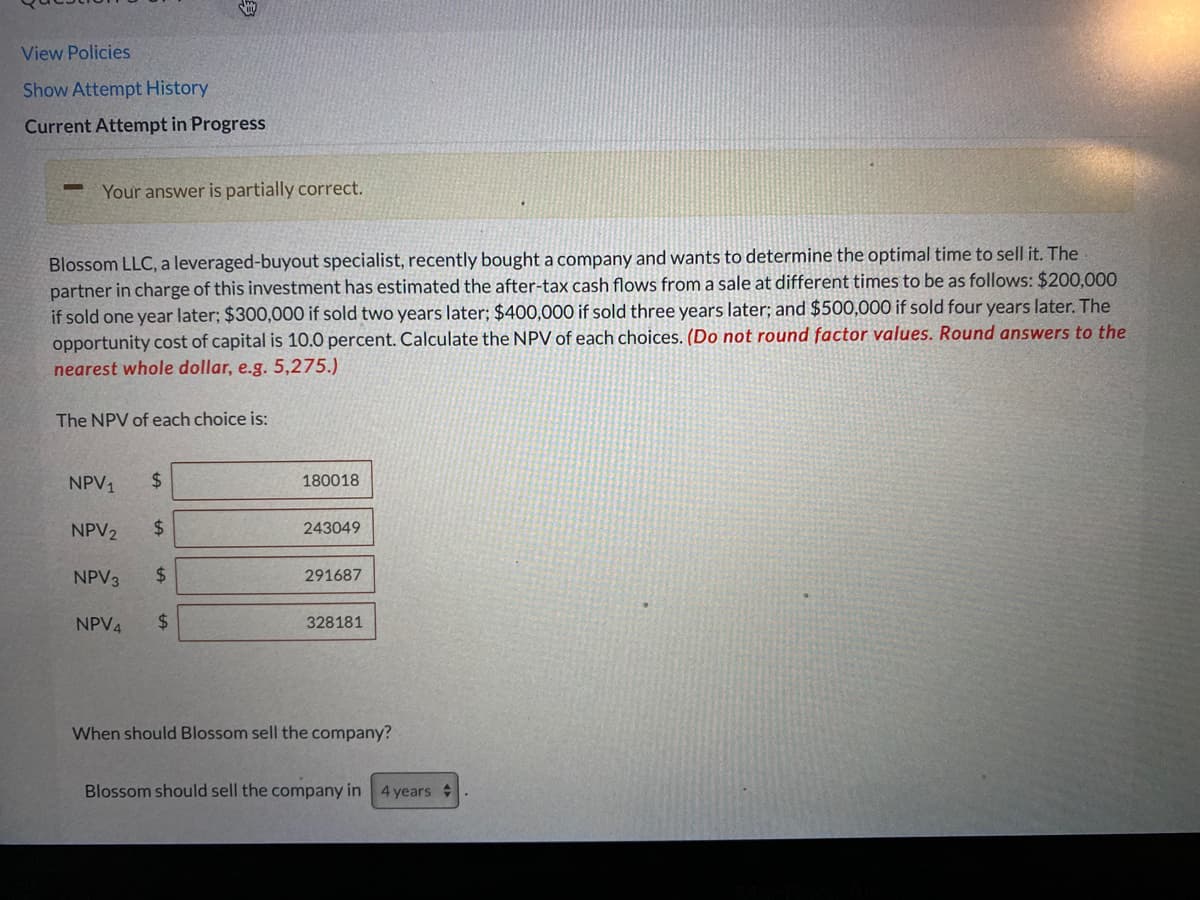

Blossom LLC, a leveraged-buyout specialist, recently bought a company and wants to determine the optimal time to sell it. The

partner in charge of this investment has estimated the after-tax cash flows from a sale at different times to be as follows: $200,000

if sold one year later; $300,000 if sold two years later; $400,000 if sold three years later; and $500,000 if sold four years later. The

opportunity cost of capital is 10.0 percent. Calculate the NPV of each choices. (Do not round factor values. Round answers to the

nearest whole dollar, e.g. 5,275.)

The NPV of each choice is:

NPV1

24

180018

NPV2

%$4

243049

NPV3

%24

291687

NPV4

$.

328181

When should Blossom sell the company?

Blossom should sell the company in 4 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub