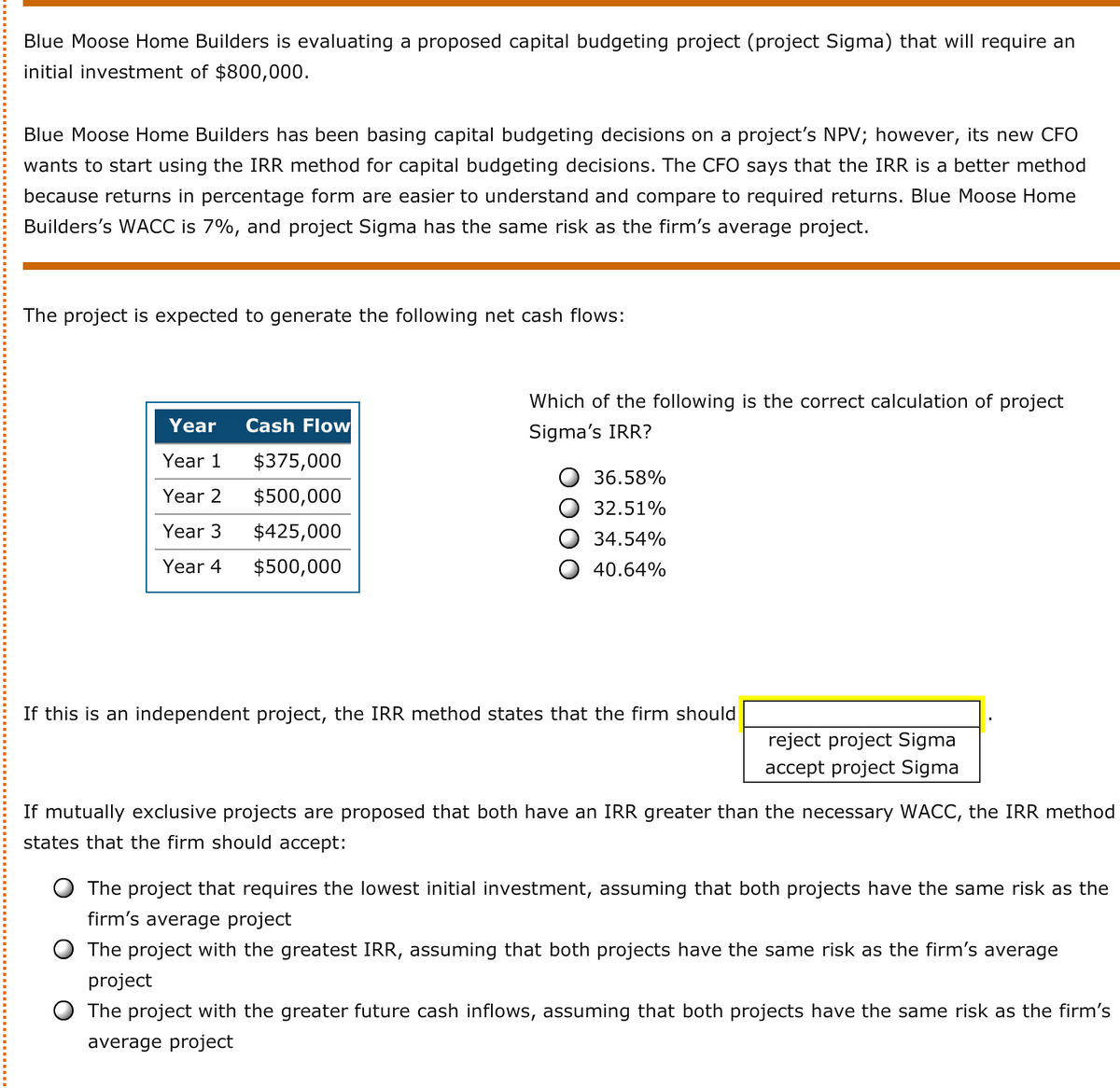

Blue Moose Home Builders is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $800,000. Blue Moose Home Builders has been basing capital budgeting decisions on a project's NPV; however, its new CFC wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better metho because returns in percentage form are easier to understand and compare to required returns. Blue Moose Home Builders's WACC is 7%, and project Sigma has the same risk as the firm's average project. The project is expected to generate the following net cash flows:

Blue Moose Home Builders is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $800,000. Blue Moose Home Builders has been basing capital budgeting decisions on a project's NPV; however, its new CFC wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better metho because returns in percentage form are easier to understand and compare to required returns. Blue Moose Home Builders's WACC is 7%, and project Sigma has the same risk as the firm's average project. The project is expected to generate the following net cash flows:

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 21P: Your division is considering two investment projects, each of which requires an up-front expenditure...

Related questions

Question

please answer all questions

Transcribed Image Text:Blue Moose Home Builders is evaluating a proposed capital budgeting project (project Sigma) that will require an

initial investment of $800,000.

Blue Moose Home Builders has been basing capital budgeting decisions on a project's NPV; however, its new CFO

wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method

because returns in percentage form are easier to understand and compare to required returns. Blue Moose Home

Builders's WACC is 7%, and project Sigma has the same risk as the firm's average project.

The project is expected to generate the following net cash flows:

Which of the following is the correct calculation of project

Year

Cash Flow

Sigma's IRR?

Year 1

$375,000

36.58%

Year 2

$500,000

32.51%

Year 3

$425,000

34.54%

Year 4

$500,000

40.64%

If this is an independent project, the IRR method states that the firm should

reject project Sigma

accept project Sigma

If mutually exclusive projects are proposed that both have an IRR greater than the necessary WACC, the IRR method

states that the firm should accept:

The project that requires the lowest initial investment, assuming that both projects have the same risk as the

firm's average project

The project with the greatest IRR, assuming that both projects have the same risk as the firm's average

project

O The project with the greater future cash inflows, assuming that both projects have the same risk as the firm's

average project

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning