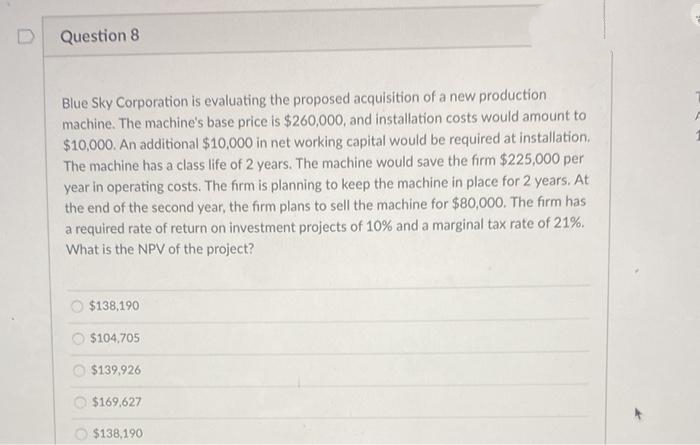

Blue Sky Corporation is evaluating the proposed acquisition of a new production machine. The machine's base price is $260,000, and installation costs would amount to $10,000. An additional $10,000 in net working capital would be required at installation. The machine has a class life of 2 years. The machine would save the firm $225,000 per year in operating costs. The firm is planning to keep the machine in place for 2 years. At the end of the second year, the firm plans to sell the machine for $80,000. The firm has a required rate of return on investment projects of 10% and a marginal tax rate of 21%. What is the NPV of the project?

Blue Sky Corporation is evaluating the proposed acquisition of a new production machine. The machine's base price is $260,000, and installation costs would amount to $10,000. An additional $10,000 in net working capital would be required at installation. The machine has a class life of 2 years. The machine would save the firm $225,000 per year in operating costs. The firm is planning to keep the machine in place for 2 years. At the end of the second year, the firm plans to sell the machine for $80,000. The firm has a required rate of return on investment projects of 10% and a marginal tax rate of 21%. What is the NPV of the project?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 6P: New-Project Analysis

The Campbell Company is considering adding a robotic paint sprayer to its...

Related questions

Question

Transcribed Image Text:Question 8

Blue Sky Corporation is evaluating the proposed acquisition of a new production

machine. The machine's base price is $260,000, and installation costs would amount to

$10,000. An additional $10,000 in net working capital would be required at installation.

The machine has a class life of 2 years. The machine would save the firm $225,000 per

year in operating costs. The firm is planning to keep the machine in place for 2 years. At

the end of the second year, the firm plans to sell the machine for $80,000. The firm has

a required rate of return on investment projects of 10% and a marginal tax rate of 21%.

What is the NPV of the project?

$138,190

O $104,705

O $139,926

$169,627

O $138,190

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning